Apr 12 2023

This week marked a milestone for the Ethereum community: the deployment of the Shapella Upgrade, enabling full and partial validator withdrawals for the first time since the Beacon Chain's launch in 2020. Congratulations to the entire Ethereum ecosystem on this important milestone with significant implications for the staking landscape.

While it's still early to measure the impact of withdrawals on liquid staking, in this month's edition you'll find a preview of Liquid Collective's ETH withdrawal implementation and target timeline, alongside resources from Liquid Collective members.

Read on for the latest news, data, and resources from Liquid Collective!

Liquid Collective's Latest

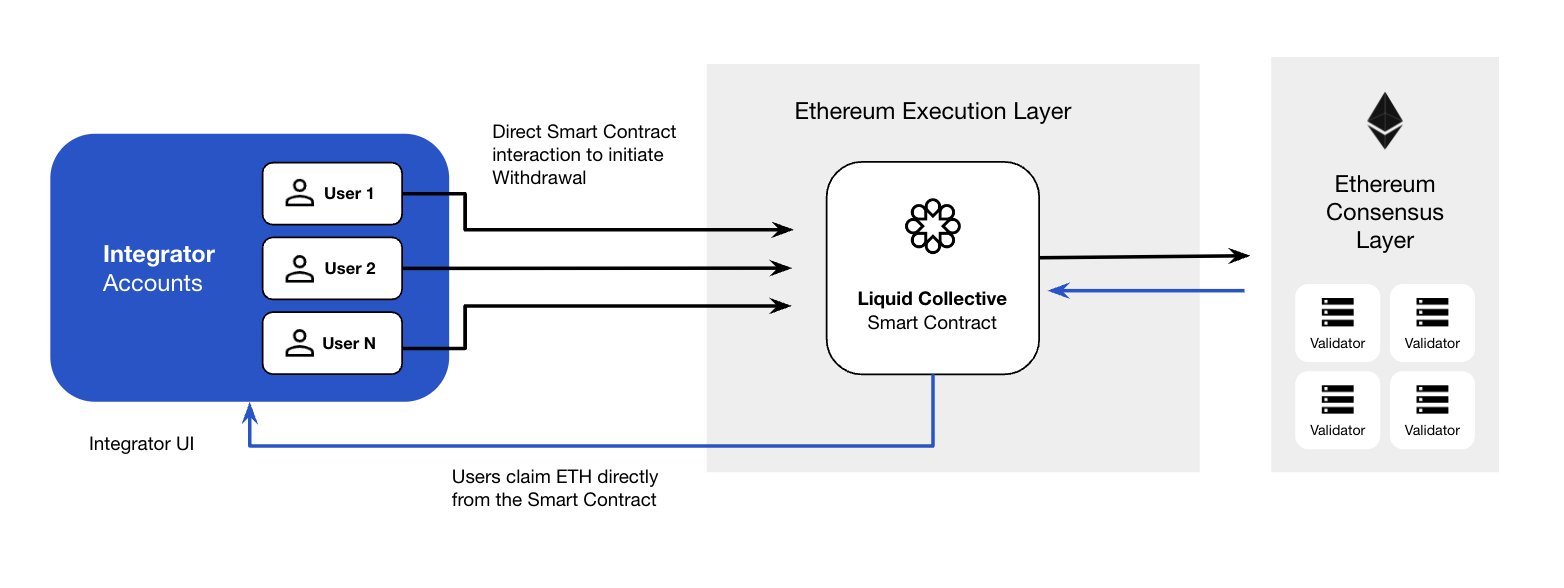

Preview: Liquid Collective's Ethereum withdrawal implementation

A community preview covered the high-level overview of Liquid Collective's Ethereum withdrawal implementation and target timeline (TLDR: targeting mid-May for mainnet).

The highlights of the withdrawal architecture cover Liquid Collective's planned LsETH redemption process, Validator Exit Daemon, and Oracle Daemon. Read the Twitter thread or LinkedIn post to learn more.

Ethereum's activation and exit queues

The churn limit is a parameter that governs Ethereum's validator activations and exits. At the current churn limit only ~0.04% of the circulating ETH supply can be activated per day (~1800 validators per day), and any staking demand spiking beyond that limit will have to wait in a first-come-first-serve line to start earning Ethereum network rewards.

So how do staking activations and exits actually work, how can they lead to waiting in line to stake or unstake, and what are the potential implications for liquid staking tokens (LSTs)? Learn more in our explainer.

The need for enterprise-grade compliance

Growing adoption of crypto by institutional investors has long been cited as a meaningful channel for growth of the web3 ecosystem overall, and institutional adoption of staking is no exception. Despite the growing popularity of liquid staking several challenges have hindered institutions from participating in a widespread and meaningful way—including compliance, a concern for institutions which require a level of transparency and due diligence.

Read up on the “why” behind enterprise-grade compliance standards in our post.

Exploring the importance of Liquid Staking Tokens (LSTs)

Last month, the Proof of Stake Alliance published two white papers representing first research and analysis into key legal questions surrounding the taxation and regulation of liquid staking and LSTs in the U.S. Alison Mangiero, Executive Director of the Proof of Stake Alliance, caught up with Mike Selig, Counsel at Willkie Farr & Gallagher LLP, to discuss the importance of LSTs with Liquid Collective. Watch the interview, or read the transcript, here.

Events

Ethereum Zurich: April 14 - 16th, 2023

- Zurich's first major Ethereum conference will bring ecosystem participants from around the world to Switzerland this weekend for the event and hackathon. Representatives from Liquid Collective's member teams will be speaking at the event, including Wolfgang Amadeus Vitale and Luzius Meisser from Bitcoin Suisse, Petter Ikekhua from Kiln, and Mara Schmiedt from Alluvial. Reach out to the teams to connect in Zurich!

Paris Blockchain Week: In case you missed it...

- Kiln hosted a series of panel discussions during Paris Blockchain Week, including a discussion on the launch of LsETH and how institutions can make the most out of liquid staking. The panel was moderated by Mara Schmiedt, CEO at Alluival, and featured Frederick Allen from Coinbase, Yves Holenstein from Bitcoin Suisse, Ernest Oppetit from Kiln, and Matt Leisinger, CPO at Alluvial. If you couldn't make it, you can watch the recording here.

News from the Collective & Ecosystem Updates

- Ethereum's Shapella Upgrade was finalized with only some minor blips from client bugs on Wednesday, marking the first time that withdrawals have been enabled on PoS Ethereum. Stay tuned for more analysis from Liquid Collective on the upgrade's impact for stakers.

- Kiln's research team has launched a new series of articles on proto-danksharding, a proposal to improve Ethereum's scalability. The series kicks off with an in-depth exploration of Ethereum's present scalability constraints—read part one here.

- Coinbase Institutional hosted a “Staking at Scale” webinar featuring Freddie Allen from Coinbase Cloud and Nicolas Jubera from Coinbase Institutional. The webinar covered “some of the most important questions for institutional investors when seeking to better understand staking digital assets and their role in the cryptoeconomy.” Watch the recording here.

- Mara Schmiedt of Alluvial published an op-ed in Blockworks, Stake Now or Get in Line: Ethereum's Churn Limit Will Create Speed Bumps Post-Shanghai. The piece covers how Ethereum's churn limit may affect staking and withdrawal timelines, encouraging participants on the sidelines to stake early to avoid delays. Read the op-ed on Blockworks or the Alluvial site.

- Rated released new features for the overview and operator sections of their explorer, allowing users to granularly track activations and withdrawals on Ethereum. Don't miss the network overview live data in the app, and read their full thread of updates here.

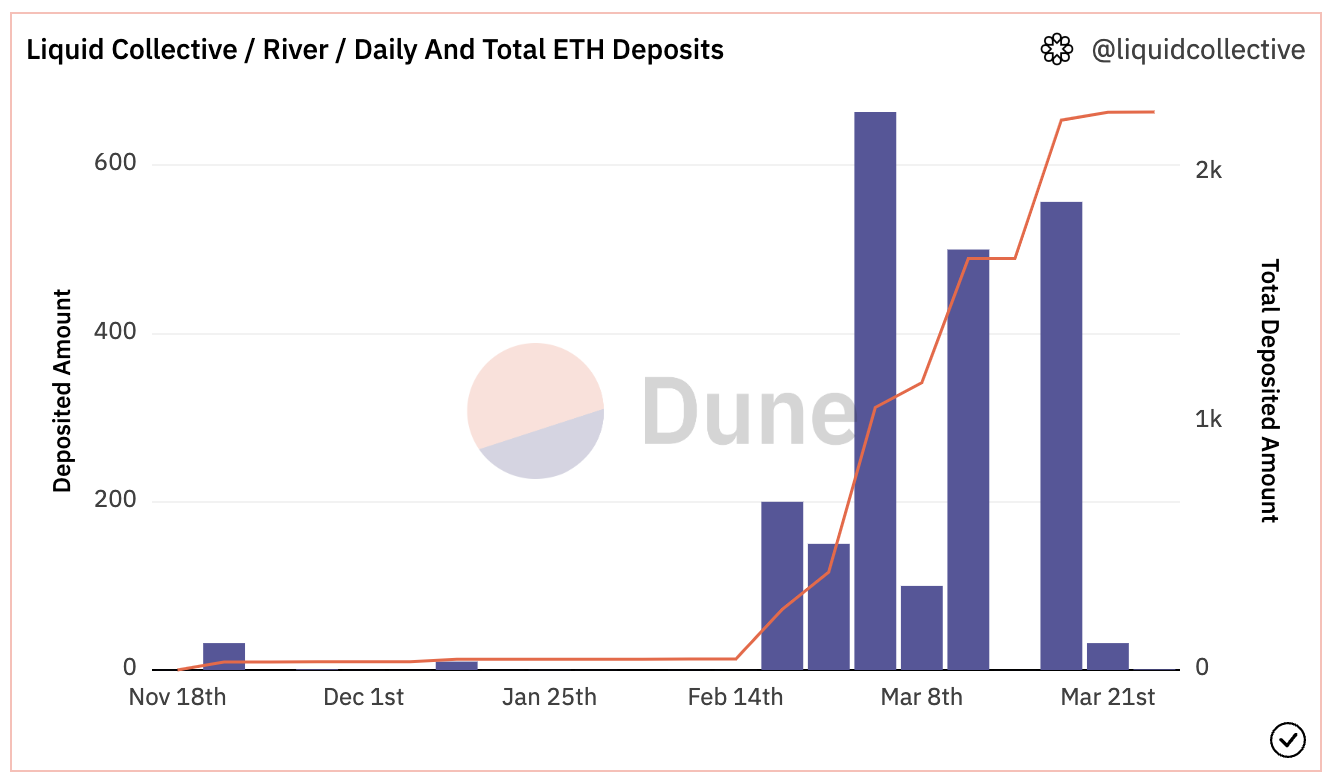

Liquid Collective by the Numbers

- Total Deposited ETH: 2,247.25 ETH +150.81%

- LsETH Conversion Rate: 1 LsETH = 1.01060 ETH +0.43%

- Total Reported Validator Balance Sum: 2,248.46 ETH +690.82%

- Total Reported Validator Count: 70 validators +483.33%

All data is accurate as of April 14, 2023. View real-time onchain data here on Dune. Percentage changes are from last month's newsletter send on March 10, 2023.