Jun 07 2023

- The contracts allowing stakers to redeem LsETH for ETH via the Liquid Collective protocol are now live, marking a significant step forward for the protocol's liquidity and capital efficiency.

- By design, Liquid Collective's automatic staking of consensus and execution layer network rewards increases the protocol's staking efficiency by maximizing the number of validators in the active set, removing the pain point of manually automating this process for stakers.

- Seamless redemptions of LsETH for ETH are enabled by Liquid Collective's ETH Deposit and Redemption Buffers, allowing flows in and out of the protocol to be managed efficiently between Ethereum's execution and consensus layers.

- A first-in-first-out Redemption Queue aims to ensure fair conversions and protect against a run on claims.

Ethereum staking withdrawals are now live on the Liquid Collective protocol, following robust testing and auditing. This significant upgrade unlocks full participation for Liquid Collective's stakers to support Ethereum's security while retaining the option to access increased capital efficiency and liquidity via Liquid Staked ETH (LsETH).

With the contracts to natively redeem LsETH for ETH deployed at the protocol level, Liquid Collective's Platforms can now implement LsETH withdrawals. This allows Liquid Collective's stakers to directly control their Ethereum staking participation.

In the short period since withdrawals were enabled on Ethereum the demand to participate in staking has only continued to grow. Institutional staking is seeing unprecedented inflows, while Ethereum's activation queue has exceeded the exit queue by over 46 days (as of June 6, 2023).

We believe that the protocol's design combined with its built-in Slashing Coverage and compliance standards bring the protocol one step further in its mission to collectively build the ecosystem's most trusted and secure staking standard.

Ethereum staking withdrawals and the Liquid Collective protocol's implementation

Ethereum withdrawals were enabled by the network's Shapella upgrade in April of this year, allowing staked ETH to be unstaked. This process involves transferring ETH locked on Ethereum's consensus layer to the execution layer where it can be used in transactions.

There are two types of staking withdrawals on Ethereum:

- Full exits are when a validator stops participating in Ethereum's consensus and all of its staked ETH is withdrawn. Full exits can either be voluntary, resulting from a request to withdraw all ETH, or involuntary, due to being slashed for misbehaving on the network.

- Network reward skimming, or partial withdrawals, are an automatic process that withdraws only the network rewards collected by the validator (consensus layer rewards above the validator's effective balance of 32 ETH), while the validator remains active in Ethereum's consensus with its effective balance of 32 ETH staked.

There are variable waiting periods associated with validator withdrawals on Ethereum. You can learn more about Ethereum's validator activations and exits in our post.

Liquid Collective's withdrawal implementation:

- allows stakers to redeem LsETH for ETH via the Liquid Collective protocol, according to the protocol conversion rate

- allows the protocol to automatically stake any Ethereum network rewards received, increasing the protocol's staking efficiency by compounding the number of validators in the protocol's active set

- increases the liquidity and capital efficiency of participation in securing the network for LsETH holders

What is Liquid Collective's protocol conversion rate?

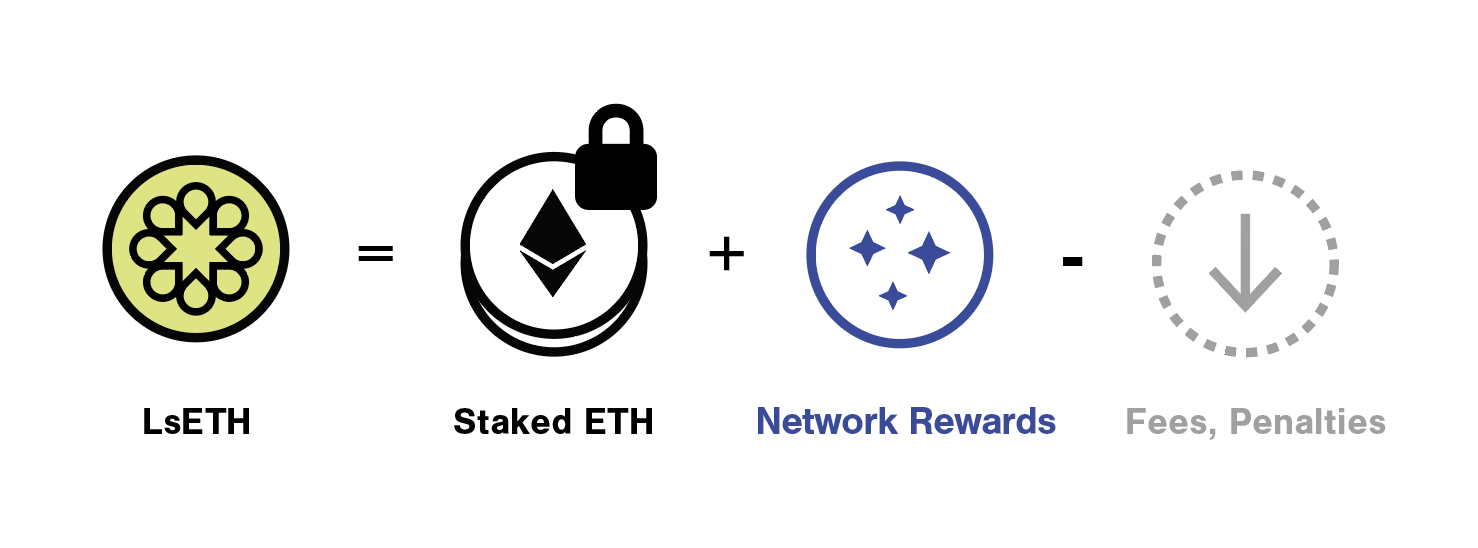

The LsETH protocol conversion rate is the amount of ETH for which LsETH can be redeemed, and the amount of LsETH that is minted to evidence ETH staked.

The value of the conversion rate reflects the amount of ETH staked plus any Ethereum network rewards that the stake has accrued, minus any potential penalties (e.g., slashing) imposed by the network and protocol service fees.

As such, the conversion rate for LsETH is not fixed 1:1 LsETH:ETH—instead, the conversion rate fluctuates over time.

Redeeming LsETH for ETH

Liquid Collective's redemption design allows LsETH holders to redeem LsETH for ETH through a simple three-stage process, the underlying functions of which are all performed programmatically by the Liquid Collective protocol:

- Request: the LsETH holder requests a redemption via a Platform (e.g. in the Coinbase Prime app), surrendering the amount of LsETH that they would like to redeem. This LsETH will eventually be burned.

- Satisfaction: after the protocol completes any required validator exits and the corresponding amount of ETH is withdrawn as according to the protocol conversion rate, the request is satisfied and can be claimed at any time.

- Claim: the redemption request is claimed, triggering the actual transfer of ETH to the redeemer.

Redemptions are orchestrated by the Liquid Collective protocol's Redemption Queue, which facilitates the satisfaction of redemption requests in the same order as they have been requested. The first-in-first-out Redemption Queue is intended to protect against a race for claims in the event of high withdrawal demand.

Redemption requests on the Liquid Collective protocol cannot be canceled once they have been made. This is because validator exits cannot be canceled on Ethereum once they have been triggered.

The protocol conversion rate is applied to a redemption request, to determine the amount of ETH to be redeemed, at the time of satisfaction and capped by the conversion rate at the time of request. This design is intended to ensure a fair conversion rate is applied for redeemers while protecting the protocol from premature redemptions.

When redemption demand increases the protocol initiates the exit of a corresponding amount of ETH by programmatically requesting Node Operators to submit validator exits. The time to satisfaction (or redemption time) depends on Ethereum network dynamics—particularly the length of Ethereum's exit queue.

Last, but not least, to optimize staking efficiency, the protocol automatically maintains ETH Deposit and Redemption Buffers. These buffers are designed to ensure that flows in and out of the protocol are managed efficiently between Ethereum's execution and consensus layers, which enable seamless redemptions of LsETH for ETH via automatic rebalancing.

Liquid Collective's redemption architecture

When a LsETH holder requests a redemption, the request is added to the protocol's Redemption Queue. On each Oracle report, completed approximately every 24 hours, the protocol assesses the unsupplied ETH demand for redemptions.

If there is unsupplied redemption demand, the protocol requests validator exits by signaling Node Operators. Upon receiving this request, the validators are entered to Ethereum's exit queue, where they are subject to Ethereum's exit queue timeline. The withdrawn ETH is then used by the protocol to satisfy the redemptions.

To efficiently balance flows between Ethereum's execution and consensus layers, the Liquid Collective protocol maintains a rebalance buffer. The protocol's Deposit Buffer includes ETH pending to be deposited to Ethereum's consensus layer, while the Redemption Buffer includes ETH pending to be supplied for redemptions.

- ETH deposits enter the Deposit Buffer to be programmatically staked in Ethereum's consensus layer

- Ethereum execution layer fees received by Liquid Collective validators automatically enter the Deposit Buffer to be programmatically staked

- Ethereum consensus layer network rewards received by Liquid Collective validators automatically enter the Deposit Buffer to be programmatically staked

- Withdrawn validator consensus layer ETH from validator full exits, or slashed validator exits, automatically enter the Redemption Buffer to fund LsETH redemptions

- Funds from Liquid Collective's Slashing Coverage Program enter the Deposit Buffer according to the Slashing Coverage Program to be programmatically staked

As ETH in the Deposit Buffer reaches a fungible bulk of 32 ETH it is programmatically staked, funding new validator keys and being pushed to Ethereum's activation queue. As validator exits are processed, the withdrawn ETH feeds the Redemption Buffer to fulfill redemption requests. The Liquid Collective protocol programmatically rebalances ETH between the Deposit and Redemption Buffers to preserve capital efficiency by minimizing consensus layer operations and offer seamless ETH withdrawal requests

You can learn more about Liquid Collectives redemption architecture in Liquid Collective's Ethereum Implementation Documentation.

Supporting the ecosystem with collective collaboration

Liquid Collective's approach of building with collective collaboration among a broad and dispersed community of market participants encourages innovation by tapping into diverse expertise and perspectives, driving the development of new use cases, efficient financial primitives, and integration of proven solutions. The protocol's Ethereum staking withdrawal design is the result of collaboration and diversified experience in developing staking infrastructure across multiple ecosystem-leading teams.

Thank you to those who have supported the protocol's technical development, including the Alluvial and Kiln teams, to those that have audited the protocol's smart contract code and provided feedback, including the Spearbit team, for auditing the protocol’s smart contract code and providing feedback, and to Liquid Collective Platforms, including Coinbase and Bitcoin Suisse, for providing feedback on the withdrawal design.

Have questions about Liquid Collective's withdrawal architecture for LsETH redemptions? Join us for a live community AMA with members of the Alluvial and Kiln teams to answer any questions about LsETH redemptions and Ethereum withdrawals on Tuesday, June 15t 2023, at 11:30 AM ET / 5:30 PM CET. The information to join is here.