Dec 15 2023

- 1. Milestones & achievements

- 2. Liquid Collective in the news

- 3. Strategic collaborations & ecosystem growth

- 4. Market trends & outlook

- 5. From the Collective

- 6. Top 5: research & analysis

- 7. Top 5: resources

- 8. & more!

“It’s safe to say we’re at the cusp of the next wave of adoption in the staking market.”

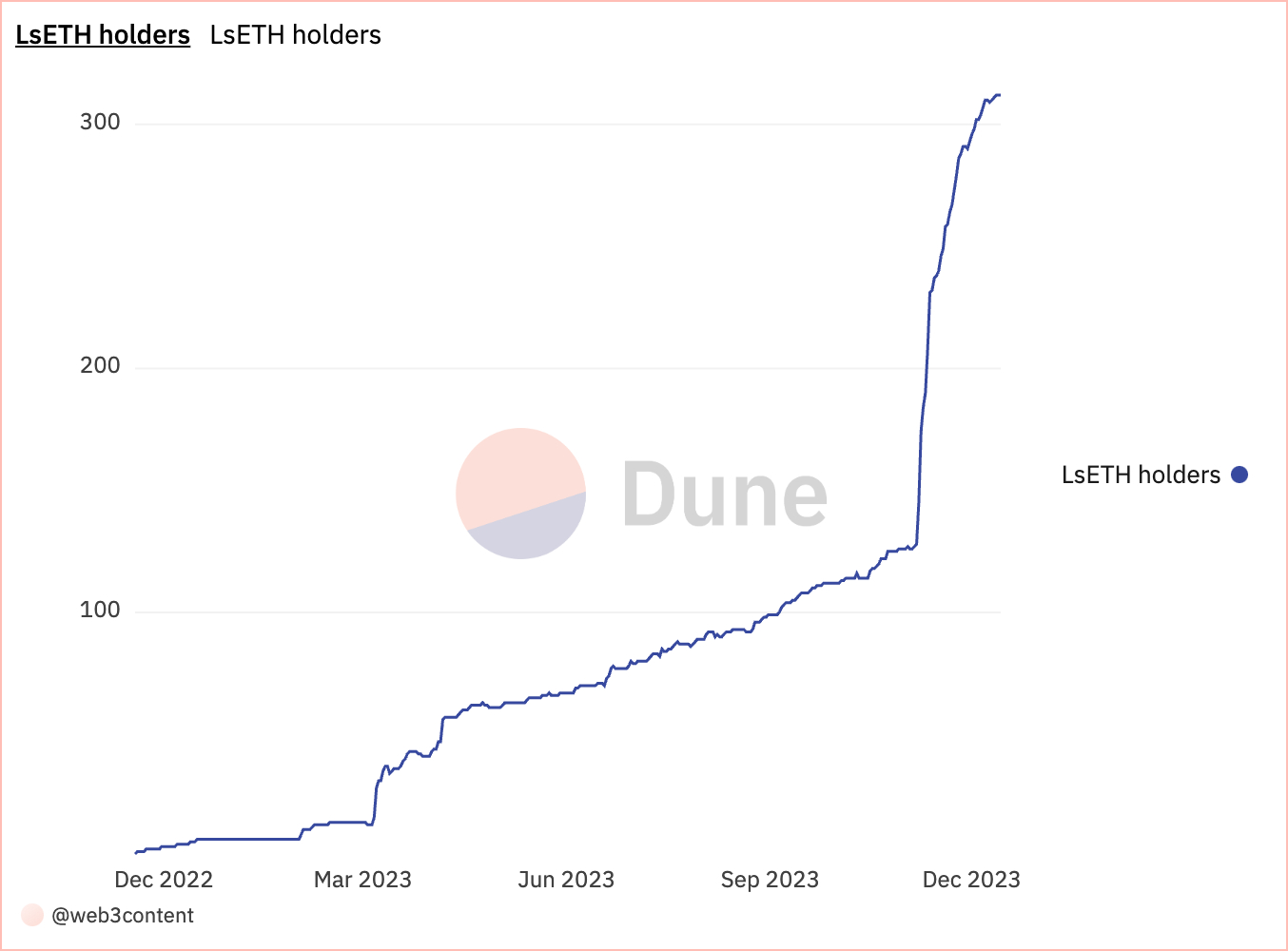

Marked by dynamic changes and significant advancements in the staking industry, 2023 was also a year of progress for Liquid Collective, the trusted and secure staking protocol. In a year characterized by steep LST ecosystem growth, Liquid Collective grew in scale and began establishing the framework to influence and shape the future of staking.

As we reflect on 2023, this lookback provides an overview of Liquid Collective’s strategic collaborations, initiatives, and solutions, setting the stage for an even more impactful 2024.

| 36,226.510 ETH | $81,149,749 USD | 1,143 | 1 LsETH = 1.03466 ETH |

| Total deposited ETH | Total value locked | Validators | Protocol conversion rate |

1. Milestones & achievements

March: Launching ETH liquid staking with Liquid Collective

Liquid Collective’s LsETH, the liquid staking token representing ETH staked through the Liquid Collective protocol and ETH network rewards received, was launched with day-one support on Coinbase Prime and Bitcoin Suisse.

LsETH was designed through a collective, collaborative approach. The simple idea is that by tapping into the diverse expertise and perspectives of teams who have built proven solutions we can create innovative products to address unmet market needs.

While, at the same time, healthy competition and diversity in the staking ecosystem brings better resiliency, security, innovation, and new participants to Ethereum by tailoring products to unmet needs of certain participant segments.

“Institutional and private clients are increasingly looking to participate in staking to receive network rewards. Staking involves blockers of participation, the largest two being illiquidity windows and the lock-up of staked tokens—mechanisms that primarily exist to preserve network security and integrity. Liquid staking is an innovation that addresses these blockers of participation, providing users with higher capital efficiency and liquidity, while preserving the network's security features. With this new partnership, Bitcoin Suisse is further advancing the institutionalization of crypto-financial services for our Swiss institutional clients and for the benefit of the crypto ecosystem.”

June: Ethereum staking withdrawals on the Liquid Collective protocol go live on mainnet

The contracts allowing stakers to redeem LsETH for ETH via the Liquid Collective protocol, were deployed just two months after withdrawals were enabled on Ethereum by the Shapella Upgrade.

The LsETH redemption design includes three core features:

- Automatic reward staking of consensus and execution layer network rewards increases the protocol's staking efficiency by maximizing the number of validators in the active set, removing the pain point of manually executing this process for stakers.

- Seamless redemptions of LsETH for ETH are enabled by Deposit and Redemption Buffers, allowing flows in and out of the protocol to be managed efficiently between Ethereum's execution and consensus layers.

- A first-in-first-out Redemption Queue aims to ensure fair conversions and protect against a run on claims.

You can learn more about ETH staking withdrawals on Liquid Collective in the recorded AMA here.

July: Liquid Collective’s protocol source code made available under BUSL-1.1

The Liquid Collective protocol's code was made available under the Business Source License 1.1 (BUSL-1.1), allowing anyone to access the code independently, contribute to the development of the protocol, or to build their own decentralized applications connecting with the Liquid Collective ecosystem.

The Business Source License 1.1 (BUSL-1.1) is the same license used by Uniswap V3 and other leading decentralized protocols. The BUSL license grants the right to copy, modify, create derivative works, redistribute, and make non-production use of the code, and will automatically transition to a full open-source license, GPLv3, in 2026.

“By making the Liquid Collective protocol's code fully public we hope to encourage greater collaboration while increasing transparency into, and trust of, the protocol.

We believe that by working together in the spirit of collective development we can grow the pie for participants big and small through collaboration, shared purpose, and inclusivity.”

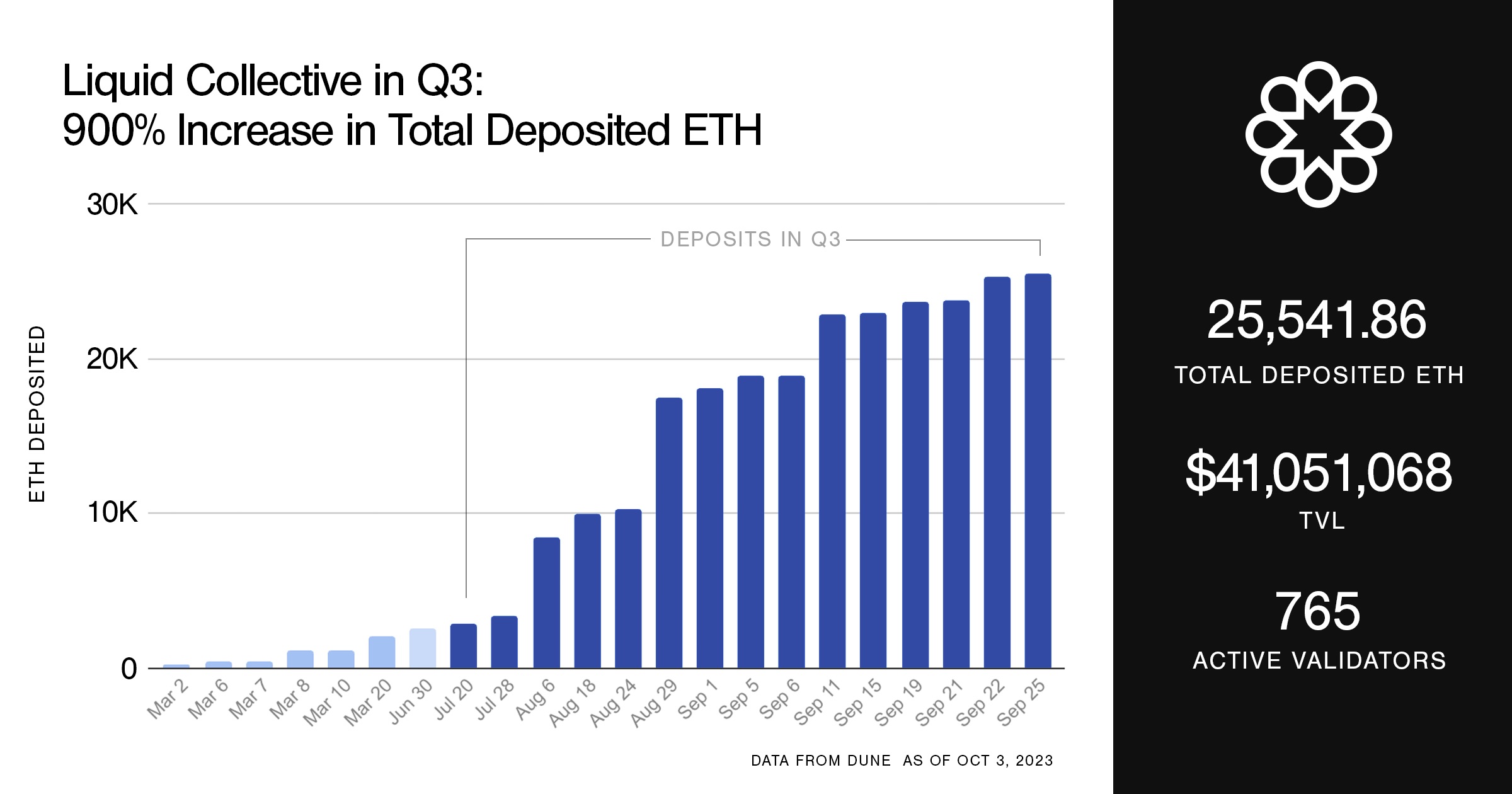

September: Liquid Collective becomes one of top 10 liquid staking protocols by TVL with 900% TVL growth in Q3

Despite the volatility in the broader crypto markets, staking adoption surged through 2023, with ETH experiencing a 96% increase in staking participation from 2022 and liquid staking participation up 112% by October. In September Liquid Collective joined the ranks of Ethereum's top 10 liquid staking protocols, with a remarkable 900% TVL growth by the end of Q3.

December: Publishing the first open Ethereum node operator performance methodology

In December, Liquid Collective’s Node Operator Working Group published the first open, objective, standardized approach for evaluating and benchmarking professional ETH staking providers, made publicly available under the Creative Commons CC BY-SA license to be used by the ecosystem at large. The methodology represented the first release of Liquid Collective’s validator performance and security standards initiative announced in July 2023, with the working group spearheaded by Rated Labs in collaboration with Alluvial, Coinbase Cloud, Figment, and Staked.

Until the launch of this node operator performance methodology, the Ethereum ecosystem lacked a uniform set of metrics and methodologies to objectively assess the performance of and risks associated with node operators. Common in traditional finance, this shared metric to evaluate participation through a risk-adjusted lens is critical for PoS' continued growth and maturity.

The Ethereum node operator performance methodology focuses on the aspects of validator performance within a node operator’s control, providing a more practical and effective way of evaluating a node operator’s long-term performance as opposed to evaluating an operator based on their staking reward rate alone.

“The v1 performance methodology published by Liquid Collective’s Node Operator working group addresses a crucial need in the Ethereum ecosystem: a unified, objective metric for measuring node operator performance. We hope that developing this shared understanding of benchmarking and measuring performance against peers will help to foster a more transparent, competitive, and efficient staking environment, contributing significantly to the integrity and growth of Ethereum's staking sector.”

December: Liquid Collective becomes the first liquid staking protocol to introduce service level agreements for Node Operator performance

The introduction of Service Level Agreements (SLAs) for Node Operator performance, a first for the industry, represents Liquid Collective’s decentralized protocol aligning with the high standards and reliability that enterprises traditionally expect from their technical service providers.

Based on the open performance methodology published by Liquid Collective’s Node Operator working group, the SLAs require that Liquid Collective’s Node Operators perform in the top 50th (-1σ) percentile of all ETH staking providers that operate 100+ nodes, based on deterministic performance on the consensus layer. Once fully implemented, failure to comply with the SLAs will result in Node Operators reimbursing the Liquid Collective protocol for missed reward opportunities.

“The introduction of service level agreements for Node Operator performance by Liquid Collective marks a significant milestone in liquid staking, raising the bar for how protocols offer guarantees to their stakeholders. At Rated Labs, we believe that these SLAs, based on the public node operator performance benchmarking methodology underpinned by the Rated Validator Effectiveness Rating, will set a new precedent for the LST industry by ensuring Node Operators adhere to objective, replicable, high-performance benchmarks.”

Ongoing: Security advancements

In 2023 Liquid Collective shared information on our progress towards building the secure liquid staking standard, 2023 saw a year full of technical and security advancements for the protocol:

- Four third-party security audits were published over the course of the year, in addition to the initial three conducted in 2022.

- A collaboration with Hypernative was announced to develop an advanced protocol threat monitoring platform, elevating the security and observability of Liquid Collective's network while addressing staking risks.

- An initial due diligence resource was launched to make it easier for Liquid Collective’s participants to locate key information.

2. Liquid Collective in the news

- Blockworks:

Liquid Collective pitches efficiency standards for Ethereum validators - 0xResearch Podcast:

The Enterprise-Grade Liquid Staking Standard | Mara Schmiedt - Redstone Oracles:

LSTfi Report: The Ultimate Q4 2023 Market Overview - Forbes:

4 Liquid Staking Startups That Are Unlocking Ethereum’s Potential - Coindesk:

A Spot ETH ETF Represents the Dawn of Institutional Liquid Staking - TechCrunch:

Brevan Howard Joins $12M Round for Liquid Staking Protocol Alluvial, creator of the enterprise and institution-focused Liquid Collective - Fortune:

Alluvial raises $12 million to build out Liquid Collective, an Ethereum staking protocol for institutions - OurNetwork:

ON #165: ETH Post-Shapella - The Block:

Liquid Collective launches on Coinbase Prime and Bitcoin Suisse - Cointelegraph:

DeFi exec breaks down what it takes to attract institutions to staking - Pantera Capital:

The Seventh Bull Cycle - Blockworks:

All Eyes on Liquid Staking Derivatives as Shanghai Upgrade Nears - The Block:

Bitcoin Suisse to offer Ethereum Liquid staking for Swiss Market and joins Liquid Collective - Forbes:

Ethereum’s Centralized And Decentralized Liquid Staking Providers Battle For Dominance

3. Strategic collaborations & ecosystem growth

Liquid Collective’s ecosystem of industry-leading Custodians and Platforms where users can access LsETH expanded in 2023, consistent with Liquid Collective’s guiding principle to grow the pie for participants big and small through collaboration, shared purpose, and inclusivity.

By bringing the industry's leading participants together, including trading venues, custodians, service providers, node operators, and users, a broad set of stakeholders involved in building and governing Liquid Collective helps ensure that the liquid staking protocol can effectively scale beyond dependence on any single entity, reducing the risk of interest-capture and critical dependence, while still meeting high standards of excellence for operations and service.

As of December 2023, LsETH is supported on…

| Platforms: Stake ETH to mint LsETH | Custodians: Store and manage LsETH |

|---|---|

January: Bitcoin Suisse Joins Liquid Collective

Bitcoin Suisse expands liquid staking access for institutional and private clients as the protocol's first Swiss–incorporated Platform focused on targeting the Swiss market.

June: Hashnote joins Liquid Collective as a Platform, launching enterprise-grade liquid staking

Hashnote, the first fully regulated, institutional-grade investment management platform for DeFi, joins Liquid Collective as a LsETH Platform to offer enterprise-grade liquid staking to their users.

July: Liquid Collective x Rated partnership

Building a way to objectively evaluate staking providers through a risk-adjusted lens, Rated and Liquid Collective announce Validator Performance Standards.

“For the staking industry to mature and grow into its full potential, a common language and metrics around performance and risk are a keystone to unlocking latent capital to flow into the base layer of what has the potential to be the bedrock of a better, more transparent financial system.”

July: Twinstake joins as a Platform to offer institutional liquid staking

Twinstake, a leading institutional-grade, non-custodial staking provider, has joined Liquid Collective as a Platform to provide enterprise-grade Ethereum liquid staking to its institutional clients.

November: Hypernative & Liquid Collective collaborate to develop industry-leading protocol threat monitoring platform

Hypernative’s premier security monitoring platform will proactively identify and mitigate risks to the network, providing holistic liquid staking security.

Ongoing: ecosystem growth

We’re excited to see the Liquid Collective ecosystem growing in tandem as Liquid Collective’s collaborations and integrations expand. Stay tuned for opportunities to connect with the teams building Liquid Collective in 2024 across live and virtual events, special activations, and opportunities to learn about the secure liquid staking standard.

4. Market trends & outlook

2023 witnessed remarkable growth in staking adoption. The global staking market cap soared to a staggering $174.04 billion, while the DeFi space has seen liquid staking emerge as its fastest-growing sector, amassing a market value of $25 billion as of December 15, 2023. On Ethereum, the launch of staking withdrawals in April was widely seen as a significant de-risk for stakers. Over the last year the percentage of ETH staked has reached nearly 24%, with a whopping 41.65% of all ETH now staked via liquid staking solutions.

Liquid Collective's traction in the nine months following launch signaled 2023's trend of continued maturation in the DeFi market. This includes the rise of compliant DeFi ecosystems, the development of enterprise-grade solutions like Liquid Collective provides for liquid staking, and a movement in the security domain towards adopting web2 processes, practices, and certifications.

While DeFi solutions like P2P lending markets and automatic liquidations represent the foundation of decentralized financial participation, the integration of compliant LSTs like LsETH with compliant DeFi ecosystems has the potential to unlock the full benefits of participation in blockchain-based finance for the mainstream market. Liquid Collective’s 2023 growth, along with its integration with leading players across the ecosystem, signals the wave of this new segment of users seeking to blend crypto's decentralization with a focus on compliance.

This maturation can, in part, be attributed to the likely launch of an ETH spot ETH in 2024 and the growing demand for structured products and services in the DeFi ecosystem. We expect that LSTs will represent a foundational, backbone technology for staking-backed products and services due to their combining of Ethereum participation and ETH network rewards with access to liquidity and composability.

Further, approval of a spot ETH ETF in the United States could drive liquid staking adoption alongside supporting overall crypto market growth. LSTs will likely become the tool of choice for managing staked ETH, especially in light of ETFs' redemption periods, which lead asset managers to gravitate towards shorter redemption periods.

In addition, 2023 was a landmark year for the development of restaking and DVT technologies. EigenLayer’s restaking solution continues to expand its ecosystem in support of developing a robust security marketplace in the coming year, including adding more liquid staking integrations Q4-Q1.

Obol’s DVT network, currently in pilot phases, represents the potential to enable more efficient, stable, and distributed infrastructure technology for liquid staking networks. We expect that both staking and DVT will continue to develop and play an increasingly important role in how the crypto ecosystem participates in staking by expanding how security and diversity can be configured.

5. From the Collective

Figment: The Complete Liquid Collective LsETH Staking Guide

Proof of Stake Alliance (POSA): Most liquid staking tokens are not securities

Bitcoin Suisse: Liquid Staked ETH (LsETH) at Bitcoin Suisse

Coinbase Cloud Q&A with Evan Weiss

IOSG: Post-Shapella: Ethereum Staking Market to Display Dynamic Competitive Landscape

IOSG OFR Singapore Panel: Staking Innovation and What Comes Next?

Proof of Stake Alliance (POSA): Proof of Stake Alliance Offers First Legal Research and Analysis on Liquid Staking Tokens: Urges Industry to Self-Regulate

Alluvial: The Missing Piece: the Need for Risk-Adjusted Rewards in Staking

Coinbase Institutional: Liquid Staked ETH (LsETH) launches on Coinbase Prime

Proof of Stake Alliance (POSA): Proof of Stake Alliance Releases Industry Principles for Staking

6. Top 5: research & analysis

Ethereum's activation and exit queues: How Ethereum's activation and exit queues work, and their implications for stakers and node operators.

Ethereum’s Dencun upgrade: A look at the changes included in Ethereum's next network upgrade, and what the EIPs could mean for liquid staking protocols.

Leading considerations for staking participation in the evolving crypto landscape: Survey of experienced staking participants unmasks the consistent factors considered in their decision to stake.

What's next for ETH staking? With demand to participate in ETH staking heating up post-Shapella, a panel of experts takes a look at what’s next for the sector. A livestream conversation with leading staking experts covering post-Shapella traction, liquid staking solutions, decentralized validator technology (DVT), restaking, and more.

Maximum extractable value, Ethereum staking, and how MEV can make liquid staking protocols more efficient via automatic reward staking.

7. Top 5: resources

Liquid staking is easy to understand. Liquid staking is a rapidly growing solution for locking up a user's tokens and contributing to the security of proof of stake blockchains.

Liquid Staked ETH (LsETH) is the receipt token programmatically generated when users stake ETH through the Liquid Collective protocol.

Liquid Staking Tokens are an important technological innovation allowing participants in proof of stake networks to access liquidity while staking.

As liquid staking grows in popularity, the need for a composable, decentralized, and secure liquid staking standard has emerged.

What are Liquid Staking Tokens (LSTs)?: At ETHDenver, Mike Selig and Alison Mangiero discuss the Proof of Stake Alliance’s publication of two white papers representing first research and analysis into key legal questions surrounding the taxation and regulation of liquid staking in the U.S.

8. & more!

Mr. X: Liquid Collective’s distinguished broadcatter

Live from under the couch in New York, Mr. X launched a monthly news report in April to bring Liquid Collective’s community the latest updates. From his humble beginnings touring with Bjork to his latest commentary as host of Liquid Collective’s expert panels, we’re proud that Mr. X has developed into a leading voice of today’s liquid staking mews.

Subscribe to Liquid Collective Updates

Top apparel 2023

Champion Tie-Dye Hoodie

Oversized Tie-Dye T-Shirt

Use LSTs Responsibly

Visit the Liquid Collective store

Thank you!

One of Liquid Collective’s guiding principles is to operate with a positive sum mindset. That’s why it’s so exciting to see the growth experienced by the Liquid Collective community in 2023, with the protocol’s traction and momentum building as staking continues to evolve. We can’t wait to see what growth and development 2024 will bring for the Ethereum community, liquid staking, and Liquid Collective, too.

Thank you for being a part of this journey to build the trusted and secure staking standard.

To stay up-to-date with the latest from Liquid Collective, follow Liquid Collective on X, LinkedIn, YouTube, or subscribe to monthly Liquid Collective Updates. Learn more at liquidcollective.io.