Apr 26 2024

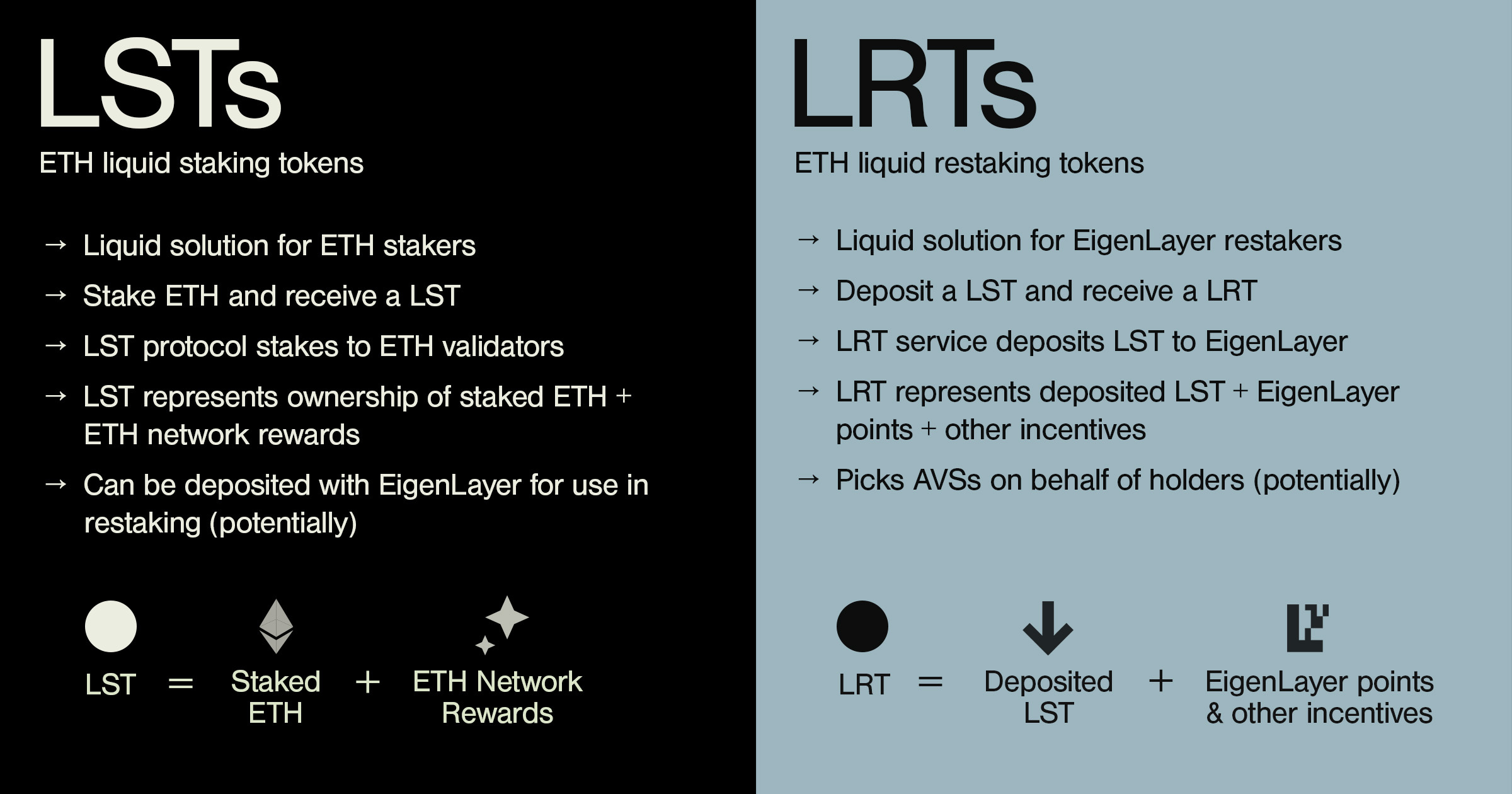

- A liquid staking token (LST) is a receipt token that provides access to liquidity and flexibility while participating in staking on a proof of stake network. LSTs are programmatically minted by a liquid staking protocol to represent ownership of one’s staked tokens and network rewards received.

- A liquid restaking token (LRT) is a token minted to provide access to liquidity while participating in restaking, the primitive developed by EigenLayer that enables staked ETH to be used for securing other networks. While there are many LRT designs, most LRTs represent ownership of restaked tokens, including LSTs that are deposited in EigenLayer to be restaked and EigenLayer points received.

- Liquid Collective’s liquid staking token, Liquid Staked ETH (LsETH), is supported for restaking on EigenLayer and is also supported by a variety of liquid restaking products.

- While this post focuses on Ethereum, many proof of stake networks have robust liquid staking sectors, and new restaking solutions are beginning to emerge within other PoS ecosystems.

Why does the difference between a LRT and a LST matter?

One sector has had the most growth in Ethereum over the last year: staking, and the variety of enabling technologies, protocols, and primitives being developed to expand participation.

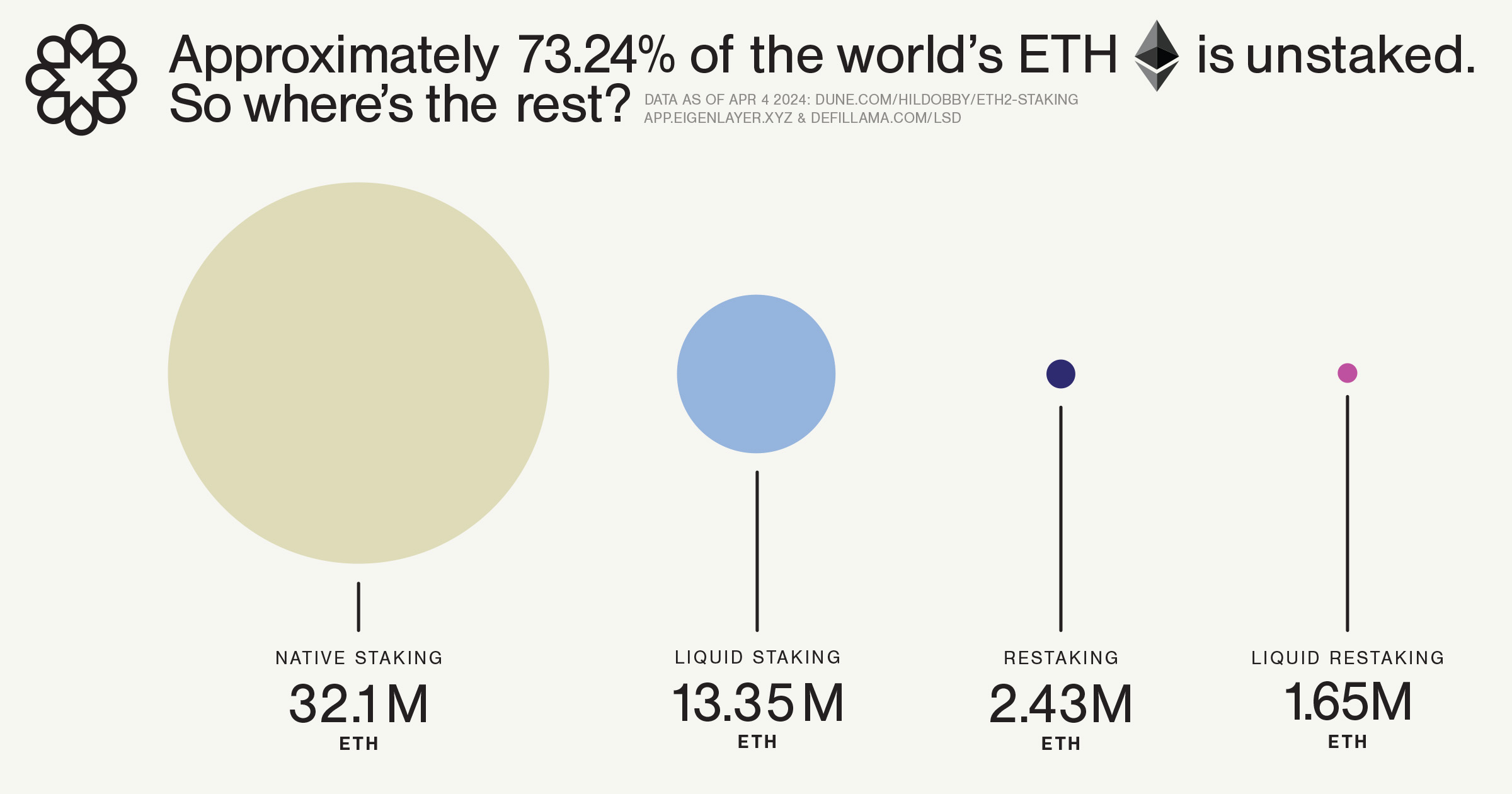

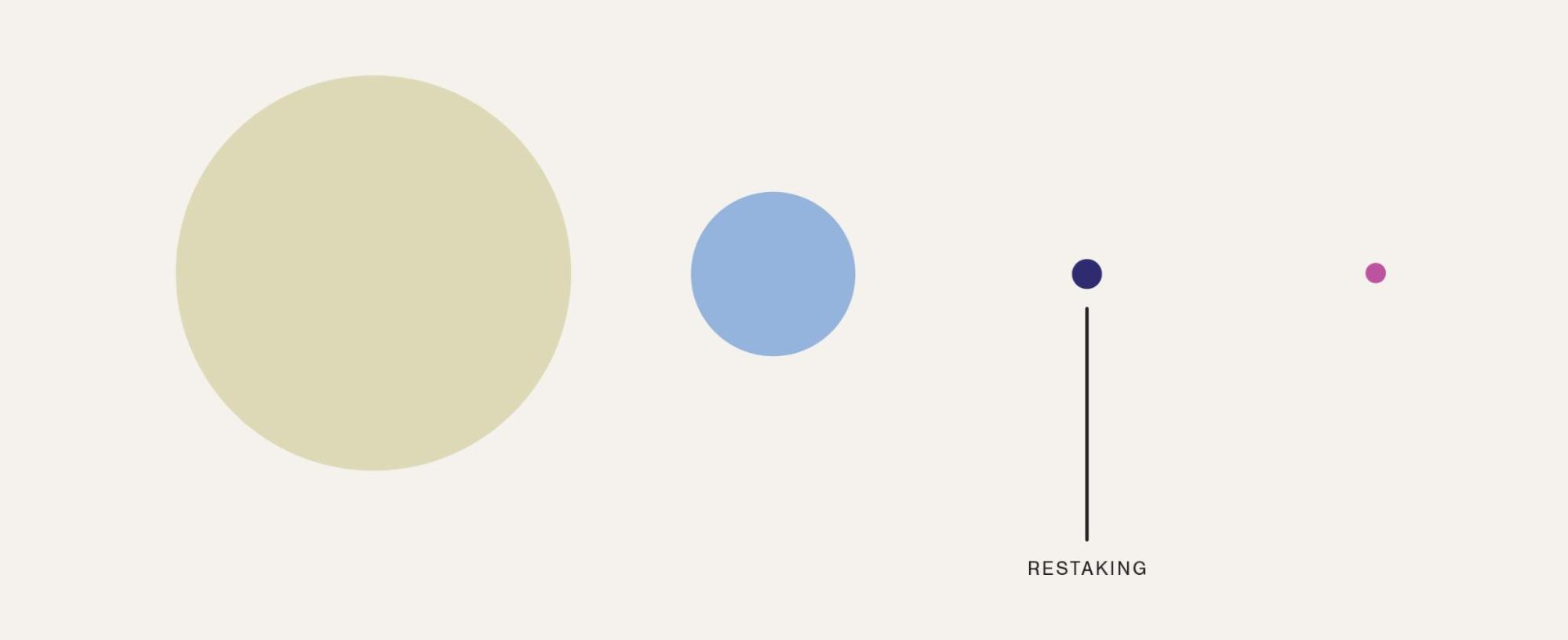

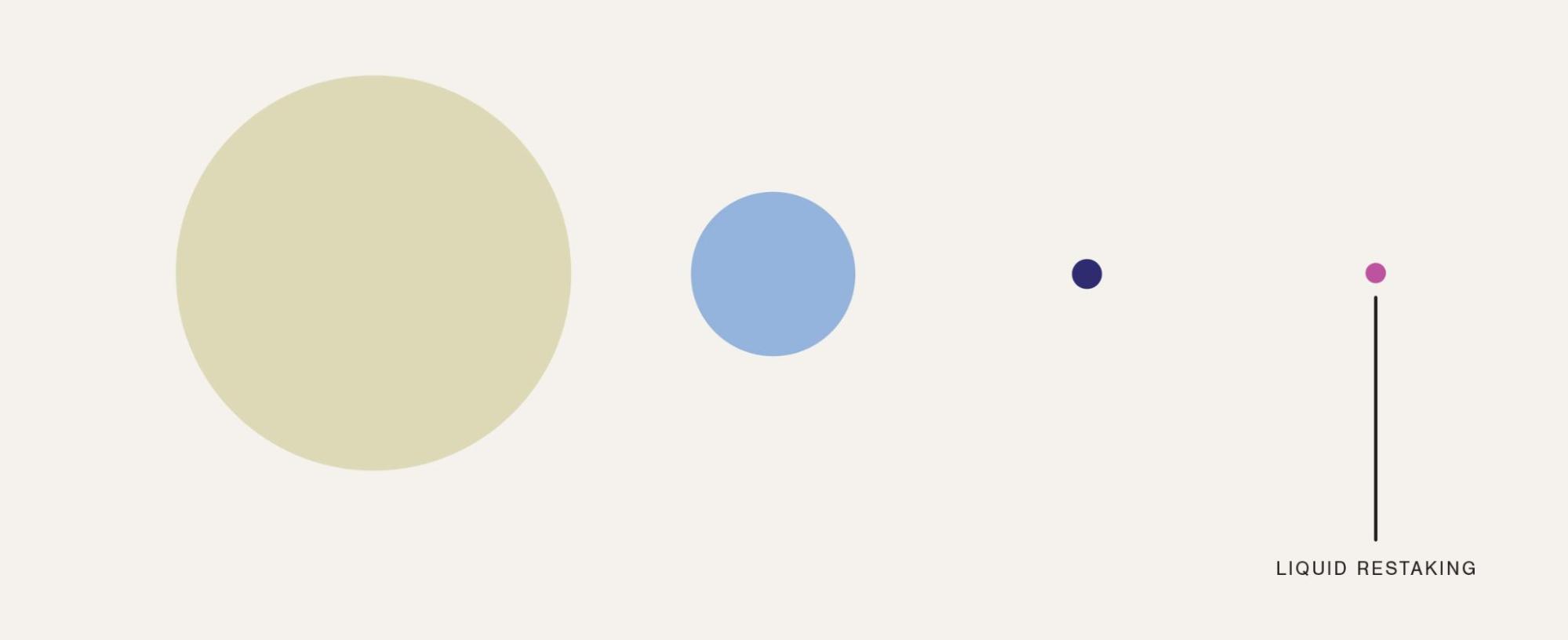

- Staking participation has been practically up-only since Ethereum’s Shapella Upgrade enabled validator withdrawals in April 2023, with over $100B worth of ETH, representing over 27% of the overall supply of ETH, currently staked.

- Liquid staking, a software solution that expands staking’s liquidity and capital efficiency, is emerging as one of the most popular staking technologies. Over 40% of all staked ETH is now staked via liquid staking solutions, representing over $40B at the time of writing.

- Restaking is a new primitive introduced by EigenLayer in June 2023. Entering its mainnet phase in April 2024, EigenLayer has already garnered over $13B in staked ETH + LSTs deposited to the platform.

- Hot on restaking’s heels, liquid restaking, an emerging crypto market that provides liquidity to restakers, is rapidly growing in popularity. Over $8B is currently in liquid restaking protocols on Ethereum.

The next summer is liquid

You may have heard Bankless and other Ethereum thought-leaders speculate on the harbingers of “restaking summer,” or even, perhaps, “liquid restaking summer” ahead—and anyone who remembers 2020's “DeFi summer” knows exactly the hype, network activity, and TVL that a compelling wave of participation can bring. The patterns are comparable though the technologies are unrelated; liquid staking outpaced lending as DeFi’s largest sector in Q3 ‘23, lending’s DeFi summer crown.

If you’re considering taking part, it’s important to do so with a sound understanding of the risks and tradeoffs betweens different kinds of staking solutions. Evaluating how staking, liquid staking, restaking, and liquid restaking offerings interact with each other, and build on top of one another, along with examples of the kinds of trust dependencies they introduce as they do, can help market participants develop a risk-adjusted lens on participation.

Staking

Staking is the act of participating in a proof of stake network’s consensus mechanism, operating the validator nodes, with the appropriate hardware and software, to maintain and secure the network and process transactions. Those who want to participate in staking without operating a node themselves can do so using a variety of solutions, including liquid staking solutions and staking-as-a-service platforms.

Activating a validator node on a network requires “locking up” the staked token (in Ethereum’s case, this means depositing 32 ETH to Ethereum’s deposit contract—though various staking solutions unlock ways for users to participate with any amount) to provide a guarantee that the validator will perform as expected within the protocol. If a validator “misbehaves” and does a poor job of maintaining the network, such as by doing having excessive downtime or signing two blocks in the same window, the stake associated with that validator can be slashed, which means that it is programmatically seized from its validator and burned.

On Ethereum, the more validators that are slashed at the same time, the greater the penalty per validator (due to Ethereum’s correlation penalty). This is an additional parameter within the protocol to encourage distribution while disincentivizing collusion.

The node operator

Operating staking infrastructure can be time-consuming, and requires a level of both reliability and technical capabilities. From staking’s earliest days, many stakers have chosen to work with staking-as-a-service providers to operate validator node infrastructure on their behalf; as early as December 2021, well before Etheruem's merge to PoS made staking mainstream, Messari estimated that the top 15 staking-as-a-service providers already had over $43B in assets staked on their platforms across 12 PoS networks.

Participating in staking with one’s node operations outsourced to a specialized provider introduces a variety of trust dependencies, which any participant should consider carefully.

Considerations of the node operator include:

- Is the node operator a known and trusted entity, with reputation at stake?

- What is the node operator’s track record of performance?

- How ‘good’ of a job do they do operating infrastructure on the network, and receiving network rewards for doing so?

- What kinds of risk mitigations does the node operator have in place, to reduce the risk of slashing, mitigate operational or security risks, etc.?

Liquid staking

Liquid staking is a software solution that enables users to stake directly on a proof of stake network such as Ethereum, with a liquid staking token (LST) programmatically minted by the liquid staking protocol providing access to liquidity while the user stakes.

While traditional methods of staking are subject to bonding and unbonding periods (ranging from days to weeks), liquid staking provides stakers with increased liquidity and capital efficiency. The liquid staking token can be transferred, stored, traded, and utilized in DeFi or supported dapps.

The LST node operator

Liquid staking is one of the newest innovations for how stakers can use a staking service provider to participate in securing PoS networks. There are many design considerations for how liquid staking protocols are integrated with staking infrastructure.

- Many single-platform LST issuers may operate all of their own validator infrastructure in-house, such as Binance’s bETH.

- Many liquid staking protocols (LSPs), including Liquid Collective, have a distributed active set of independent node operators.

There are many configurations for how LSPs include operators in the active set. The Liquid Collective protocol distributes staked ETH eventually across proven, enterprise-grade operators, including Coinbase, Figment, Staked, and Blockdaemon, requiring that Liquid Collective’s Node Operators meet Performance SLAs and compliance requirements.

In general, the same considerations as with staking apply to node operator selection for liquid staking, including the operator’s reputation, performance, and risk mitigations.

The liquid staking protocol and its smart contracts

The most vulnerable time when participating on the blockchain is when a user’s tokens are sitting in a private smart contract. The longer the token sits, the more potential risk. The consideration of smart contract risk is no different with liquid staking protocols, which use a system of smart contracts and on- and offchain software components to programmatically stake ETH.

Considerations of the LSP include:

- Are the liquid staking protocol’s smart contracts audited? Has the code deployed to mainnet received security reviews and/or code audits?

- How long does deposited ETH pass through the protocol before it is programmatically staked via Ethereum’s deposit contract?

- Has the liquid staking protocol’s code been made public, so that external security researchers and participants can evaluate it?

- How long has the LSP been active without a meaningful security incident or loss of staked funds?

You can learn more about how Liquid Collective addresses the protocol’s security considerations in Liquid Collective’s diligence hub. In addition to audits and reviews of the protocol’s code, and a compliance-focused ecosystem for enterprise-grade participation, Liquid Collective also implements smart contract proxies and firewalls for added protection, while direct interactions with the protocol’s smart contract to deposit ETH or redeem LsETH are limited to allowlisted wallet addresses.

Restaking

In June of 2023 EigenLayer introduced a new technological innovation to the Ethereum ecosystem: restaking, or the ability to stake ETH across multiple protocols at once. Restaking on EigenLayer enables liquid staking tokens and traditionally staked ETH to be used as cryptoeconomic security for protocols other than Ethereum.

Stakers can participate in restaking on EigenLayer today by either depositing “vanilla” staked ETH to be restaked, or by depositing a liquid staking token to be restaked. For the purposes of this article, we’ll focus on the considerations of participating in EigenLayer with a LST.

The LSP and its LST node operators

When restaking one’s LST, it's important to remember that the same considerations of participating in liquid staking still exist—one must still keep in mind the liquid staking token’s node operators and the liquid staking protocol’s security, etc.

Should the underlying liquid staking token become compromised, any loss will then waterfall to one’s restaking participation.

The EigenLayer restaking protocol and smart contracts

As with any DeFi protocol, participation in EigenLayer comes with the risks associated with EigenLayer’s smart contracts themselves, and participants should always conduct due diligence. Learn more about EigenLayer’s security considerations, including audits, and Bug Bounty for code vulnerabilities in EigenLayer’s documentation.

In general, many of the same considerations apply to evaluating restaking protocols and smart contracts as those of liquid staking protocols, including the presence of code audits and other security reviews, whether the code has been made public for external security research, the length of time that the contract has been active without significant security incidences, etc.

Restaking’s Actively Validated Services (AVSs) and operators

Once deposited to EigenLayer, restakers can delegate their restaked ETH or LSTs to operators of Actively Validated Services (or AVSs), which can effectively “buy” security from the Ethereum validator set by using the already-staked ETH as a source of cryptoeconomic security. The restakers delegating to AVS operators opt-in to additional slashing agreements, and will be able to receive additional protocol fees and rewards from the EigenLayer protocol and AVSs in exchange.

Considerations of the AVSs and operators include:

- What are the slashing risks and conditions associated with the AVS? Under what circumstances can staked tokens be slashed, due to the behavior of the restaking operators, etc?

- As with staking and liquid staking, are the AVS operators reputable and experienced?

- Do they have slashing mitigations in place that meet the slashing considerations of the AVS?

- What is the economic model of the AVS, and how does the AVS and the operators being delegated to manage economic incentives?

- Does the AVS have any governance mechanism?

- Does the AVS introduce any external risks due to the services it is offering, such as additional attack vectors or liquidation risks?

In many ways, these baseline considerations for participating in restaking are similar to those of participating in staking and liquid staking. However, since restaking relies on depositing already-staked ETH, these considerations should be evaluated in addition to those of staking and liquid staking.

Novel restaking considerations

Innovations in DeFi, especially novel ones like EigenLayer, also come with unknown and unforeseen risks. For example, critics say that EigenLayer’s staking could carry overleveraging risks and/or rehypothecation risks, with complex interdependence coming from the use of liquid staking tokens, which themselves represent ownership of staked ETH, to secure other networks—along with the potential for users to use representative liquid restaking tokens in other areas of DeFi as well.

To many of these critiques the EigenLayer community advocates that EigenLayer’s approach focuses on using staked assets for network security rather than speculative financial activities, and that liquid restaking tokens themselves will not be able to be restaked, thus reducing systemic risks.

Liquid restaking

Liquid restaking, an emerging market that has mostly developed from Q3 ‘23 - Q1 ‘24 on top of EigenLayer’s restaking primitive, is rapidly growing in popularity. Though still early, patterns are beginning to develop between the staking/liquid staking and restaking/liquid restaking market preferences for participation—as the solutions to do so develop, an increasing number of restaking participants are taking part via liquid restaking solutions, just as liquid staking continues to gain traction as a preferred method for users to stake.

In most cases, to participate in liquid restaking a user will deposit their staked ETH or liquid staking token to the liquid restaking protocol or platform. The liquid restaking platform then deposits the staked tokens to EigenLayer to be used in restaking, and issues a liquid restaking token (LRT) to the liquid restaker. The LRT can be transferred or used elsewhere, with the potential to provide access to liquidity and flexibility for restakers.

In most cases, the LRT represents all rewards and yield being distributed together: liquid restaking protocol points, ETH staking network rewards as represented by the liquid staking token, EigenLayer restaking points, etc. Of course, given how relatively young LRTs still are, the design space for LRTs is diverse. Some projects are using liquid restaking as a “bootstrapping” method to build the total value locked on their networks overall, though their core focus may be building something else other than liquid restaking alone.

The LSP and LST node operator, the EigenLayer restaking contract and protocol, and the restaking unknown

In liquid restaking, one must continue to keep the considerations of liquid staking and restaking in mind. Because liquid restaking participants are depositing liquid staking tokens to mint liquid restaking tokens, and those liquid staking tokens are going on to be deposited into restaking to receive rewards from the EigenLayer protocol and AVSs, the considerations such as risk of slashing, risk of hack, etc. still apply for one’s liquid staking protocol, liquid staking token node operators, EigenLayer restaking protocol, AVS platforms, and restaking operators, along with any potential “unknown” of EigenLayer’s novel solution.

Liquid restaking platforms, operators, and novel unknowns

In addition, as with any form of onchain participation, liquid restaking participants have to evaluate the specific considerations of the liquid restaking solution they are depositing LSTs into, including the reputation and experience of the liquid restaking operators, the security of the liquid restaking protocol or contracts, as applicable, and the transparency of the liquid restaking platform.

Today, given how new liquid restaking is within the larger proof of stake ecosystem, there are still many unknowns. Some question whether liquid restaking compounds the rehypothecation risk of restaking, introducing even more leverage and risk of liquidation to the ETH staking ecosystem. There are also many questions, and unknowns, about the process of how liquid restaking platforms will choose AVSs, and delegate to restaking operators, on the behalf of their liquid restakers.

Legal and securities thought leaders have questioned whether a liquid restaking platform selecting an AVS on behalf of a liquid restaker could rise to the level of active management that could make a liquid restaking platform’s LRT be considered as a securities offering. In general, it will likely vary greatly from one liquid restaking platform to another in how they conduct diligence on the restaking operators they delegate liquid restaker’s LSTs to, along with how they select and evaluate AVSs.

Participating through a risk-adjusted lens

While their names are as similar as the solutions they offer for their participants, liquid staking and liquid restaking represent two entirely different markets of Ethereum participation. While a liquid staking token (LST) is a solution for participating in staking, a liquid restaking token (LRT) builds on top of staking, liquid staking, and EigenLayer’s restaking. Understanding the relative considerations and risks that each of these solutions offers, in addition to the potential rewards of participating in them, can help develop a risk-adjusted lens on participation.

As Mara Schmiedt, CEO of Alluvial, a team supporting Liquid Collective’s development, said in her op-ed on risk-adjusted staking participation, “Today, the staking industry has a common baseline for assessing and comparing performance across networks, providers, or solutions: the widely adopted annual reward rate (ARR) metric. However, looking at ARR alone fails to account for the comparative risks involved with different staking solutions. Participants need to see how risks affect rewards to have an accurate and holistic perspective.”

There are many options in the web3 ecosystem today for what a participant can do while they’re staking. Whether it’s participating through liquid staking, liquid staking and participating in restaking, or liquid staking while participating in restaking through a liquid restaking solution, understanding the differences between these solutions, and the trust assumptions their platforms and service providers represent, can help you to choose ways of participating in DeFi that meet your own risk appetite.

Please Note

Liquid staking via the Liquid Collective protocol and using LsETH involves significant risks. You should not enter into any transactions or otherwise engage with the protocol, LsETH or any third-party software unless you fully understand such risks and have independently determined that such transactions are appropriate for you. Any discussion of the risks contained herein should not be considered to be a disclosure of all risks or a complete discussion of the risks that are mentioned. The material contained herein is not and should not be construed as financial, legal, regulatory, tax, or accounting advice. LsETH users may be subject to slashing losses. If slashing losses were to occur, they would be socialized pro rata for all LsETH user's starting with earned but unredeemed network rewards. EigenLayer offers third-party products that are not offered by or in partnership or affiliation with Liquid Collective. Any discussions of EigenLayer products contained herein are not and should not be considered to be an endorsement of EigenLayer or its products and services. Restaking involves significant risks. You should not enter into any transactions or otherwise engage with EigenLayer products and services unless you fully understand such risks and have independently determined that such engagement is appropriate for you. EigenLayer is a software protocol developed by third parties that are unaffiliated with Liquid Collective. You acknowledge and agree that we are not party to any transactions conducted while using EigenLayer. We make no representations or warranties regarding EigenLayer. We are in no way liable for any acts or omissions by you in connection with your use of EigenLayer or as a result of your restaking of LsETH. Products and services offered by EigenLayer and other third parties are subject to separate terms and conditions. Please visit https://www.eigenlayer.xyz/ for more information.