Jun 12 2023

- Liquid staking is a rapidly growing software solution that can enhance liquidity and capital efficiency for stakers. But, Liquid Collective also offers a leading experience for stakers who have priorities other than the ability to access liquidity.

- LsETH is able to represent both staked ETH and rewards earned by following the simple, familiar ERC-20 cToken model, supporting LsETH's composability while providing holders with the ability to control their network reward flow.

- Liquid Collective offers robust slashing coverage to every participant, including Nexus Mutual cover, to mitigate the risk of Node Operator failures and network outages—all by holding LsETH.

- Liquid Collective's diversified Node Operator set reduces correlation (and its associated slashing risks) by spreading stake round-robin across a distributed network of independent, industry-leading Node Operators.

- Multiple audits from leading security experts support the protocol's security, and the protocol's onchain transparency allows anyone to view rewards and Node Operator performance.

Liquid staking is a rapidly growing software solution that has redefined the landscape of proof of stake (PoS) blockchains. Participants in liquid staking protocols receive a liquid staking token (LST) as evidence of their staked token; that LST can be transferred, traded, and utilized in DeFi or supported dapps, all while continuing to contribute to network security.

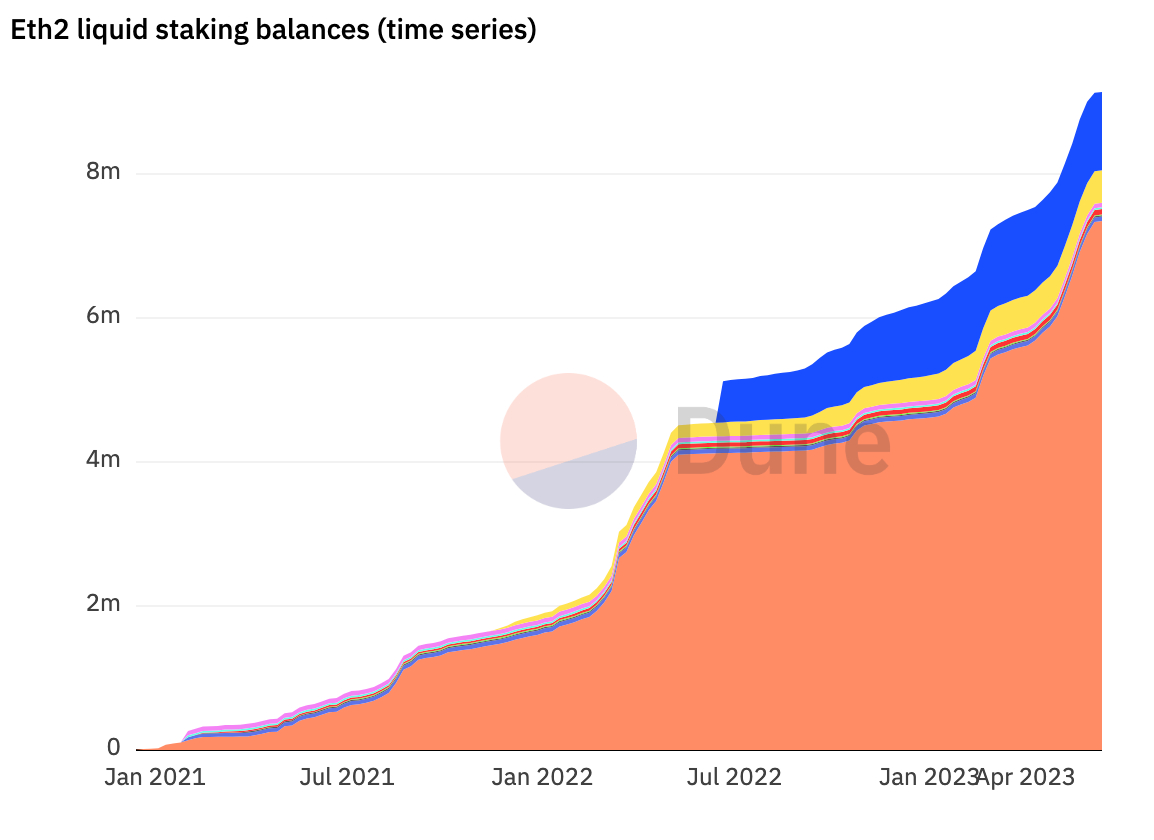

Demand for liquid staking has only grown since withdrawals were enabled with the Ethereum Shapella upgrade in April of this year, with the ETH in liquid staking protocols growing by over 24% in the last two months according to DefiLlama data. At the same time the market is increasingly moving away from centralized offerings and into decentralized solutions, with the amount of ETH held on centralized exchanges dropping to a 5-year low as of May 26th.

Liquid Collective is a protocol developed in collaboration with a diverse group of industry leaders to meet the need for an enterprise-grade liquid staking standard that can be widely adopted, increasing liquidity and composability for the web3 economy. But, as the only decentralized, non-custodial liquid staking solution focused on compliance, security, and performance, the Liquid Collective protocol also offers a leading experience for those stakers who have priorities other than accessing liquidity while staking.

Let's explore some of the key features that allow you to have a powerful ETH liquid staking experience by participating via Liquid Collective.

LsETH: cToken model with built-in User Agreement

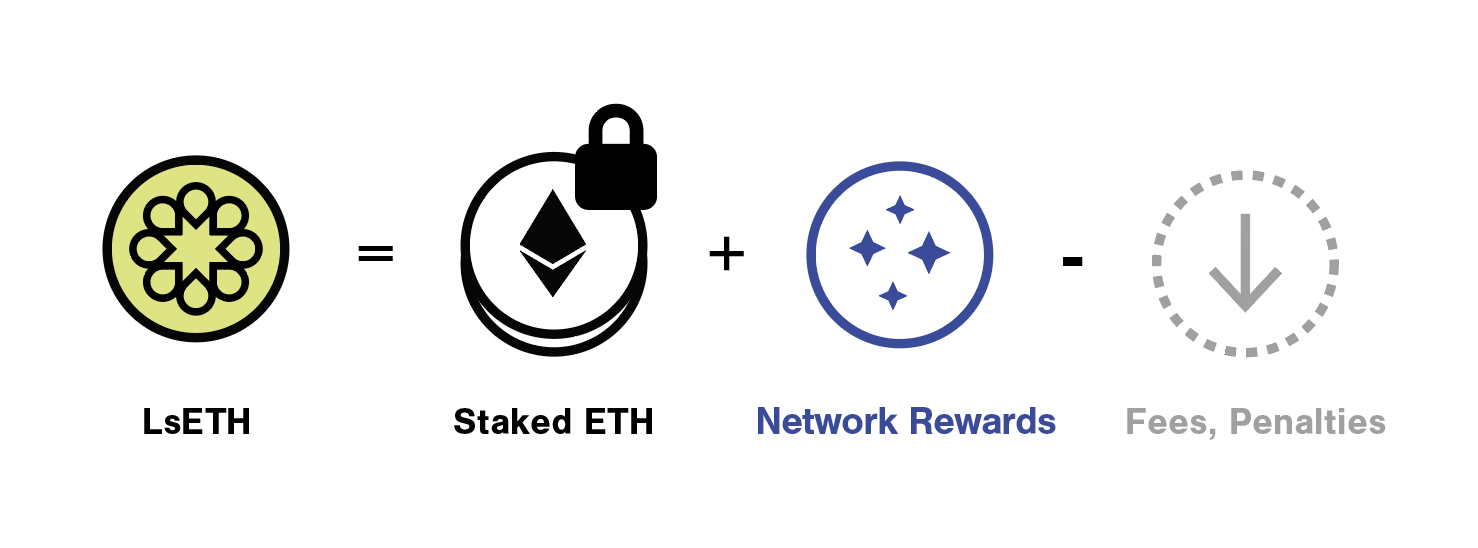

Liquid Staked Ether (LsETH) is Liquid Collective's LST, minted to represent the holder's legal and beneficial ownership of the staked ETH, plus any network rewards that accrue to the staked ETH (and minus any fees or penalties).

LsETH is able to reflect both staked ETH and rewards earned by following the simple, familiar ERC-20 cToken model, which uses a floating conversion rate—a.k.a. the protocol conversion rate—between a receipt token and the staked tokens to reflect the value of accrued network rewards, penalties, and fees associated with the staked tokens.

This conversion rate, independent of the price at which ETH or LsETH may trade on the open market, defines the amount of ETH for which LsETH can be converted. That means that as network rewards are earned for performing work the value of LsETH increases compared to ETH, rather than more LsETH being minted to reflect rewards.

In addition to its cToken design maximizing LsETH's composability in the ecosystem (by following a standard ERC-20 model) this floating conversion rate can provide participants with the option to control their network reward flow, as network rewards are claimed upon redemption of LsETH rather than being minted to a wallet as they are received.

By obtaining LsETH, participants agree to the terms of the LsETH User Agreement which remains in effect for as long as the participant holds LsETH. This legal agreement, unique within the world of digital assets, plays an important role in the protocol: informing users, ensuring transparency, and preventing misunderstandings.

One of the key features of the LsETH User Agreement is that it expressly establishes that the staked ETH, as well as the LsETH, are user-owned and will not change hands. In other words, legal and beneficial ownership of a staker's ETH will always remain with the staker and will never pass to any other third party. Moreover, only the staker controls when and how crypto assets are staked as there is no discretion held by any other third party.

The LsETH User Agreement also contains important information about the protocol's token specifications and ownership characteristics, protocol service fees, slashing and slashing coverage, AML/KYC compliance, and risks associated with staking on Ethereum via the Liquid Collective protocol—ensuring that all of these protections are accessible to all token holders equally by being built into the token itself.

Slashing coverage out-of-the-box

One of the key protections offered by the LsETH User Agreement is the Liquid Collective protocol's Slashing Coverage. Liquid Collective offers robust slashing coverage to every participant, including Nexus Mutual cover, to mitigate the risk of Node Operator failures and network outages.

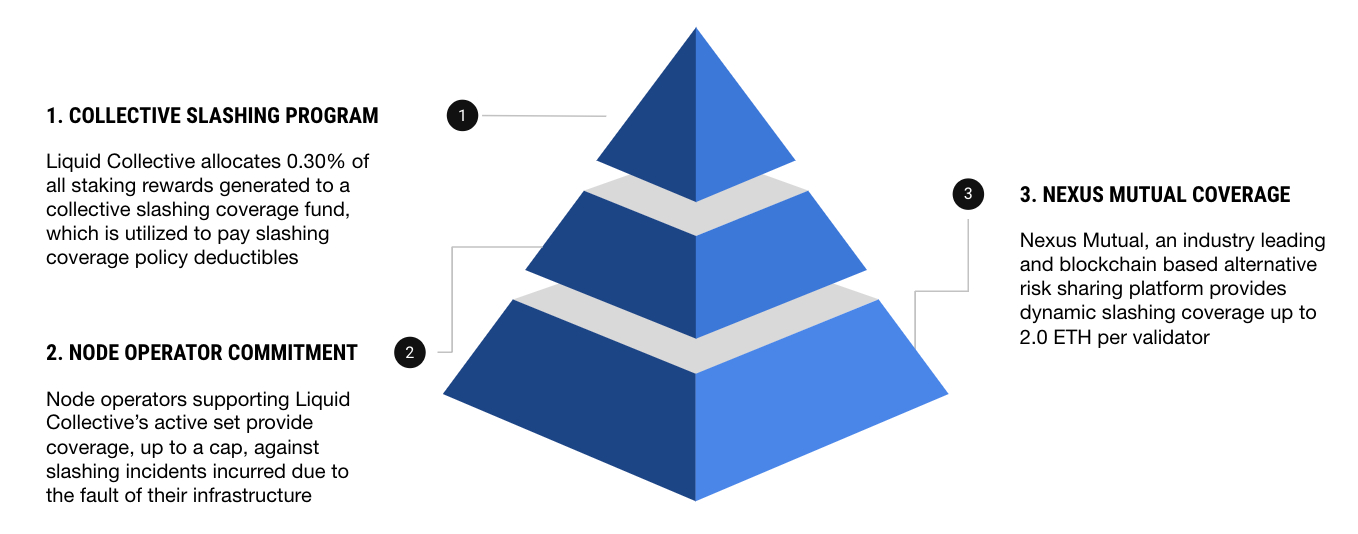

It includes three layers of coverage:

- Nexus Mutual Coverage — Nexus Mutual is the leading provider of decentralized crypto-native protection, having secured billions of dollars in value held in smart contracts. Nexus Mutual's bespoke Slashing Coverage for Liquid Collective is fully scalable coverage that dynamically adjusts with the protocol's assets on platform (“AoP”) and provides access to Nexus Mutual's slashing coverage directly from a user's custody account at platforms such as Coinbase and Bitcoin Suisse.

- Slashing Coverage Treasury — Liquid Collective's Slashing Coverage Treasury allocates a percentage of all network rewards to pay slashing coverage deductibles on network-wide slashing incidents. The Treasury continues to accrue network rewards unless deployed.

- Node Operator Commitment — Node Operators supporting Liquid Collective's active set provide coverage for deductibles, up to a cap, against slashing incidents and missed rewards incurred due to the fault of their infrastructure.

This built-in access to slashing coverage is another important differentiator of Liquid Collective. While any staker can access slashing coverage themselves through web3-native providers like Nexus Mutual, the process represents an additional pain point for participants.

Despite the importance of protecting against slashing, many stakers forgo obtaining coverage instead of taking the time to complete the steps to access coverage. With Liquid Collective, participants can now access coverage simply by holding LsETH.

Node Operator diversity

When you want to stake on infrastructure built and maintained by the industry's leading Node Operators, why keep your eggs in one basket?

Liquid Collective's diversified Node Operator set reduces correlation (and its associated slashing risks) by spreading stake round-robin across a distributed network of independent Node Operators.

Initial node operators in the Liquid Collective protocol include industry veterans such as Coinbase, who are required to meet leading security, compliance, and performance measures. These best-in-class Node Operators provide the protocol's enterprise-grade validator infrastructure, including multi-cloud, multi-region, multi-client infrastructure with global distribution, and double-signing protection.

As part of the Collective's aim for the protocol to set liquid staking's multichain standard, Liquid Collective will be releasing an open-source standard for validator risk, security, and performance to the ecosystem, which will be monitored onchain for full transparency into the protocol's performance.

Auto-staked rewards

With LsETH, you don't have to manually claim and stake as you receive ETH network and execution layer rewards. Liquid Collective provides automated reward staking for LsETH by default, which is very hard to automate for traditional staking.

This provides key operational efficiencies to the protocol's design:

- Smaller stakers don't need to receive an extra 32 ETH to stake rewards

- Larger stakers don't need to monitor or manage reward staking

- Reward staking is fully onchain and automated through the protocol

Transparency, security, and compliance

Liquid Collective is not only secure by design, it's transparent by nature. As a decentralized protocol, anyone can see rewards and Node Operator performance with onchain transparency.

While there are many liquid staking solutions available, most cater to crypto-native stakers and often fall short of the stringent requirements of institutional and enterprise participants. Liquid Collective addresses this gap by offering a solution that not only meets institutional needs, but the needs of the most security-minded individual stakers as well.

The protocol has undergone multiple audits of its smart contracts from the industry's security experts, with the protocol's code further vetted by Platform teams like Coinbase and Bitcoin Suisse as they integrate support for LsETH.

Liquid Collective is the only decentralized liquid staking protocol that requires KYC/AML on all participants interacting with the protocol directly, ensuring known staking counterparties and limiting the surface area for direct attacks on the protocol's smart contracts.

Option for liquidity

Liquid staking tokens can be used in a number of ways in DeFi, from lending and borrowing to providing liquidity for liquidity pairs on DEXs, or pursuing other yield farming opportunities.

| CeFi | DeFi |

|---|---|

| Use LsETH as collateral to secure centralized financing or loans | Use LsETH as collateral to participate in DeFi (e.g. Uniswap, Aave, etc.) |

| Use LsETH to hedge or take leveraged upside | Use LsETH for restaking through solutions such as EigenLayer |

| Use LsETH to get exposure to staking rewards without actually staking tokens | Build composable applications on top of LsETH in LSTFi |

But with Ethereum's staking activation and exit queue lengths growing, why not have the option of liquidity when you stake? Regardless of how high liquidity is on your list of priorities, network events can lead to uncertainty. Post-Shapella, Ethereum's activation and withdrawal queues are based on network congestion, and can take weeks or even months—currently, the wait to start staking is over 46 days.

Whether you need liquidity to participate in DeFi, or might need liquidity in the future to trade out of a position with a long wait to withdraw, having the option to access liquidity by holding an LST can provide stakers with peace-of-mind.

Why stake via Liquid Collective?

By staking with Liquid Collective, you not only contribute to Etherum's network security, but also enjoy the benefits that automated software solutions can provide direct stakers—like a composable staking token, built-in slashing coverage, Node Operator diversity, transparency, liquidity, and more.

Liquid Collective empowers global participation in securing the decentralized internet through a collaborative approach. You can also participate in a protocol that champions industry standardization, provides an open system encouraging composability, prioritizes security and compliance standards, and caters to enterprises and institutional participants.

To learn more about how you can start participating with Liquid Collective today, view the Platforms where you can stake ETH to mint LsETH on liquidcollective.io.