May 12 2023

A full month has passed since Ethereum's Shapella Upgrade enabling staking withdrawals and demand for participation in the staking ecosystem continues to grow.

That staking activation queue we told you about? It's been at 99.9% capacity for the last week, holding steadily for the last month, while the exit queue has dwindled from the high 90s to a mere 57% of exit queue capacity reached.

So, with stakers beginning to line up down the block, what's next for the ETH staking industry? Tune in to our virtual panel featuring leading experts from Alluvial, Rocket Pool, EigenLayer, Obol Network, and Coinbase, next Wednesday May 17th at 9 AM ET / 3 PM CT, on Liquid Collective's Twitter, Youtube, or LinkedIn pages. You can find the information to join here.

Read on for the latest news, data, and resources from Liquid Collective! Of course, if you don't feel like reading, Mr. X is just a click away.

Liquid Collective's Latest

Exploring Liquid Collective's collaborative approach

By leveraging a collaborative approach that unites trusted industry experts, Liquid Collective can shine as a decentralized protocol that offers a resilient, composable, and innovative liquid staking solution with deep liquidity.

Collaboration can encourage innovation by tapping into diverse expertise and perspectives—driving the development of new use cases, efficient financial primitives, and integration of proven solutions. At the same time, increased composability is achieved through a collaboratively-built protocol that fosters interoperability across different platforms.

Learn more about the strategy and benefits of Liquid Collective's collaborative approach in our post.

A refresher on MEV and liquid staking

Maximum extractable value (MEV) enables more efficient and decentralized block creation by dividing responsibilities among specialized agents. Running MEV middleware has become the industry standard, with over 88% of blocks on Ethereum proposed by validators running MEV-Boost.

Currently, Liquid Collective's node operators run MEV middleware, with any rewards captured automatically staked by the protocol for optimal staking efficiency.

We cover the basics of MEV, how it relates to liquid staking protocols, and Liquid Collective's current MEV design here.

The need for enterprise-grade compliance

Growing adoption of crypto by institutional investors has long been cited as a meaningful channel for growth of the web3 ecosystem overall, and institutional adoption of staking is no exception. Despite the growing popularity of liquid staking several challenges have hindered institutions from participating in a widespread and meaningful way—including compliance, a concern for institutions which require a level of transparency and due diligence.

Read up on the “why” behind enterprise-grade compliance standards in our post.

Events

What's next for ETH staking?: May 17th 2023, at 9:00 AM ET / 3:00 PM CET

- With demand to participate in ETH staking heating up post-Shapella, what's next for the sector? Join a livestream conversation with leading staking experts covering post-Shapella traction, liquid staking solutions, decentralized validator technology (DVT), restaking, and more.

- Set a reminder to join today, or, tune in live on Wednesday on Liquid Collective's Twitter, Youtube, or LinkedIn pages. The information to join is here.

News from the Collective & Ecosystem Updates

- Ethereum core developers met to discuss the protocol's next major upgrade, expected to include EIP 4844 for proto-danksharding, a scalability solution. Learn more in The Block's coverage.

- Coinbase Institutional published a market intelligence report on the growth of liquid staking, reporting that “liquid staking started picking up again beginning in late 2Q22/early 3Q22, despite the market disruptions earlier in June.” Read the report here.

- Elias Simos, co-founder of Rated, has been reporting out on ETH staking traction post-Shapella—including sharing that there's nearly 2x the demand for validator activations as for withdrawals on Ethereum. You can find more staking data on the Rated Network Explorer.

- Bitcoin Suisse published an overview of macro financial conditions and crypto indicators to explore “Crypto & Macro - Is the Bottom in?” using BTC as a proxy for crypto at large. Read the analysis here.

- Kiln announced that the company achieved SOC 2 Type II compliance, the rigorous standard for security and data protection controls, with zero exceptions. Learn more in their post.

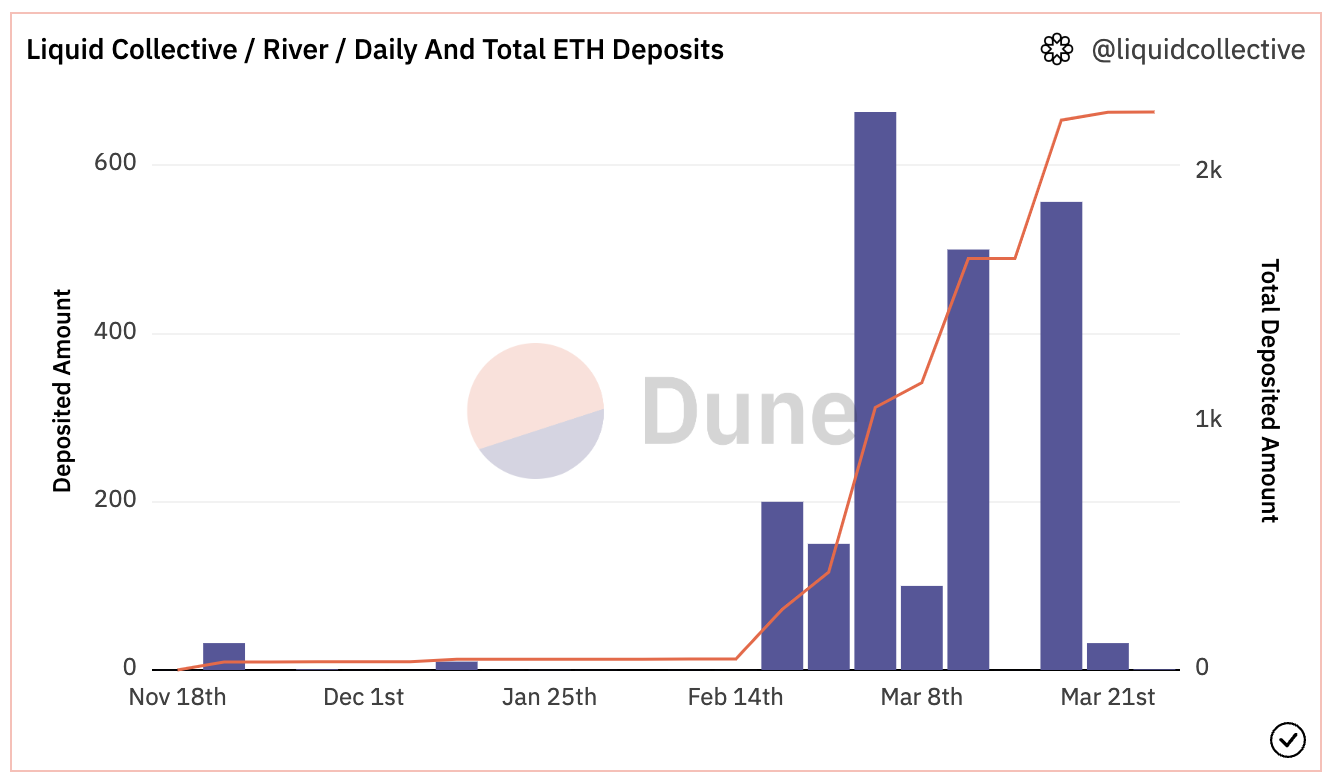

Liquid Collective by the Numbers

- Total Deposited ETH: 2,247.47 ETH

- LsETH Conversion Rate: 1 LsETH = 1.01485 ETH

- Total Reported Validator Balance Sum: 2,254.79 ETH

- Total Reported Validator Count: 70 validators

All data is accurate as of May 12, 2023. View real-time onchain data here on Dune.