Mar 07 2023

- Liquid Collective, a decentralized enterprise-grade liquid staking protocol, is now live for Ethereum staking on Coinbase Prime and Bitcoin Suisse.

- Instead of just holding your ETH, you can hold LsETH, a liquid staking token programmatically minted by the protocol, to receive ETH network rewards for helping to secure the Ethereum network—without sacrificing liquidity. Use LsETH in DeFi and web3 for increased capital efficiency.

- Liquid Collective is designed to expand decentralized participation in securing web3 by solving for blockers to institutional participation in staking.

- The multichain-capable protocol is built and governed by a broad and dispersed group of industry leaders, including The Liquid Foundation, Alluvial, Coinbase, Kiln, Acala, Rome Blockchain Labs, and Bitcoin Suisse.

- Always make sure to confirm the Liquid Staked ETH (LsETH) token address on Etherscan here before interacting with LsETH on any exchanges, DEXs, or applications you use.

Starting today you can use Liquid Collective, a new decentralized liquid staking protocol, to stake your ETH with access to liquidity.

Instead of just holding ETH, you can hold LsETH, which is a liquid staking token programmatically generated by the protocol, to stake ETH and receive ETH network rewards for helping to secure the Ethereum network—without giving up the liquidity of holding unstaked ETH. Plus, LsETH holders receive coverage against slashable events, like network outages and poor validator performance, through Liquid Collective's built-in slashing coverage program with Nexus Mutual.

Coinbase Prime and Bitcoin Suisse, two leading institutional crypto platforms, have launched support for the Liquid Collective protocol and are ready for you to participate. By accessing Liquid Collective's liquid staking solution, you can stake your ETH and receive network rewards, while using LsETH to participate in web3 and decentralized finance (DeFi) projects.

Stake ETH with liquidity

Getting involved in ETH liquid staking is simple using Liquid Collective. Work with your preferred Platform team, including exchanges, custodians, multi-wallet solutions, and brokers, to onboard to the protocol by completing their standard KYC/AML checks.

Then, use the Liquid Collective protocol to stake your ETH directly via the Ethereum blockchain, the protocol will automatically mint your LsETH to evidence your ownership of your staked ETH, and you can start receiving ETH network rewards knowing that your ETH is staked across security-focused node operators with access to slashing coverage baked-in. Liquid Collective's slashing coverage treasury is supported via the protocol's service fee.

Your LsETH is the liquid staking token (LST) minted by the protocol to evidence your legal and beneficial ownership of your underlying staked ETH, plus the staking rewards that you have received. LsETH can be transferred, stored, traded, and utilized in DeFi while continuing to accrue network rewards for helping secure the network. Once withdrawals are enabled on Ethereum, if you want to claim the network rewards that have accrued to your staked ETH and stop staking, you will be able to redeem your LsETH to ETH.

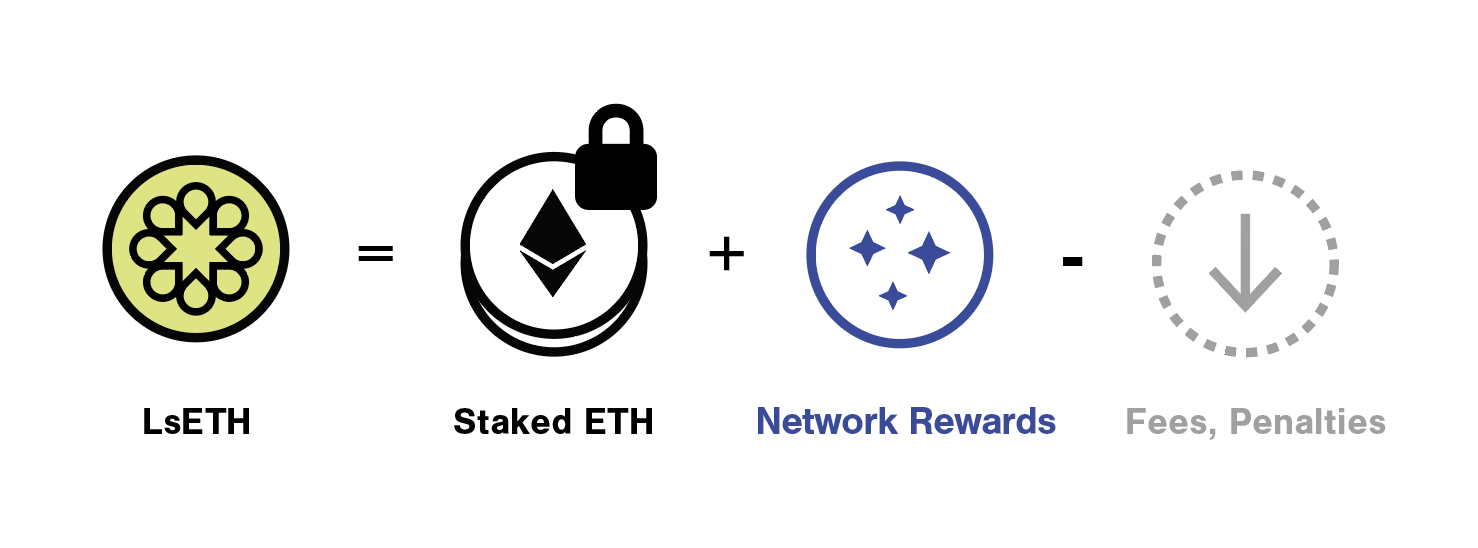

LsETH's conversion rate for ETH is not pegged 1:1, and you will not receive more LsETH in your wallet as you receive ETH network rewards. Instead, LsETH's conversion rate reflects both the underlying staked ETH and the network rewards it has accrued, minus any fees or penalties.

To avoid potential fraud, always make sure to confirm the Liquid Staked ETH (LsETH) token address on Etherscan here before interacting with LsETH on any exchanges, DEXs, or applications you use. The LsETH token address is 0x8c1BEd5b9a0928467c9B1341Da1D7BD5e10b6549.

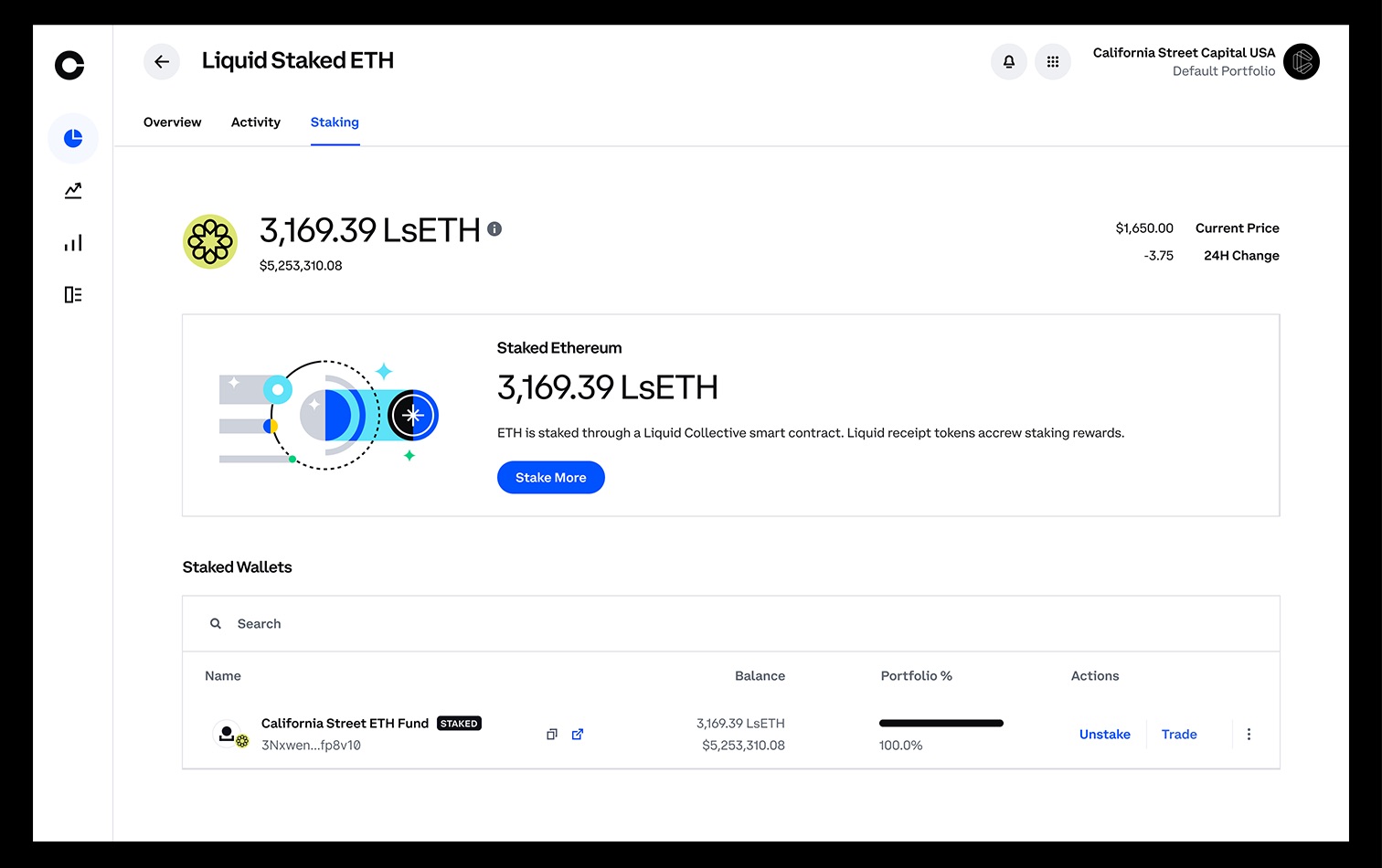

Stake ETH with Liquid Collective on Coinbase Prime

Coinbase Prime is a fully integrated prime broker built to support institutions through the entire transaction lifecycle including advanced multi-venue agency trade execution, custody for 360+ assets, financing, staking and staking infrastructure, data and analytics, and reporting. Qualified Coinbase Prime users can onboard to Liquid Collective, stake ETH, and mint LsETH directly from their Coinbase Prime account. In addition, any qualified Coinbase user can purchase LsETH directly on the Coinbase retail exchange once trading is live.

“Liquid Collective is uniquely positioned to offer an enterprise-grade liquid staking product with robust slashing coverage and a forward-looking compliance approach to our institutional clients. We're excited to support this new liquid staking standard as part of our multi-product strategy.”

—Aaron Schnarch, Vice President of Custody at Coinbase

Stake ETH with Liquid Collective via Bitcoin Suisse

Bitcoin Suisse is one of the oldest Swiss crypto-financial services providers and trusted gateway to crypto asset investing, offering a wide range of institutional-grade crypto services. Bitcoin Suisse clients can access the Liquid Collective protocol, stake ETH, and mint LsETH directly within their Bitcoin Suisse Online account. Reach out to Bitcoin Suisse here to start the process of onboarding to access the new Liquid Collective staking feature.

“Institutional and private clients are increasingly looking to participate in staking to receive network rewards. Staking involves blockers of participation, the largest two being illiquidity windows and the lock-up of staked tokens—mechanisms that primarily exist to preserve network security and integrity. Liquid staking is an innovation that addresses these blockers of participation, providing users with higher capital efficiency and liquidity, while preserving the network's security features. With this new partnership, Bitcoin Suisse is further advancing the institutionalization of crypto-financial services for our Swiss institutional clients and for the benefit of the crypto ecosystem.”

—Michael Gauckler, Chief Product Officer at Bitcoin Suisse

Expanding secure participation in liquid staking

Staking is a key way to participate in the security of a blockchain network, and to receive network rewards for doing so. But staking traditionally comes with several tradeoffs, as holders must weigh the opportunity costs of locking up their tokens rather than using them in DeFi or other decentralized applications (dapps).

Using liquid staking solutions, token holders no longer have to make these tradeoffs, as liquid staking offers liquidity and enhanced capital efficiency. Liquid staking is a software solution that enables users to stake directly via the Ethereum blockchain, with a liquid staking token programmatically minted by the protocol providing access to liquidity while the user stakes. However, we believe participation in liquid staking has been limited until today, as existing liquid staking solutions have failed to prioritize the compliance and security needs of institutions, which poses validator counterparty risks, or have been single-entity offerings lacking composability, and pose centralization risks.

Liquid Collective is designed to empower global participation in securing the decentralized internet by solving for blockers to institutional participation in staking, including the need for KYC/AML compliance, sanctions screening and enterprise-grade security. The protocol is founded on compliance with due diligence standards designed to protect platform users from reputational harm and business disruptions.

To enforce these standards, the Liquid Collective partners with Exiger, a premier software and tech-enabled governance, risk, compliance and diligence solutions firm, as its exclusive partner to perform compliance program reviews, AI-enabled open-source screening and due diligence of participants.

"As finance becomes more decentralized, core principles of transparency, compliance and due diligence become critical. We're proud that Liquid Collective selected Exiger to develop the protocol to safeguard all participants by using AI-enabled technology, informed by expertise, to maintain strong compliance and due diligence standards."

—Michael Roe, Managing Director and Americas Head of Advisory Solutions at Exiger

Fostering decentralized participation in securing web3

Why is this important? Currently, only 14.6% of the entire Ethereum supply is being staked. With Liquid Collective, institutional participants can reasonably participate in staking while meeting their compliance requirements and not sacrificing liquidity, which has the potential to drive widespread participation in securing web3.

At the same time, Liquid Collective offers a decentralized approach to liquid staking, addressing the need for security and compliance while also promoting composability and ecosystem standardization. Liquid Collective is non-custodial and decentralized, built and governed by a broad and dispersed group of trusted, industry-leading web3 teams, including The Liquid Foundation, Alluvial, Coinbase, Kiln, Acala, Rome Blockchain Labs, and Bitcoin Suisse.

Clear, meaningful purpose and compelling ethical principles evoked from and shared by all participants should be the essence of every institution.

—Dee Hock, CEO Emeritus of Visa, One From Many

Stake on the protocol is distributed round-robin amongst a distributed group of Node Operators with multi-cloud, multi-region, multi-client infrastructure, including Coinbase Cloud. Liquid Collective's Ethereum development was led by Kiln, the protocol's Ethereum Technology Provider, with support from Alluvial. Kiln is an industry-leading enterprise staking provider.

Our goal is to provide the most trusted liquid staking standard: transparent, decentralized, meeting compliance and security needs, and highly performant.

Become a Platform to offer LsETH

Platforms, such as Coinbase and Bitcoin Suisse, play a key role in the Liquid Collective protocol. Platforms provide a seamless on-ramp and access for users to interact with the Liquid Collective protocol. There are two types of Liquid Collective Platforms. Platforms that enable direct Liquid Collective protocol interactions, including depositing ETH to Ethereum's deposit contract and redeeming LsETH for ETH (minting and redeeming), offer KYC/AML and Sanctions Screening procedures for their users, then submit the user's wallet address to Liquid Collective's Allowlist smart contract upon successful completion. Platforms that do not enable minting, redeeming, or direct Liquid Collective protocol interactions, but do enable secondary protocol interactions such as trading, lending, or other services, do not Allowlist wallet addresses; users of these Platforms can seamlessly interact with LsETH, and may accrue Ethereum's consensus and execution layer network rewards simply by holding LsETH..

Organizations interested in offering LsETH and liquid staking via the protocol to their customers can become a Liquid Collective Platform to take part in running the network, with an API-first solution that makes it easy for Platforms to offer ETH liquid staking.

If you're interested in learning more about becoming a Liquid Collective Plaform, get started here.

About Liquid Collective

Liquid Collective is the secure liquid staking standard: a protocol with multi-chain capabilities, built and run by a collective of leading web3 teams. Developed in collaboration with a diverse group of industry leaders, Liquid Collective is designed to meet the need for an enterprise-grade decentralized liquid staking standard that can be widely adopted, increasing liquidity and composability for the web3 economy.

Bitcoin Suisse Disclaimer

The information provided in this document pertaining to Bitcoin Suisse AG and its Group Companies (together "Bitcoin Suisse") is for general informational purposes only and should not be considered exhaustive and does not imply any elements of a precontractual or contractual relationship nor any offering. This document does not take into account, nor does it provide any tax, legal or investment advice or opinion regarding the specific investment objectives or financial situation of any person. While the information is believed to be accurate and reliable, Bitcoin Suisse and its agents, advisors, directors, officers, employees, and shareholders make no representation or warranties, expressed or implied, as to the accuracy of such information, and Bitcoin Suisse expressly disclaims any and all liability that may be based on such information or errors or omissions thereof. Bitcoin Suisse reserves the right to amend or replace the information contained herein, in part or entirely, at any time, and undertakes no obligation to provide the recipient with access to the amended information or to notify the recipient hereof. The information provided is not intended for use by or distribution to any individual or legal entity in any jurisdiction or country where such distribution, publication or use would be contrary to the law or regulatory provisions or in which Bitcoin Suisse does not hold the necessary registration, approval, authorization or license, in particular in the United States of America including its territories and possessions. Except as otherwise provided by Bitcoin Suisse, it is not allowed to modify, copy, distribute, transmit, display, reproduce, publish, license, or otherwise use any content for resale, distribution, marketing of products or services, or other commercial uses. Bitcoin Suisse 2023.

Coinbase Disclaimer

Coinbase is a founding member of the Liquid Collective and has a financial and reputational interest in Liquid Collective’s success. Through its participation in Liquid Collective, Coinbase may propose, approve, or otherwise influence changes to underlying blockchain protocol. Coinbase will earn fees from your use of Liquid Staking Services offered by Liquid Collective through revenue sharing.