May 09 2023

- Maximum extractable value (MEV) has become prominent in the Ethereum staking ecosystem, enabling more efficient and decentralized block creation by dividing responsibilities among specialized agents.

- MEV-Boost is an example of open-source middleware that allows Ethereum validators to source blocks from the builders' marketplace, creating a transparent and mutually beneficial MEV market.

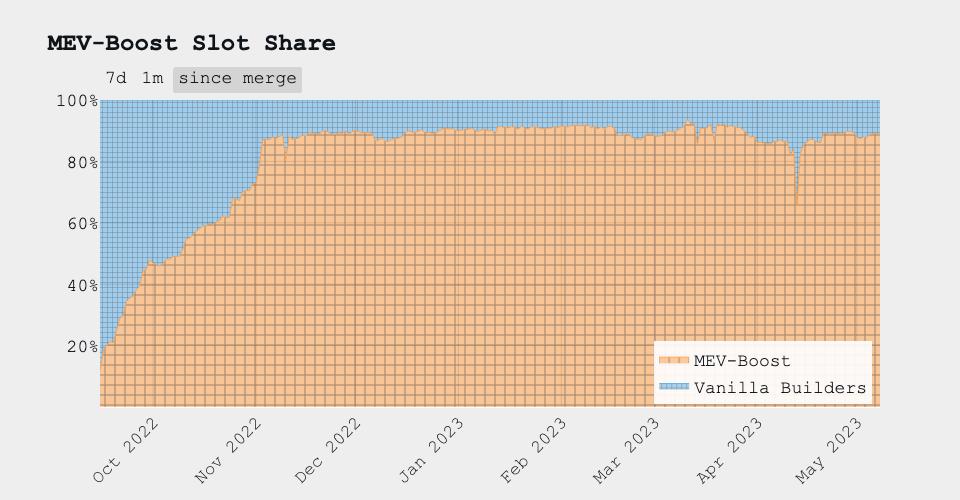

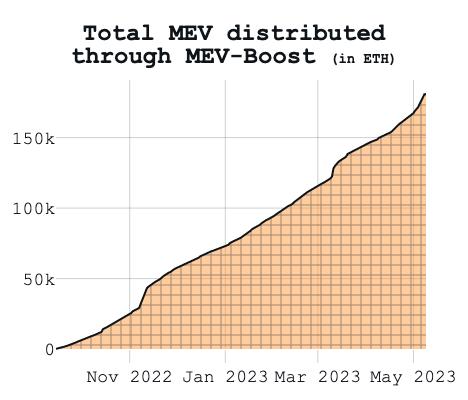

- Running MEV middleware has become the industry standard, with over 88% of blocks on Ethereum proposed by validators running MEV-Boost.

- MEV benefits the Ethereum network by increasing efficiency, reducing transaction costs, and supporting decentralization.

- Currently, Liquid Collective's Node Operators run MEV middleware, with any rewards captured automatically staked by the protocol.

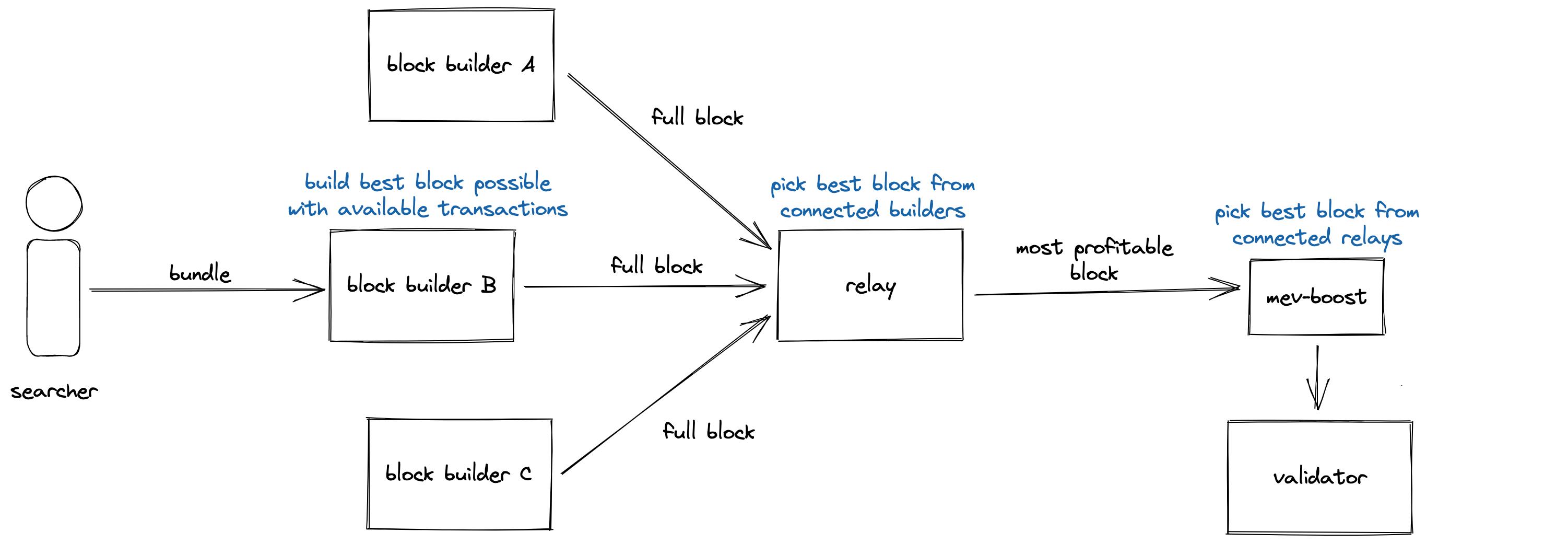

Maximum extractable value (MEV) refers to the value of adding and reordering transactions in a block to improve the quality of blocks proposed by validators. MEV rewards captured are programmatically split between different agents participating in block creation, including searchers who look for transaction reordering opportunities, builders who build blocks by selecting best opportunities found by searchers, and validators who propose blocks built by builders.

Using MEV middleware has become extremely prominent. At the time of writing, over 88% of blocks in the last two weeks were proposed by validators running MEV-Boost, which is a widely accessible open-source software. MEV complements the Ethereum staking architecture given that it allows block creation responsibilities to be divided between a set of specialized technologies, ultimately making the network and smart contract applications more decentralized and efficient.

MEV can also compliment liquid staking protocols when their node operators run a form of industry-standard MEV middleware. Let's cover the high-level overview of how MEV works before diving into MEV's benefits for the staking ecosystem, and how MEV is handled in the Liquid Collective protocol.

Execution layer rewards

Ethereum's execution layer is responsible for processing transactions, executing smart contracts, and maintaining the state of the blockchain. The consensus layer focuses on achieving agreement among the network participants. Consensus layer rewards are those that incentivize validators to act honestly and contribute to the proper functioning of the blockchain, for creating new blocks and validating transactions.

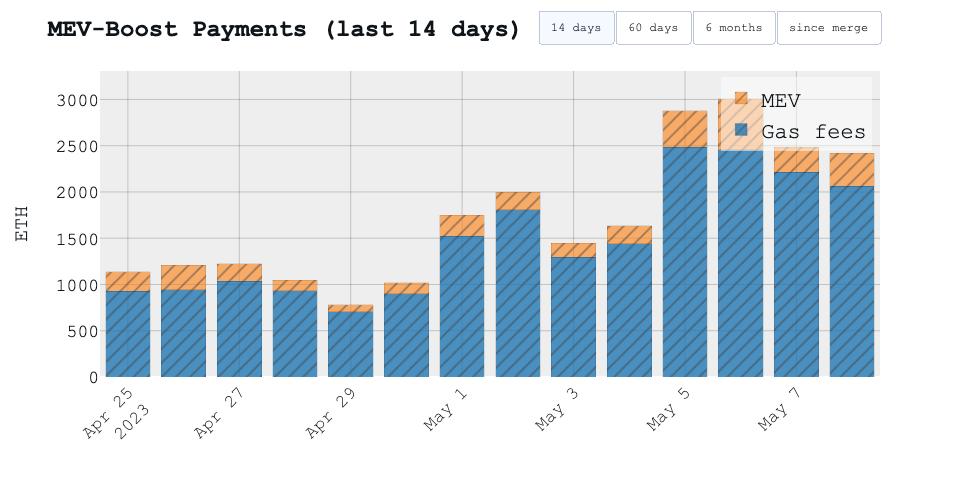

Execution layer rewards are generated by processing transactions and executing smart contracts. For the most part, these rewards come in the form of transaction fees, which are paid by users who initiate transactions or interact with smart contracts on the blockchain. These execution layer rewards are what can be processed more efficiently using MEV middleware.

MEV capture alone is not as effective for maximizing a validator's potential rewards compared to a long-term strategy of performing validation duties on the consensus layer to the highest standards. The MEV rewards that validators may receive can vary widely depending on a number of factors, including the level of competition for blockspace in the market, the volume and frequency of transactions, and the efficiency of the MEV middleware.

Yet, even small advantages in transaction sequencing can potentially lead to substantial additional rewards earned—given that Ethereum serves as the basis for the decentralized finance (DeFi) ecosystem, where billions of dollars are moved around by users daily.

Development of MEV-Boost

Flashbots is one research and development organization focused on MEV. The team built MEV-Boost, an open-source middleware that allows Ethereum validators to source blocks from the builders marketplace.

Before Flashbots' development, and Ethereum Merge, miners had centralized control over block creation responsibilities: selecting transactions, building blocks, and proposing blocks.

This could lead to a situation where the interests of miners and participants transacting in the network were misaligned, as miners could prioritize their own profits over the needs of participants. It also could lead to an unfair marketplace, where those participants who had direct relationships with miners were the only ones able to get their transactions to be included in favorable block positions.

Flashbots and other MEV developers in the ecosystem seek to address this issue by creating an open economic space, splitting block creation responsibilities between a set of distinct specialized agents, for a more transparent, secure, and mutually beneficial MEV market.

Because of these developments any validator can now participate in this open MEV marketplace, instead of just those that have privileged relationships. Validators, by running MEV-Boost and connecting to MEV Relays, can source blocks from the marketplace of builders and propose the block that most efficiently captures MEV value rather than proposing their own built block.

So, how does MEV relate to liquid staking? For node operators on liquid staking protocols, capturing and programmatically staking rewards generated via MEV using industry-standard middleware can be a way to transparently and programmatically optimize the protocol's staking efficiency overall.

The benefits of MEV

Node operators that collect execution layer rewards can stake those rewards to increase the number of validators they are operating, and thus increase the likelihood of one of their validators being selected to propose new blocks and to earn rewards for doing so. This process can be one lever to help validators increase staking efficiency.

By capturing rewards from market inefficiencies and arbitrage opportunities, MEV extractors help to make the Ethereum network more efficient, and reduce the overall cost of executing transactions. Over time, this could lead to increased demand for the network's services, which would also increase the amount of work validators are called upon to do.

Liquid staking can also help to create a more democratic and decentralized MEV ecosystem. By enabling anyone to stake their tokens and directly participate in the consensus process, liquid staking can help to distribute MEV rewards more widely and reduce the concentration of network rewards in the hands of a few large validators. This can create a more open, equitable, and resilient crypto ecosystem, a benefit to all participants.

Overall, Ethereum's decentralization and network security benefit from MEV's efficiency dividing the technological capabilities of block creation. This benefits the staking ecosystem with a market that is more efficient, stable, and robust for all users.

Liquid Collective and MEV

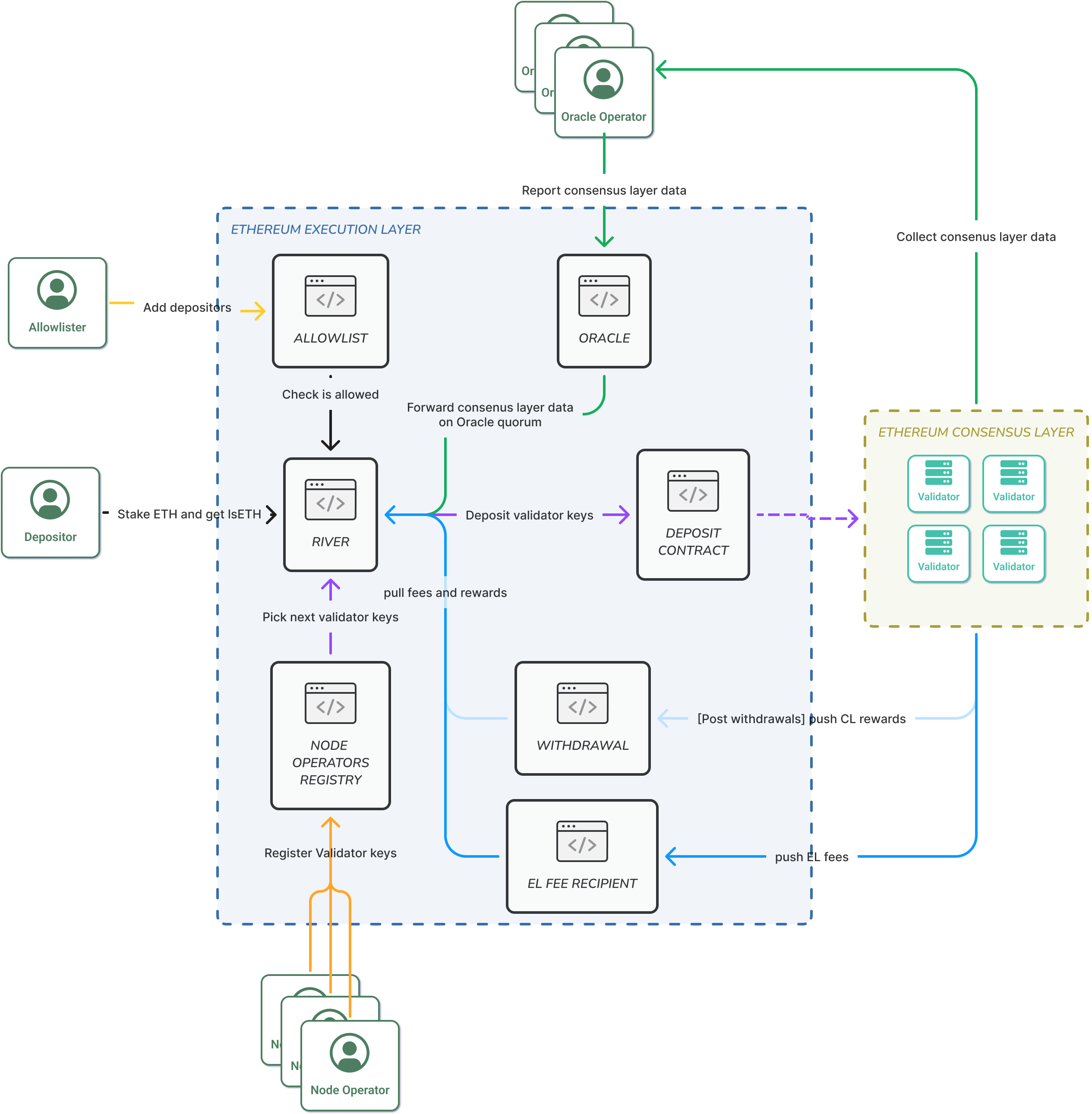

Liquid Collective is monitoring recent developments around MEV. Currently, Liquid Collective Node Operators are required to run a MEV middleware comparable to MEV-Boost. These rewards are automatically pulled and programmatically staked to activate new validators as they reach a fungible bulk of 32 ETH.

The cToken model of Liquid Collective's liquid staking token (LST), Liquid Staked ETH (LsETH), means that the potential to earn execution layer rewards is socialized via the conversion rate. Every 24 hours, the protocol's Oracles report the new balance of staked ETH across the protocol, accounting for accrued network rewards and penalties.

This results in updating the protocol conversion rate—or the amount of ETH that each unit of LsETH is redeemable for. As execution layer rewards are captured and re-staked, this should increase LsETH's conversion rate.

MEV middleware may be able to provide improved staking efficiency without compromising Liquid collective's extended values of trust and transparency, because MEV rewards are distributed in a secure, fair, and transparent manner.

Researching MEV in the context of distributed validator technology (DVT) is an ongoing workstream for the protocol's participants, with both DVT and MEV currently in exploration on the Liquid Collective product roadmap. While there are potential benefits of MEV extraction, it's important to design MEV integrations in a responsible and equitable way. Liquid Collective will not participate in MEV extraction to maximize any one party's benefit. Instead, the protocol is designed to spread the benefit of MEV to all the actors involved in the network.