Jan 03 2025

- 1. Liquid Collective’s 2024 Milestones

- 2. Liquid Collective’s 2024 Ecosystem Expansion

- 3. Top 5 of 2024: Research, Insights, & Analysis

- Thank you!

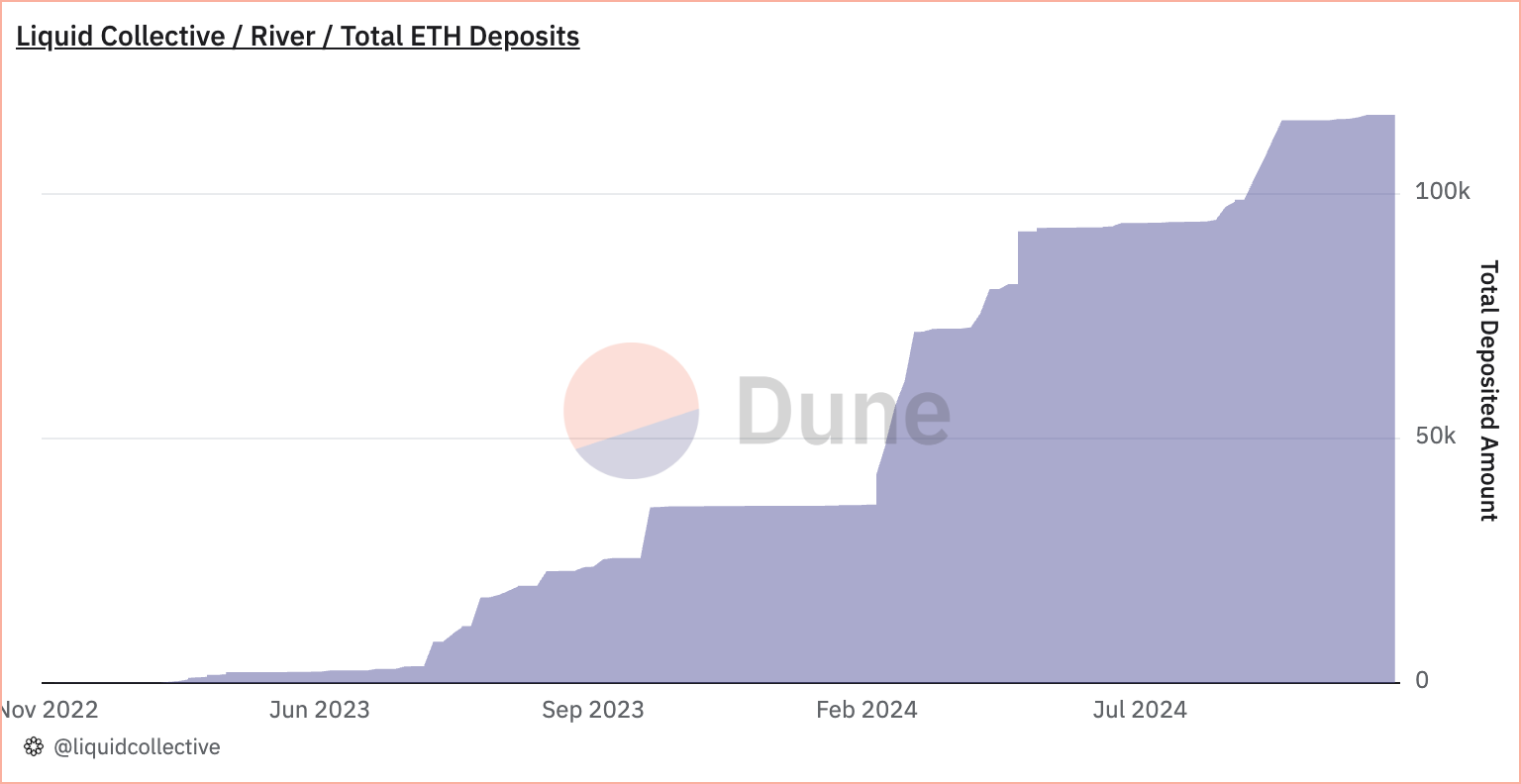

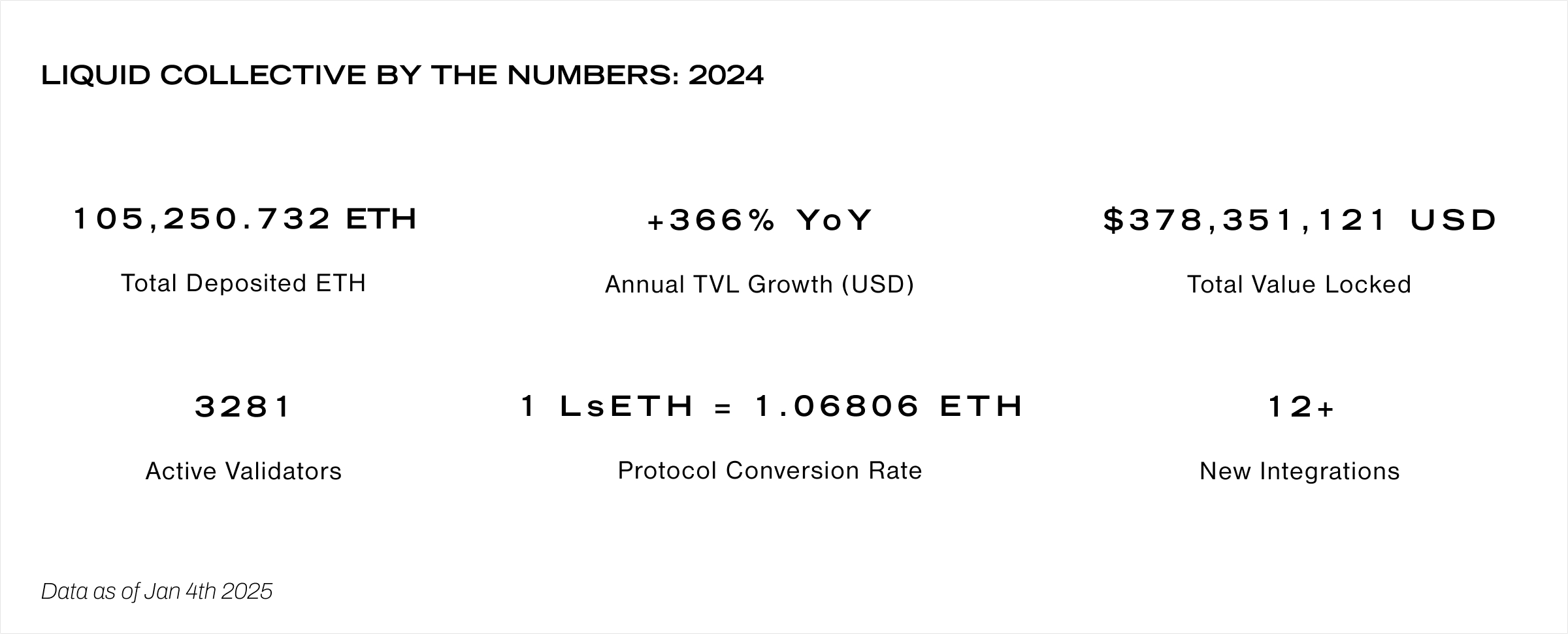

2024 was a landmark year for Liquid Collective, along with a year marked by dynamic growth across the blockchain ecosystem. Staking, in particular, has been propelled into the mainstream, strengthened by Ethereum’s successful Dencun upgrade and the landmark US approval of ETH ETFs in July. Over 27.9% of the ETH supply is currently staked, with over $49B of that staked through ETH liquid staking solutions (over 40% of the total staked supply).

Across the board, proof of stake networks have seen incredible growth. Participants are increasingly putting their crypto to work, and DeFi’s total value locked (TVL) has recently hit its highest levels since 2021.

Liquid staking continues to dominate the sector, being the preferred way to stake and participate in DeFi, and today, Liquid Collective is among the top staking protocols on Ethereum. As of January 4, 2025, Liquid Collective has over $378M in TVL, representing over 366% TVL growth since the beginning of 2024.

The start of 2025 brings many positive signals for another year of growth, including expectations of improved regulatory clarity for staking and crypto participation in the US, deepening integrations with TradFi, and a rapidly maturing staking landscape.

Liquid Collective remains committed to innovation, collaboration, and setting the standard for enterprise-grade staking solutions. As the only liquid staking protocol that’s accessible for both stakers and institutions, Liquid Collective is well-positioned to take advantage of the opportunities that 2025 will bring. But before the year kicks off in earnest, let’s recap some exciting milestones from 2024...

1. Liquid Collective’s 2024 Milestones

December: Liquid Collective Completes Formal Verification

Liquid Collective achieved a security milestone by completing a formal verification audit, representing the ninth security review of the protocol’s mainnet code.

This comprehensive audit included all Liquid Collective smart contracts and provided mathematical assurance of the correct accounting of staked ETH. It also validated the LsETH redemption process, verified Oracle report integrity, and confirmed proper validator key management.

August: Launching the Node Operator Risk Standard (NORS) Certification

2024 saw the launch of the Node Operator Risk Standard (NORS). This groundbreaking, enterprise-grade certification allows stakers to verify the operational security and risk management for Ethereum node operators, and sets a new benchmark for critical aspects of enterprise-grade node operation.

NORS was developed by a collaborative working group of cross-industry ecosystem leaders, facilitated by Alluvial, including Aon, Blockdaemon, Chainproof, Coinbase, DV Labs, Eigen Labs, Figment, Galaxy, Liquid Collective, Nexus Mutual, and Staked.

The certification process follows the same AICPA audit standards followed by SOC1 and other widely-adopted diligence standards. This allows ETH node operators to demonstrate their adherence to best practices through attestation reporting from Qualified Assessors at leading accounting firms.

In September, a NORS launch event in New York brought together industry-leading experts to celebrate this achievement and discuss NORS' potential applications in the Ethereum staking landscape.

Featuring speakers from the NORS development working group, topics discussed on the NORS event panels included managing institutional risk, node operator assessment, resilient validator infrastructure, and future-proofing the standard.

- Challenges: Institutional staking diligence and node operator differentiation

- Audit: Risks, controls, and reporting

- Assess: Insurance, slashing coverage, and node operator assessment

- Impact: Resilient validator infrastructure on Ethereum

- Next: NORS and future-proofing the standard

To learn more about NORS, its impact on the ecosystem, and what’s next for the standard, watch recordings of the NORS panels on nors.global here.

Since launching, NORS has expanded its roster of Qualified Assessors—the individuals approved to provide audit, attestation or advisory against the Node Operator Risk Standard (NORS) control objectives. These auditors play a key role in ensuring NORS certification meets rigorous evaluation and attestation processes.

- At launch, Eric Rae, Partner at KPMG LLP, became the first NORS Qualified Assessor.

- In October, Chimaobi Ezeibe, Partner at KPMG LLP, joined as a NORS Qualified Assessor.

- December saw further expansion with Carey Carpenter, Digital Assurance and Transparency Trust Solutions Partner at PwC LLP, joining as a NORS Qualified Assessor, and Marc Krisjanous, Associate Director at SixBlocks Audit, becoming the first NORS Qualified Readiness Assessor.

This expansion of the auditors who can complete the attestation step of NORS certification, representing individuals from across some of the world’s leading firms, underscores the growing importance and recognition of NORS in professionalizing the Ethereum staking ecosystem.

June: Quantstamp audit completed for offchain components

Liquid Collective completed its 8th security audit, conducted by Quantstamp, a leading blockchain security firm.

A significant aspect of this audit was its focus on Liquid Collective's offchain components, mainly three essential daemons: the Exit daemon, Keeper daemon, and Oracle daemon. These daemons play crucial roles in maintaining the protocol's security, stability, and functionality.

Overall, the audit included an architecture review, unit testing, functional testing, computer-aided verification, and manual review. Quanstamp found “the project's code to be well-structured and easy to read, with robust metrics and log collection demonstrating operational maturity.”

April: Reduced protocol service fee to 10%

Liquid Collective announced a significant LsETH Protocol Service Fee reduction, from 15% to 10% of ETH network rewards. This strategic move enhances LsETH's accessibility and competitiveness. The protocol’s commitment to risk mitigation and its Slashing Coverage Program for LsETH holders remain unchanged.

2024: Liquid Collective in the Press

- RealVision:

A Deep Dive into Ethereum and Staking - Cointelegraph:

Anchorage Digital to support liquid Ether staking - CryptoNews:

Brevan Howard Backed Alluvial Launches Hub to Support Staking - Blockworks Research:

Liquid Collective's LsETH - The Information:

Coinbase’s Alumni Network Boosts Its Blockchain Ambitions - Cointelegraph:

Ethereum’s Pectra upgrade: Key risks identified in Report - Consensus:

Everything You Ever Wanted to Know About 'LSTfi' But Were Afraid to Ask - Blockworks:

Liquid Collective pitches efficiency standards for Ethereum validators - Epicenter:

Institutional Liquid Staking and Spot Ethereum ETFs - OurNetwork:

Liquid staking tokens - DAS:

The Next Generation of Institutional Staking

Plus many more… be sure to follow @liquid_col on X to catch the latest as Liquid Collective news breaks!

2. Liquid Collective’s 2024 Ecosystem Expansion

December: Anchorage Digital joins as a platform, becoming the first bank to support participation in liquid staking

Just last month, we announced that Anchorage Digital, an institutional crypto bank, now supports Liquid Collective's Liquid Staked ETH (LsETH)—making Anchorage Digital the first OCC-chartered, US-regulated bank to support participation in liquid staking, opening a new door for institutions seeking access to participation in this category of ETH staking.

Anchorage Digital’s clients can participate in Ethereum staking through LsETH, leveraging the benefits of liquid staking and Anchorage Digital’s infrastructure. This expands the options available to institutional clients seeking exposure to Ethereum staking rewards.

August: Symbiotic announced restaking support for LsETH

Restaking offers a way for token holders to stake on multiple blockchain ecosystems simultaneously, and provides an opportunity to receive additional restaking rewards. For builders, restaking can offer a more efficient opportunity to secure their network. The Symbiotic restaking network differentiates through a focus on incentive alignment.

By restaking their tokens, LsETH holders who participate on Symbiotic can now receive additional fees and rewards from the Symbiotic protocol while simultaneously receiving ETH network rewards.

June: Alloy joins Liquid Collective’s ecosystem

Alloy was one of the first portfolio management systems to integrate with Liquid Collective. By joining Liquid Collective, Alloy expanded its ETH staking offerings to include LsETH minting and redemption for its institutional clients.

Liquid Collective’s regulatory-focused design, which includes mandatory KYC/AML for users and operators to facilitate compliance, made the integration possible.

May & June: Blockdaemon joins as a Platform and a Node Operator

Blockdaemon, the institutional-grade digital asset infrastructure provider, joined Liquid Collective as a LsETH Platform in May. As part of its commitment, Blockdaemon also became a Node Operator in Liquid Collective’s active set and made LsETH the exclusive liquid staking solution in the Blockdaemon Wallet product, sunsetting its Portara liquid staking product.

Through this integration, Blockdaemon’s customers—who include exchanges, custodians, financial institutions, and other crypto native and non-native platforms—can access a secure, compliance-focused, and trusted liquid staking token (LST).

Read the Blockdaemon Platform announcement here and Node Operator announcement here.

April: Obol Launches Liquid Collective Collaboration

DV Labs—a R&D team focused on PoS infrastructure for public blockchains and Distributed Validator Technology (DVT) through its work building the Obol Collective—is now collaborating with and supporting Liquid Collective’s Ethereum staking operations.

A key part of this collaboration involves DV Labs leveraging its DVT expertise to assist Liquid Collective’s Node Operator Working Group, exploring how DVT can enhance the protocol's Node Operator requirements and onboarding processes, assisting with Oracle operations for Liquid Collective, and more.

January: EigenLayer Announces Restaking Support for LsETH

EigenLayer added restaking support for Liquid Collective on February 5th, making LsETH one of the earliest liquid staking tokens supported for restaking. Today, LsETH holders can participate in restaking on EigenLayer to receive additional fees and rewards from the EigenLayer protocol, while simultaneously receiving ETH network rewards by holding LsETH.

A groundbreaker in leading the development of restaking technology, EigenLayer’s launch in 2024 drove the network into the mainstream, with over $15B restaked through the network by the end of the year. Following the announcement of February’s limited LsETH support window on EigenLayer, Liquid Collective’s 30-day TVL rose 84% (according to DeFiLlama data). Restaking caps on EigenLayer have since been lifted, and restraking rewards are now live.

Ecosystem Integrations

Beyond the announcements above Liquid Collective’s ecosystem grew across integrations in 2024, including:

- July: LBank, a cryptocurrency exchange, launched a LsETH/USDT trading pair.

- June: BIT supports Liquid Collective as "the first exchange to offer a LsETH/USDT spot trading pair."

- April: Finoa, a regulated custodian for crypto assets, announced qualified custody support for LsETH.

- March: Inception, a liquid restaking protocol, launched support for LsETH liquid restaking.

- February: Zircuit, an EVM-compatible zero-knowledge rollup, launched support for LsETH trading.

- February: EigenPie, a subDAO offering Isolated Liquid Restaking Services, launched support for LsETH liquid restaking.

As of December 2024, Liquid Collective’s LsETH is now supported by...

| Platforms Stake ETH |

Custodians & Wallets Hold LsETH |

Integrations Access & Use LsETH |

Ecosystem Other Support |

|---|---|---|---|

| Alloy Anchorage Digital Bitcoin Suisse Blockdaemon Coinbase Figment Hashnote Twinstake |

Anchorage Digital Blockdaemon Bitcoin Suisse Bitgo Bitso Coinbase Copper Finoa Fireblocks |

BIT EigenLayer EigenPie Inception LBank Symbiotic Uniswap Zircuit |

Alluvial DV Labs Exiger Integral iYield Layer3 Nexus Mutual Rated Reverie |

Ongoing: ecosystem growth

We’re excited to see the Liquid Collective ecosystem growing in tandem as Liquid Collective’s collaborations and integrations expand. Thanks to our collaborators and ecosystem members who joined us for in-person events this year, including Blockdaemon, Certora, Coinbase, EigenLayer, Gauntlet, Obol Collective, and many others!

Stay tuned for opportunities to connect with the teams building Liquid Collective in 2025, across virtual events, special activations, and opportunities to learn about the secure liquid staking standard.

Find community resources here.

3. Top 5 of 2024: Research, Insights, & Analysis

Report: Ethereum’s Correlation Risks: Poorly Understood, But Always Present

Liquid Collective and Obol Collective collaborated to develop this educational report, providing a view of diversity and correlation risks on Ethereum, as well as proposals and upcoming changes that may shift network dynamics.

The report was followed by this virtual panel, bringing together leading experts from Attestant, Nethermind, Alluvial, and DV Labs to discuss the importance of diversifying stake, mitigating slashing risk, and preserving network resilience.

Event: Legal Analysis of Staking and Securities

Liquid Collective hosted a panel of industry-leading staking and securities experts who discussed the legal and regulatory considerations surrounding staking and liquid staking in the US.

Article: What’s the difference between a liquid restaking token (LRT) and a liquid staking token (LST)?

As restaking technologies advanced in 2024 and saw rapid increases in adoption, one question became common: what’s the difference between a LRT and a LST? This educational article is jam packed with useful information about the core technologies, risks, and opportunities for staking, liquid staking, restaking, and liquid restaking.

Blockworks Survey: Unlocking Institutional Ethereum Staking

This Blockworks Research survey and analysis—cosponsored by Obol and Liquid Collective—presents a comprehensive analysis of institutional token holders' staking behaviors, with a particular focus on the Ethereum ecosystem.

To learn more about the report’s insights, listen to the Blockworks Research X Space on institutional staking featuring participants from Alluvial, 3iQ, and DV Labs.

Article: Is liquid staking safe?

Participating in crypto, including liquid staking, always involves some level of risk. However, the risks associated with direct liquid staking protocols are different from those in other forms of decentralized finance (DeFi) activities. This educational overview compares the risks of liquid staking, DeFi participation, and covers Liquid Collective’s focus on setting the standard for staking security.

Thank you!

One of Liquid Collective’s guiding principles is to operate with a positive sum mindset. That’s why it’s so exciting to see the growth experienced by the Liquid Collective community in 2024, with the protocol’s traction and momentum building and staking continuing to evolve. Thank you for being a part of this journey to build the trusted and secure staking standard.

We can’t wait to see what growth and development 2025 will bring for the Ethereum community, liquid staking, and Liquid Collective, too.

To stay up-to-date with the latest from Liquid Collective, follow Liquid Collective on X, LinkedIn, YouTube, or subscribe to quarterly Liquid Collective Updates. Learn more at liquidcollective.io.