Posted Apr 11 2023 Updated Nov 09 2023

This overview was originally published in April 2023. It was updated in November 2023.

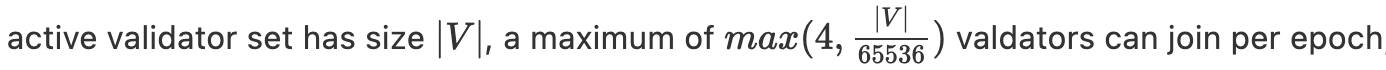

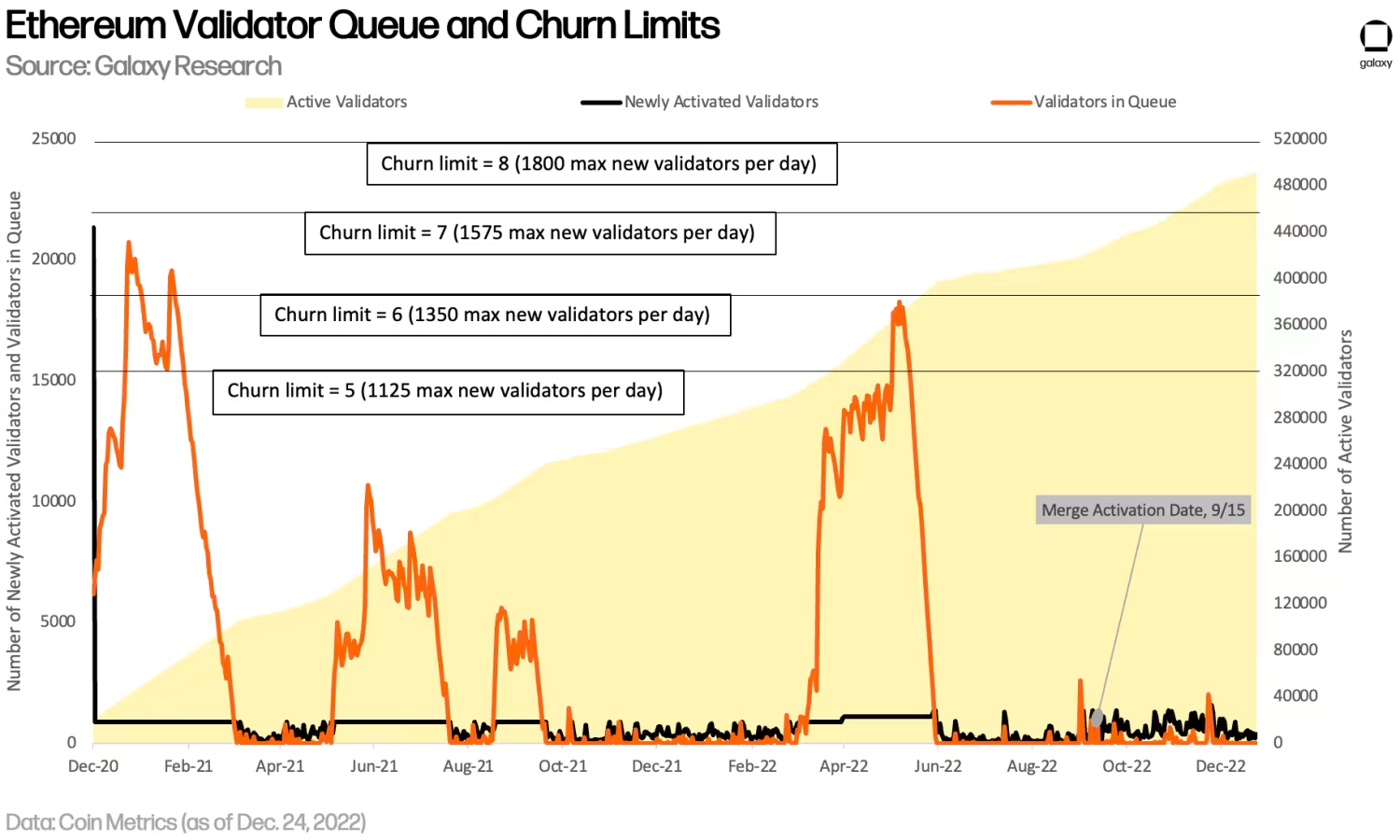

- The churn limit, which governs Ethereum's validator activations and exits, is a parameter that protects the network's stability.

- The churn limit dictates how many validator activations or exits can be initiated per epoch, and any simultaneous demand to stake or withdraw beyond that number must wait in an activation or exit queue to be processed.

- Currently, the churn limit increases and decreases based on the number of validators in Ethereum’s active set. As of November 2023, the churn limit is 13.

- EIP-7514: Add max epoch churn limit, expected to be included in Ethereum’s Dencun upgrade in Q1 2024, proposes capping the churn limit for activations at a maximum of 8, while the churn limit for validator exits will continue to scale with the active set.

- At an activation churn limit of 8, only ≈0.04% of the circulating ETH supply can be activated per day (≈1800 validators per day), and any staking demand spiking beyond that limit will have to wait in a first-come-first-serve line to start earning Ethereum network rewards. A spike in demand representing just 4% of the circulating supply would take over 83 days to become active on the network and eligible to earn rewards at the churn limit of 8 validators/epoch.

- Liquid staking tokens (LSTs) may present a critical solution to the liquidity problems introduced by extensive validator entry and exit queues.

Ethereum's activation and exit queues protect the stability of Ethereum's proof of stake (PoS) consensus. Specifically, Ethereum's churn limit, a parameter that caps how many validators can be processed by the activation or exit queue, ensures that the validator set remains stable and that the chain's finality guarantee is not affected by many validators joining or leaving the network at the same time.

In simple terms, the churn limit defines how much ETH can be staked, and a limit on how many staking withdrawals can be initiated, on Ethereum in a given epoch (≈6.4 minutes).

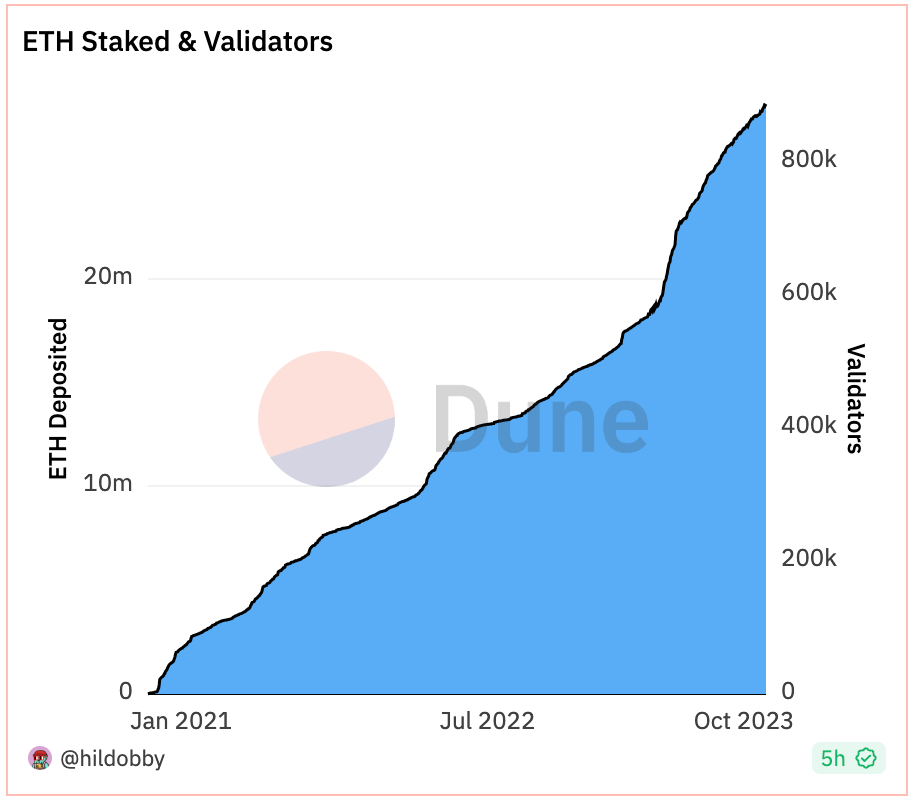

Ethereum's Shapella Upgrade in April of 2023 enabled Ethereum validators to execute partial and full ETH withdrawals for the first time. As the network prepared for this important dynamic to be live, much analysis focused on the potential for long withdrawal timelines due to the exit queue. However, the launch of withdrawals was widely seen as a significant milestone de-risking the participation and opportunity cost of ETH staking, which led to unprecedented ETH staking inflows. The activation queue quickly outpaced the exit queue.

While staking demand has since stabilized, builders within Ethereum have raised concerns that discovery work is required to ensure Ethereum’s consensus can withstand the growing number of validators on the network. EIP-7514: Add max epoch churn limit was proposed in reaction to this steep growth in staking demand. Currently slated to be included in Ethereum’s Dencun upgrade in Q1 2024, EIP-7514 proposes capping the churn limit for activations at a maximum of 8, while the churn limit for validator exits will continue to scale with the active set.

In periods of significant demand the parameters defining validator activations and exits could have significant implications for stakers. Liquid staking tokens (LSTs) may present a critical solution to the liquidity problems introduced by extensive validator entry and exit queues.

In this post, we’ll explain how the activation and withdrawal queues are determined today. Following the implementation of EIP-7514 in Ethereum’s Dencun upgrade, we’ll update this post to reflect the new churn limit dynamics and how they work

Ethereum's churn limit, today

Ethereum's churn limit is responsible for this critical job of ensuring that Ethereum's active set remains stable over time—put simply, it is a limit that ensures there is a limited amount of “churn” in the protocol's active set.

The churn limit depends on the number of validators that are already active on the network. The more validators that are active on Ethereum, the more new validator activations, and exits of existing validators, can be processed per epoch (one epoch = 32 validator voting slots, or about 6.4 minutes).

In other words, for every 65,536 additional validators that are active on the Ethereum network, the number of new validators that can be activated per epoch increases by one, and the number of validator exits that can be processed per epoch also increases by one.

Currently, the churn limit is set at 13. You can view Ethereum's current churn limit in real-time here.

Determining the Ethereum activation queue

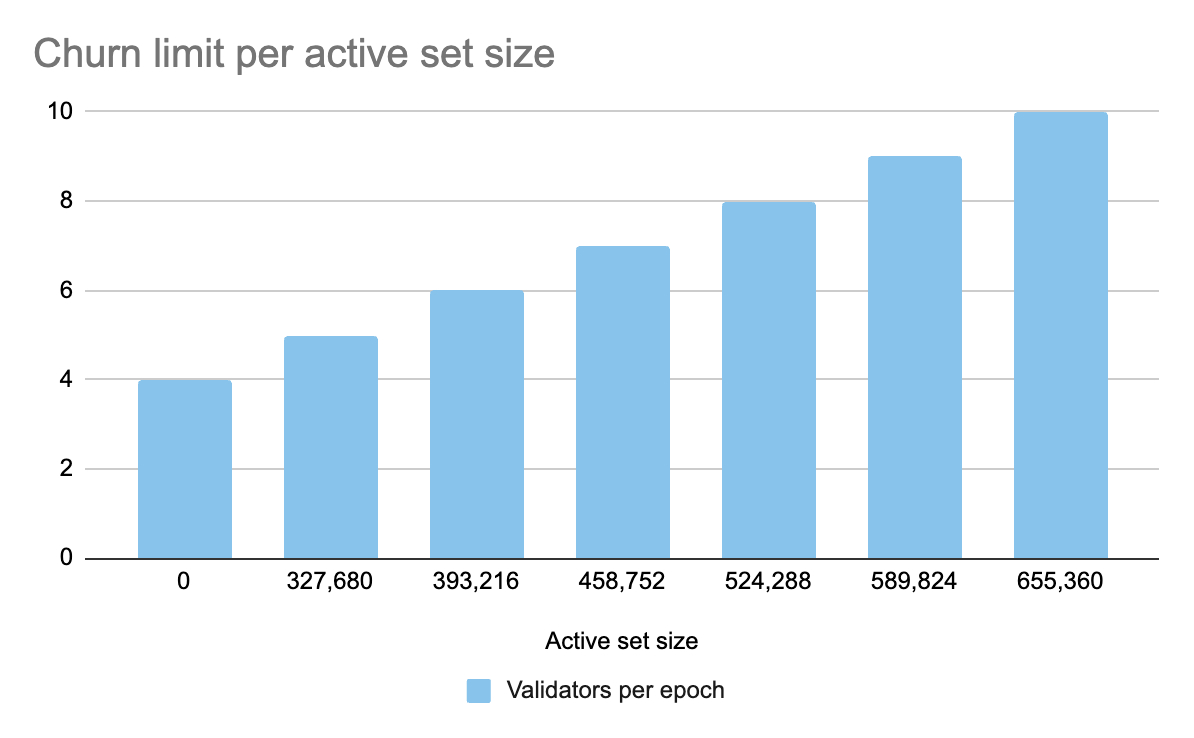

Registering a new validator node on Ethereum requires depositing 32 ETH into the Ethereum deposit contract and submitting a transaction that includes key credentials for the validator.

Before validators are activated on Ethereum they must first wait for a period of at least four epochs. The minimum wait of four epochs to be activated is designed to ensure that RANDAO, the random beacon that chooses validators as block proposers, cannot be manipulated.

The pending validators must then must be voted in by active validators, with the number that can be voted in per epoch determined by the churn limit. Once activated, validators are eligible to be selected to perform work and to receive network staking rewards in exchange.

If the number of new validators looking to enter the active set exceeds the churn limit, validators will have to wait in a first-come-first-serve activation queue before they are activated. This could stretch from a couple of days to a couple of weeks, or even months.

Example: Determining Ethereum activations

- After registering their keys and depositing ETH to Ethereum's deposit contract, validators must first wait for a 4-epoch period (≈25.6 minutes)

- At a churn limit of 8, 8 new validators can be activated by existing validators per epoch (≈6.4 minutes), representing ≈256 ETH

- This equates to approximately 1800 validators per day that can be activated on the Ethereum network at a churn limit of 8

- Any immediate demand to activate beyond 8/epoch at this churn limit must wait in a first-come-first-serve activation queue

Determining the Ethereum withdrawal lifecycle and exit queue

Similarly, Ethereum’s churn limit determines how many validators can start the process of withdrawing ETH and leaving the network’s active set at any point in time. However, the full withdrawal lifecycle also includes a separate withdrawal period, followed by a final withdrawal queue. Withdrawing staked ETH first requires submitting a withdrawal transaction to the Ethereum deposit contract.

There are three versions of withdrawal request:

- Partial withdrawal: A validator can request to withdraw a percentage of their ETH staked. This can be used to withdraw and distribute any Ethereum network rewards earned above the 32 ETH stake required to operate an active validator.

- Full exit, voluntary: If a validator voluntarily submits a request to fully exit the active set, they are entered to the withdrawal lifecycle to withdraw their staked ETH from the network.

- Full exit, slashing: If a validator is slashed for misbehaving on the network, they are automatically entered into the withdrawal lifecycle to be fully removed from the active set and withdraw their staked ETH from the network, minus any slashed ETH.

Partial withdrawals are handled differently than full withdrawals. In most cases,partial withdrawals are automatically distributed for any funds above the 32 ETH minimum required to operate a validator.

When a validator starts a full exit, whether voluntary or due to slashing, their request to exit has the same maximum throughput per epoch as the activation queue, determined by the churn limit (as such, for every 65,536 additional validators activated on Ethereum, the number of validators that can be exited per epoch increases by one).

If more validators are exiting than can be processed per epoch, the pending validators will have to wait in a first-come-first-serve exit queue before they are moved to the next phase of the withdrawal lifecycle.

Partial withdrawals, and both kinds of full exits, must then wait for an additional withdrawal period. The length of the withdrawal period is determined by whether their withdrawal is voluntary or whether their withdrawal was automatically triggered due to a slashing:

- Partial withdrawals and voluntary validator full exits must wait an additional ≈27 hour period before they can withdraw their ETH. This helps to ensure that there's a period of time to catch the validator for slashing if they recently misbehaved, along with providing some time for other key functions, like including recent rewards and making custody challenges.

- If a validator is slashed, they must wait an additional ≈36 days before they can withdraw their ETH minus slashing penalties. This provides an extra punishment for misbehavior, along with providing some time to determine whether there was correlated slashing across validators.

We believe that this increased withdrawal period for slashing emphasizes why it's important to stake with node operators that have proven performance and security standards; while slashing coverage can help reimburse stakers in the event of a slashing incident, any slashing incident will still trigger ETH being locked in a withdrawal period for at least 36 days, during which time it is not earning rewards and cannot be accessed.

Finally, all withdrawals must wait in a variable withdrawal queue. Only 16 validator withdrawals (partial or full) can be processed on each Ethereum block. To determine these 16 withdrawals per block, each block proposer conducts a round-robin sweep across all Ethereum validators to find the next 16 to process, with the next block proposer picking up the sweep where the last proposer left off (you can learn more about how the withdrawal queue process works here). At the time of writing in November 2023, the final withdrawal queue length is ~9 days and 5 hours.

Example: Determining Ethereum's exit queue

- At a churn limit of 8, 8 validators per epoch can be processed for full exits from the Ethereum network, representing approximately 1800 validators per day

- Those full voluntary exits must then wait an additional 27 hours before their funds can be withdrawn, or 36 days if they were automatically exited due to slashing

- Partial withdrawal requests are only currently subject to waiting the 27 hour withdrawal period, and are not subject to the exit parameters of 8/epoch

- All withdrawals must then wait in a final withdrawal queue, as all validators are swept to find the next 16 validators per block to process for a full or partial withdrawal (As of November 2023 this queue is 9 days and 5 hours).

Activation and exit queues, staking demand, and what it all means for liquid staking

In early 2022, Ethereum's activation queue reached a backlog of nearly three weeks. By June, the queue was back down to one day, with analysis from Figment showing that the backlog behavior was dependent on both the changing activation queue parameters (a backlog building up as the queue parameters neared the next cliff for increasing the activation rate), along with overall participant sentiment toward staking changing how many new validators were entering the queue at one time.

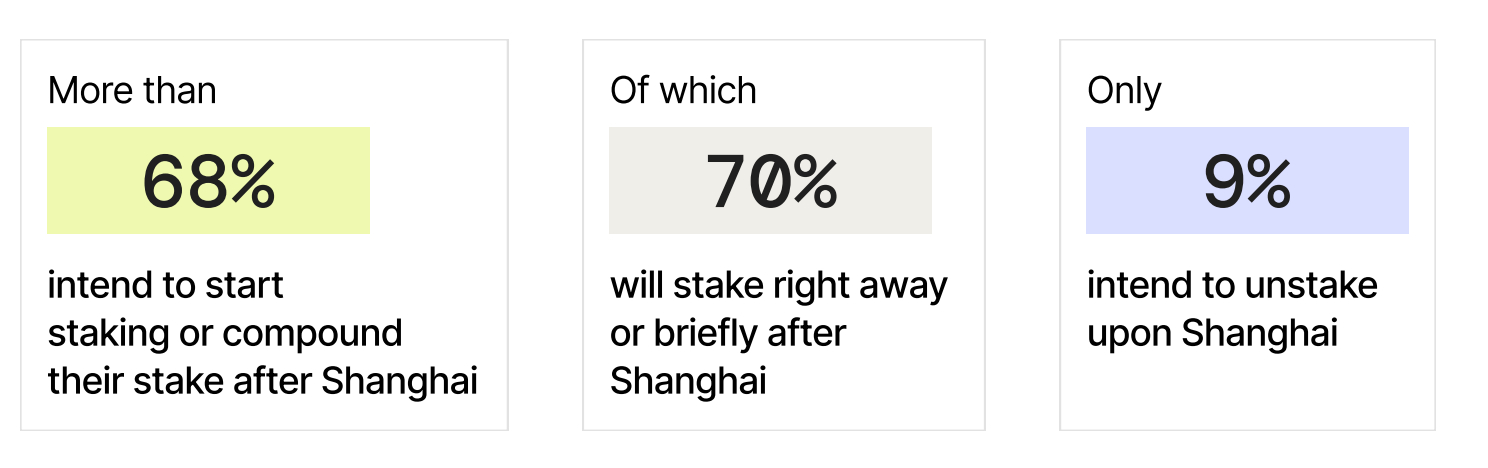

According to a pre-Shapella survey conducted by Kiln of over 100 brokers, market makers, exchanges, wallets, custodians, banks, and DeFi investment firms with over $10B in assets under management, over 68% of respondents intended to start staking or compound their stake after the Shapella Upgrade, with 70% of those respondents planning to stake “right away” after the upgrade, and only 9% of all respondents intending to unstake upon Shapella.

Extrapolating on the results of their survey to simulate activation queue volume, Kiln noted that if 42% of ETH holders intend to start staking 30% of their ETH assets immediately following the Shapella Upgrade, representing 408k new validators of simultaneous demand, the resulting entrance queue would take 176.3 days. Mara Schmeidt, CEO of Alluvial, also predicted that the activation queue would far outpace the exit queue post-Shapella.

These predictions of steep activation queues did play out, albeit not to such a significant extreme.. Following a brief period of withdrawal demand the inflows to ETH staking grew at unprecedented rates, with over 23.5% of ETH supply now staked. The validator activation queue peaked in early June around a 45 day wait to begin staking.

This rapid growth in the size of Etheruem’s active set began to raise concern post-Shapella, with researchers citing that unlimited active set growth long-term could lead to a strain on Ethereum’s consensus and bloat in the beacon chain’s state size. While debates over how to protect against this strain are ongoing, EIP-7514 was proposed in reaction to these concerns. By capping the churn limit for validator activations at 8, the proposers aim to slow the growth of Ethereum’s active set while research on (and debate surrounding) long-term solutions are considered. EIP-7514 is currently expected to be included in the Dencun upgrade, expected in Q1 2024.

Some experts estimate that overall staking demand could exceed 40% of the circulating supply. However, with an activation churn limit of 8, new validator entries are capped at roughly 0.04% of the circulating ETH supply, or 1800 validators per day, and any demand spiking beyond that limit will have to wait in a first-come-first-serve line to start earning rewards.

This could result in a significant waiting time for new participants to start earning staking rewards in periods of high demand. According to historical deposit data, we have already witnessed daily deposits exceed 10x+ daily activation capacity.

If just 4% of the circulating ETH supply tried to start staking simultaneously at a churn limit of 8, it would take over 83 days for that stake to become active on the network and eligible to earn rewards, representing nearly three months of missed opportunity for rewards.

Liquid staking tokens post-Shapella

Prolonged staking activation and exit queues can represent a significant opportunity cost for stakers who may see delays in receiving Ethereum network rewards, or face delays in accessing liquidity on their previously staked ETH. Queues can also represent a continued barrier for participants looking to offer products and services based on staking that require higher liquidity and redemption timelines, such as structured products, ETPs, or ETFs.

Now that withdrawals are enabled on Ethereum, liquid staking tokens (LSTs) continue to be a way to access liquidity while directly participating in staking. LSTs, like LsETH, are receipt tokens representing ownership of the staked ETH and any rewards earned from participating in the network, allowing users to directly participate in staking while also accessing additional liquidity and capital efficiency.

Inflows to liquid staking grow post-Shapella just as staking demand grew in turn, illustrating the clear importance of LSTs post-withdrawals. As of November 2023 liquid staking participation has grown to 11.5m ETH, representing over 40% of all ETH staked.

In addition to LSTs' ability to be used in DeFi and other dapps while the holder participates in staking, the parameters of Ethereum's activation and exit queues illustrate the importance of liquid staking tokens for facilitating liquidity. If the queues to both enter staking and exit staking are long, participants may be looking for more flexibility and optionality in entering and exiting staking positions.

Even hodling stakers who aren't concerned with instant liquidity may find LSTs more attractive than waiting to start earning rewards. If the queues to both enter staking and exit staking remain backed up for participants—delaying the ability to participate in staking from days to weeks—participants may still have the ability to trade in or out of staking positions by purchasing or selling liquid staking tokens on the open market.

What's next

As development work on Ethereum’s Dencun upgrade continues to progress we’ll keep this post updated to reflect the changes in how Ethereum’s churn limit works. You can learn more about the Dencun upgrade, and the EIPs included in it, in our post, “Ethereum's Dencun upgrade: what's next for ETH and liquid staking.” If you’d like to learn more, stay tuned for further updates on a variety of proposals under consideration for how Ethereum’s staking dynamics could be updated to reflect growing demand. Follow @liquid_col on X for more analysis and insights about Ethereum’s developments on this front.

Liquid Collective is the secure liquid staking standard: a decentralized protocol designed to meet the needs of institutions, built and run by a collective of leading web3 teams. Learn about liquid staking, LsETH, and the protocol's Slashing Coverage Program in the Liquid Collective Litepaper.