Aug 21 2024

- Symbiotic added restaking support for Liquid Collective’s LsETH on August 5, 2024. View their support announcement here.

- LsETH holders who participate on Symbiotic have the potential to receive additional protocol fees and rewards from the Symbiotic protocol, while simultaneously receiving ETH network rewards by holding LsETH.

Symbiotic, which emerged from stealth mode in June 2024, is a permissionless shared security protocol for decentralized networks and apps. Shared security uses the security of existing decentralized ecosystems to offer a network a pathway to decentralized security, with the goal of making decentralization faster, easier, and more cost effective for builders. People can stake or restake tokens from network A to secure network B, creating a capital-efficient way to scale cryptoeconomic security.

Restaking has become a prominent narrative since it was popularized by the EigenLayer protocol in 2023. For token holders, restaking offers a way to participate in multiple blockchain ecosystems while staking, and provides a new opportunity to receive rewards or other benefits from the restaking protocol on tokens they already hold and/or stake. For network builders, it offers the opportunity to access trusted operators to secure their network, either from the start or as an expansion on the current set within their own ecosystem.

Focus on incentive alignment: how Symbiotic works

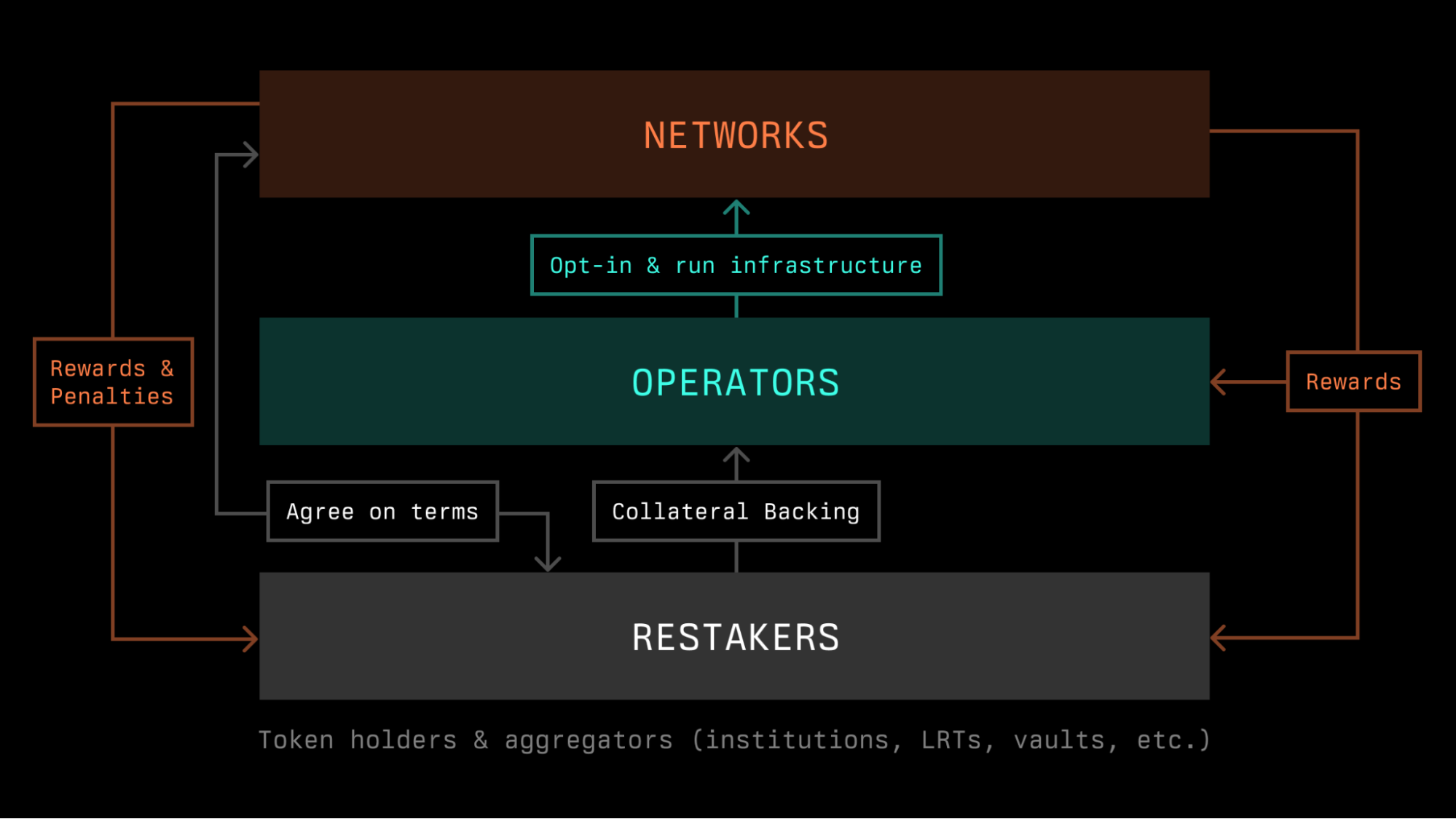

Symbiotic is focused on offering a flexible, modular solution to help align incentives of all parties within an ecosystem. While Symbiotic coordinates the relationship between the parties required to create security, such as vaults, operators and restakers, network builders have control how the process and rules are implemented. Symbiotic allows them to determine what tokens (or mix of tokens) will be used as collateral, what operators to use, what rewards to offer, and what penalties (or lack thereof) will be used to punish poor or malicious performance.

The Symbiotic ecosystem runs across five layers: economic security (collateral), staking (vaults), infrastructure (operators), arbitration (resolvers), and services (networks). Collateral can be any token on almost any chain, or even offchain assets—this is in contrast to the EigenLayer protocol, which launched with limited token support for restaking, though it is expected to launch support for any ERC-20 to be used to participate later this year.

On Symbiotic, vaults connect the collateral to the network while operators run the infrastructure components, such as nodes or ZK proving hardware. Resolvers manage security via slashing tools, committees, and other penalty mechanisms. The networks, of course, are the service providers in need of shared security and decentralization.

When these layers come together, they form a security-focused ecosystem where token holders can provide the desired collateral to the operators that offer the infrastructure required to provide security to the networks. This creates an immutable platform that enables parties to create agreements directly, without the need for intermediaries.

As a core differentiator, Symbiotic’s design is highly flexible, allowing each party to customize their agreements to suit their needs. They can choose any type of collateral, select from different vaults, work with various operators, and pick the level of security that best fits their requirements—all within an immutable framework.

Restaking Liquid Staked ETH (LsETH) on Symbiotic

Liquid Collective is designed to be a trusted and secure staking standard: built and supported by a broad and dispersed ecosystem of proven, known providers, for top-tier security, transparency, and reliability with no single point of failure.

LsETH, Liquid Collective’s LST, is a token that represents ownership of staked ETH along with accrued ETH network and MEV rewards. LsETH features auto-staking rewards, enterprise-grade security, Node Operator performance agreements, and built-in slashing coverage including Nexus Mutual cover.

FOR LSETH HOLDERS:

LsETH holders have the potential to receive additional protocol fees and rewards from the Symbiotic protocol, while simultaneously receiving ETH network rewards simply by holding LsETH.

At the time of publishing, Symbiotic’s development is currently in its devnet stage, targeting a full immutable mainnet deployment in Q3 2024. During this devnet stage, Ethereum stakers can deposit supported liquid staking tokens, including LsETH, and other supported ERC-20s, and begin accumulating native Symbiotic points in exchange. Symbiotic points are a measure of a participant’s contribution to the shared security of the Symbiotic ecosystem and equal to the time-integrated amount staked ($ deposited/hour). Anyone can query https://app.symbiotic.fi/api/v1/points/[contract address] to view LsETH points allocated, replacing the contract address with the wallet address or other contract used to deposit the token into Symbiotic.

As a LST designed with a compliance-focused ecosystem, LsETH on Symbiotic may unlock access for developers to a broad and dispersed community of institutional stakers, enabling compliance-focused protocols built on top of Symbiotic to be powered by restaked LsETH.

FOR THE SYMBIOTIC ECOSYSTEM:

Liquid Collective is a decentralized, onchain protocol built to expand global Ethereum participation and adoption by meeting the compliance and security requirements of institutions and enterprises.

Supporting LsETH for restaking on Symbiotic will offer developers and the entire Symbiotic ecosystem access to a growing and diversified segment of restakers and financial services integrations, including institutional stakers, funds, and treasuries, as well as businesses, including exchanges, banks and fintechs, who want to participate in restaking through an enterprise-grade, compliance-focused LST.

LsETH already has direct integration with some of the world’s largest platforms and support from leading custodians (including Coinbase, Bitcoin Suisse, Figment, Anchorage, BitGo, Fireblocks, and more).

Potential risks of restaking LsETH on Symbiotic

Symbiotic is an unaffiliated third-party integration protocol, subject to its own terms of service. Please review their security measures and terms of service prior to using the protocol. You can learn more about Symbiotic in Symbiotic’s documentation.

As with any blockchain protocol, participation in Symbiotic comes with the risks associated with Symbiotic’s smart contracts themselves. One thing to note is the Symbiotic’s core contracts are immutable, so there are no risks from external governance changes after due diligence is conducted.

Symbiotic is at the forefront of blockchain innovation, and restaking is a nascent technology, so as such there are likely some unknown and unforeseen risks. Critics of restaking often reference potential risks from overleveraging and/or rehypothecation, given the complex interdependencies coming from the use of liquid staking tokens, which themselves represent ownership of staked ETH, to secure other networks—along with the potential for users to use representative liquid restaking tokens in other areas of DeFi as well.

How to get involved

You can learn more about Symbiotic’s integration of LsETH support in Symbiotic’s announcement here. Anyone with access to the Symbiotic protocol can deposit LsETH to participate in Symbiotic’s restaking ecosystem. To learn more about Symbiotic and LsETH, reference the resources below.

Resources

SYMBIOTIC:

- Symbiotic’s site

- Symbiotic’s documentation

- Symbiotic’s audit documentation

- More than restaking: Symbiotic overview

- Symbiotic LsETH support announcement

- Introducing Symbiotic: Permissionless Restaking

LIQUID STAKED ETH (LSETH):

- About Liquid Collective

- LsETH contract address on Etherscan

- Liquid Staked ETH (LsETH) on CoinGecko

- What is LsETH? Overview

- Diligence resource

- Unlock the power of ETH liquid staking with Liquid Collective

Please Note

Liquid staking via the Liquid Collective protocol and using LsETH involves significant risks. You should not enter into any transactions or otherwise engage with the protocol, LsETH or any third-party software unless you fully understand such risks and have independently determined that such transactions are appropriate for you. Any discussion of the risks contained herein should not be considered to be a disclosure of all risks or a complete discussion of the risks that are mentioned. The material contained herein is not and should not be construed as financial, legal, regulatory, tax, or accounting advice. LsETH users may be subject to slashing losses. If slashing losses were to occur, they would be socialized pro rata for all LsETH user's starting with earned but unredeemed network rewards. Symbiotic offers third-party products that are not offered by or in partnership or affiliation with Liquid Collective. Any discussions of Symbiotic products contained herein are not and should not be considered to be an endorsement of Symbiotic or its products and services. Restaking involves significant risks. You should not enter into any transactions or otherwise engage with Symbiotic products and services unless you fully understand such risks and have independently determined that such engagement is appropriate for you. Symbiotic is a software protocol developed by third parties that are unaffiliated with Liquid Collective. You acknowledge and agree that we are not party to any transactions conducted while using Symbiotic. We make no representations or warranties regarding Symbiotic. We are in no way liable for any acts or omissions by you in connection with your use of Symbiotic or as a result of your restaking of LsETH. Products and services offered by Symbiotic and other third parties are subject to separate terms and conditions. Please visit https://symbiotic.fi/ for more information.