Jun 27 2023

- To help highlight what matters to stakers today Liquid Collective conducted a limited survey gathering data from a group of experienced staking participants, focused primarily on their preferences when deciding to stake.

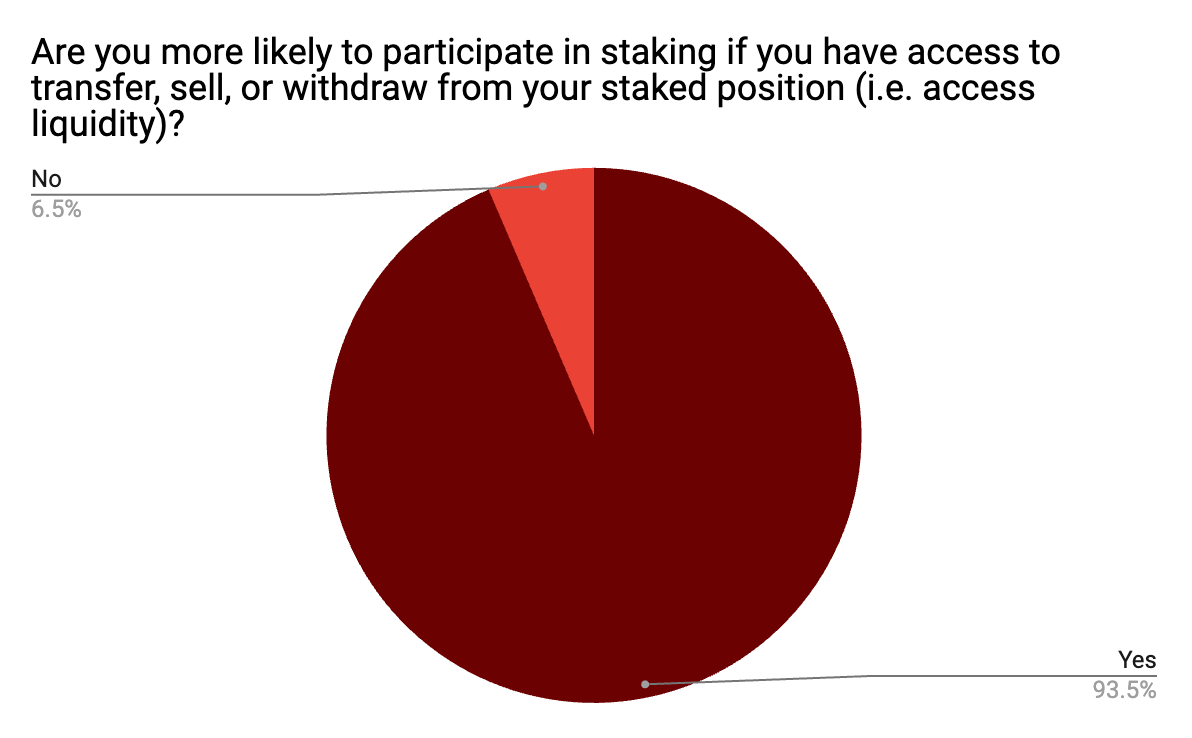

- 93.5% of all respondents said they are more likely to participate in staking with the ability to transfer, sell, or withdraw from the staked position (access liquidity).

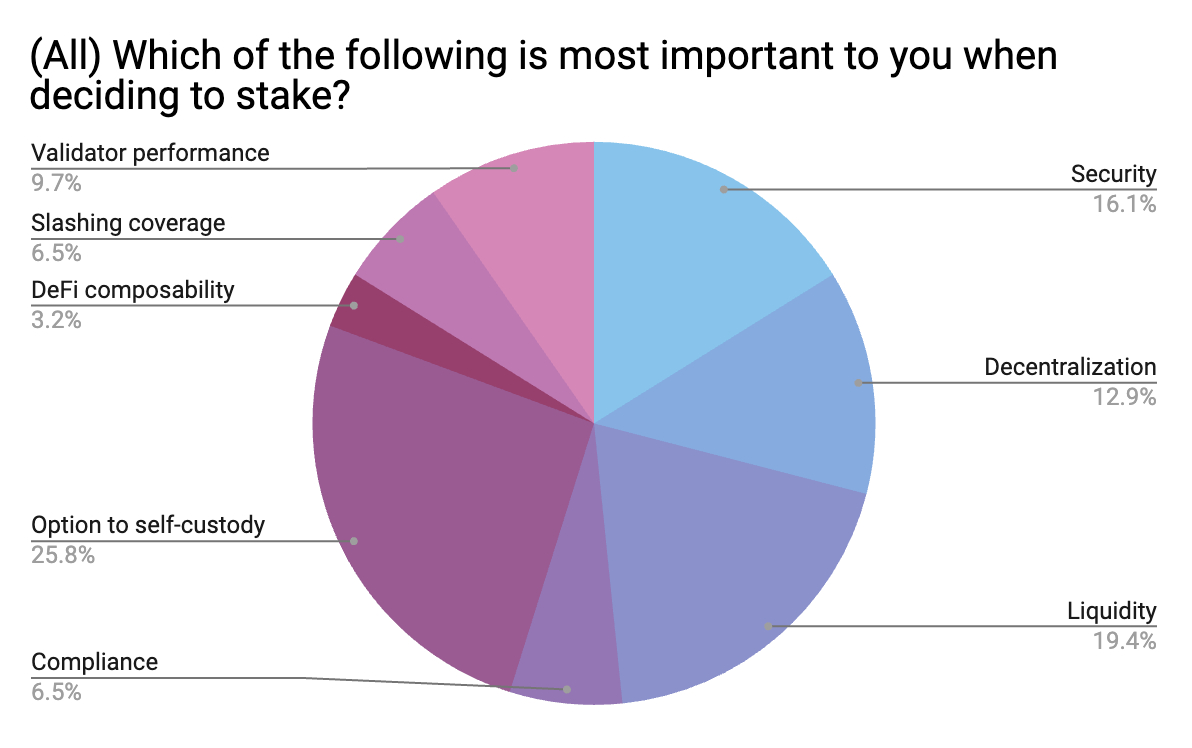

- Overall, the options to self-custody staked assets and access liquidity while staking lead as the most important considerations when deciding to stake, followed by security.

- Stakers who identify as more advanced have different considerations when deciding to stake, indicating that the needs of participants evolve as they progress in their staking journeys.

Deciding to actively participate in securing a proof of stake (PoS) blockchain, and what service provider to do so with if not solo-staking, comes with many considerations.

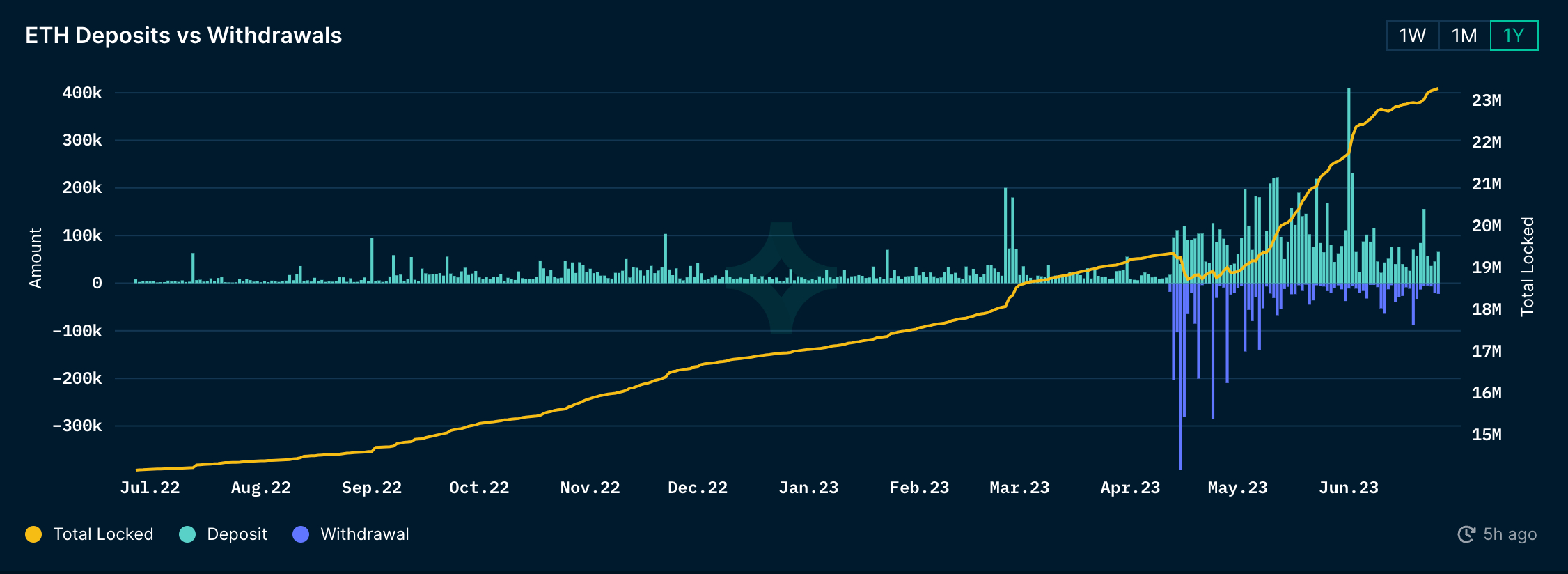

Participation in staking has skyrocketed over the last quarter. Over 7.4m ETH has been deposited to staking since Ethereum's Shapella upgrade enabled withdrawals on the network, representing a 20% increase in the total ETH locked. Yet little new research has been conducted on the leading considerations for those participants who are deciding to deposit their crypto into staking.

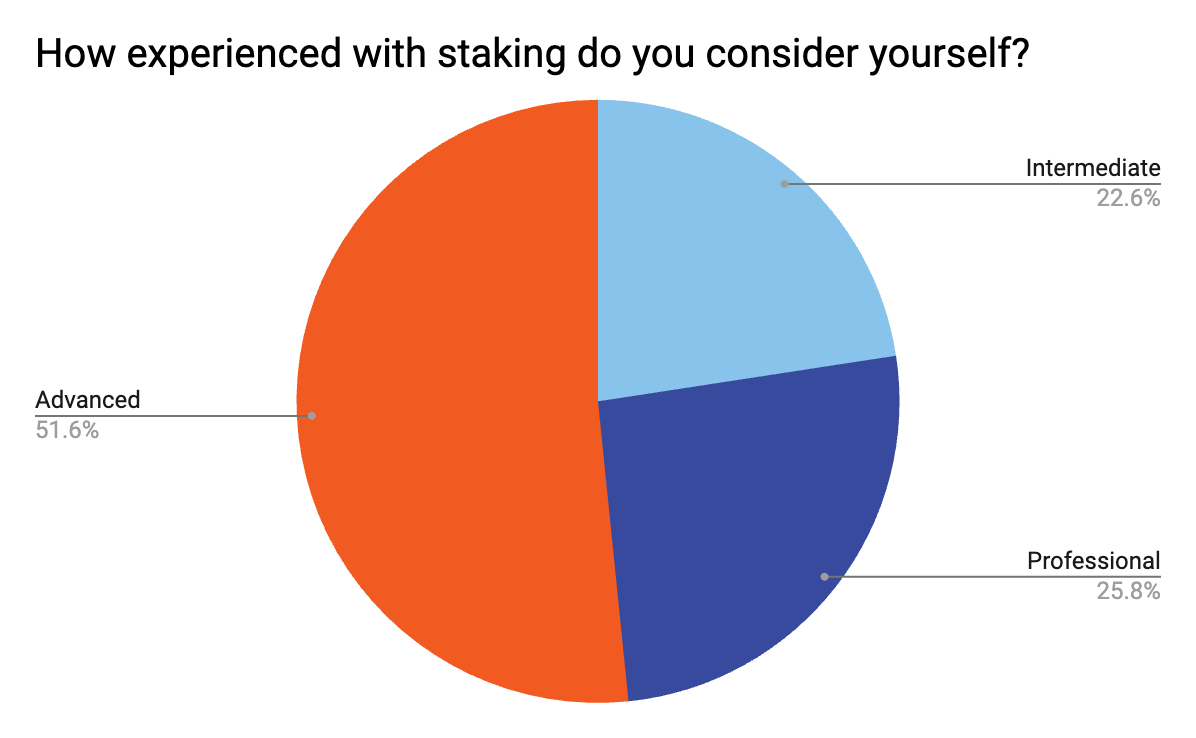

To help highlight what matters to stakers today Liquid Collective conducted a limited survey gathering data from 30 staking participants. The survey focused primarily on their preferences when deciding to stake and their likelihood to participate in staking given access to transfer, sell, or withdraw from staked positions (access liquidity).

The majority of respondents included in this analysis self-identified as advanced stakers, with all self-identifying as either intermediate, advanced, or professional stakers. This question of staking experience was intentionally left open-ended to allow respondents to express their own level of comfort and familiarity with staking—self-categorizing based on their own appraisal of their skills—rather than asking them to estimate and categorize their participation arbitrarily, such as by how many times they've submitted a staking transaction.

Results: Self-custody and liquidity lead the way

The data indicates a range of preferences when deciding to stake. These preferences notably varied across the self-identified experience levels (intermediate, professional, and advanced), indicating differences in priorities based on the respondent's level of familiarity with staking.

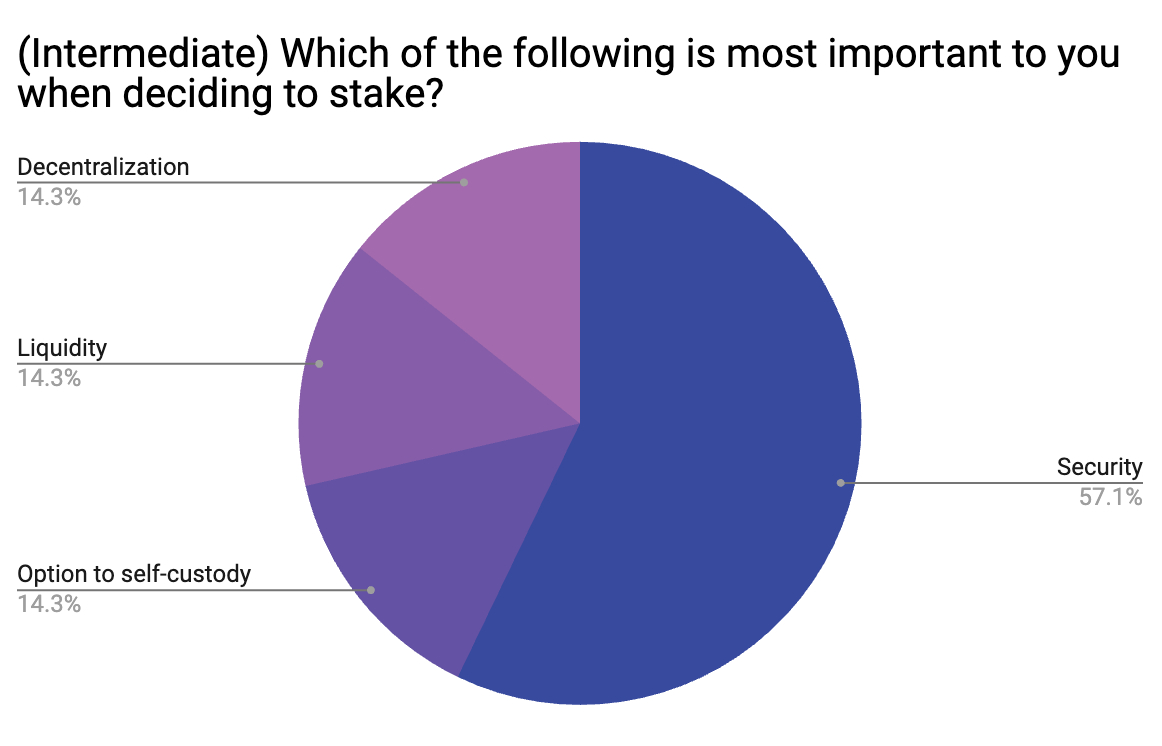

For stakers that self-identify as intermediate, security leads by a significant margin as the most important consideration when deciding to stake, with equal distribution across decentralization, liquidity, and the option to self-custody as the respondents' other top considerations.

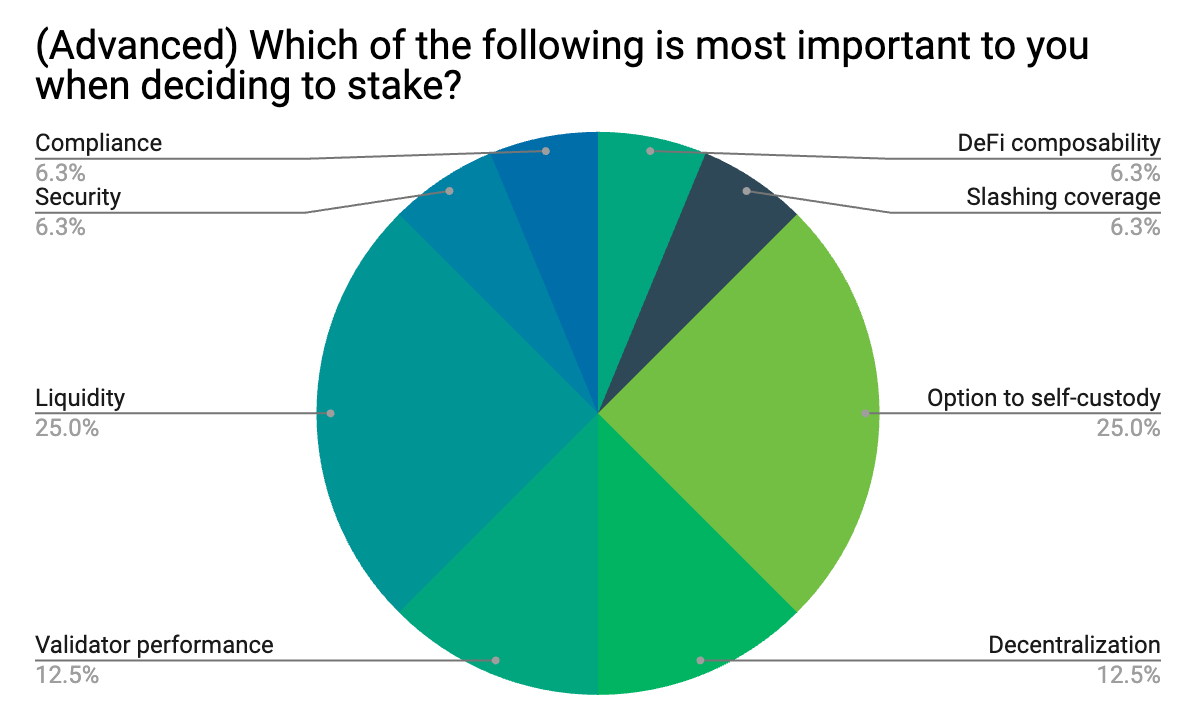

Respondents that self-identified as advanced stakers had a more even distribution of top staking considerations, with an even split between liquidity and self-custody in the lead, an even split between validator performance and decentralization in second place, and other considerations divided across survey responses.

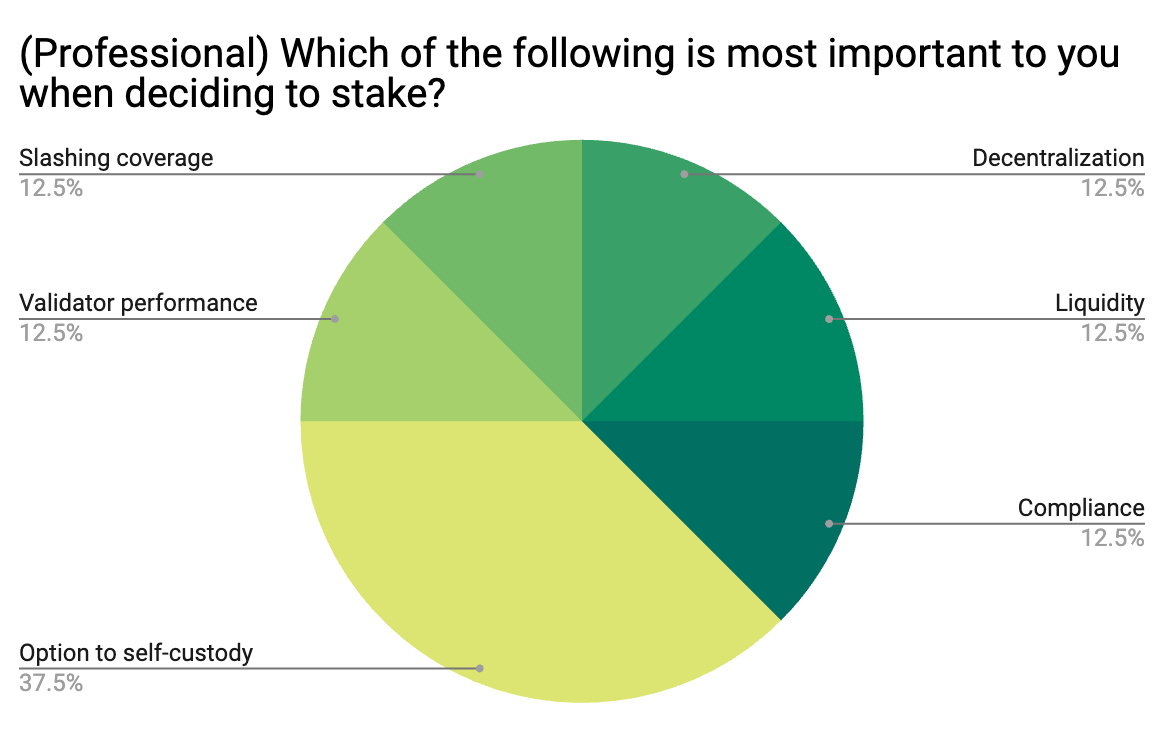

For those stakers who self-identified as being professionally experienced the option to self-custody was clearly the leading consideration when deciding to stake. With an even distribution across the other categories these respondents chose (validator performance, slashing coverage, decentralization, liquidity, and compliance), the option to self-custody was chosen as the most important consideration by over 3x as many professional respondents.

Self-custody leads as the most important consideration across segments

Overall, across groups of respondents, the options to self-custody staked assets and access liquidity while staking lead as the most important considerations when deciding to stake, followed by security.

The clear lead of self-custody as the most important consideration across segments in this survey (leading by over 5 percentage points) may reflect a shifting in staker awareness of the importance of custody following incidents in the market in 2022. A heightened awareness of the implications of self-custody may be more apparent now in stakers' preferences than in market cycles of the past due to the recent collapse of FTX and other custodians, keeping education around private key custody close in participants' minds.

However, notably, as stakers self-identify as intermediate, advanced, or professional stakers, identifying the option to self-custody as their most important staking consideration increases in tandem—from 14.3% to 25% to 37.5% identifying it as the most important consideration, respectively. The increasing importance of self-custody may also be skewed by the increasing importance of custodial flexibility for enterprise and professional stakers, who may themselves offer custodial services to their clients or need to meet other self-custody mandates.

At the same time, the importance of security decreased with experience just as the option to self-custody increased with experience. The clear majority of intermediate staking respondents chose security as the most important consideration when deciding to stake (57.1%), while only 6.3% of advanced respondents identified security, and no professional stakers identified security as their top considerations.

While the bounds of this survey did not cover the 'why' behind responses, one explanation for the converse variations in security and custody across skill levels could be that as a participant increasingly takes custody of their staked tokens, their need to consider the security practices of a service provider decreases in tandem. Yet other considerations of node operator security, such as double-signing protection or multi-region failover practices, should still remain relevant regardless of a staker's key custody or experience level.

Across the board, respondents are more likely to participate with access to liquidity

While self-custody was chosen by the most respondents as their most important consideration when deciding to stake, at the same time, 93.5% of all respondents said they are more likely to participate in staking with the ability to transfer, sell, or withdraw from the staked position (access liquidity).

This represents a significant majority of respondents who indicated that they would be more likely to participate in staking if they had access to liquidity for their staked positions, suggesting a strong desire for flexible liquidity options among staking participants.

Inflow of capital, and institutional capital in particular, to staking post-Shapella highlights the accuracy of earlier predictions that enabling Ethereum withdrawals would be seen as a significant de-risk for participation in securing the network. This correlation is further validated by the overwhelming response that the majority of respondents are more likely to stake if they will have access to liquidity.

Across the staking ecosystem (and not specific to Ethereum) these limited results displaying a strong preference for staking participation if one has access to liquidity indicate the potential power of liquid staking tokens (LSTs) to improve network security and decentralization by making participants feel more comfortable taking part in securing the network.

By generating a transferable LST to as a receipt of the staked token's legal and beneficial ownership, liquid staking protocols like Liquid Collective enable participants to directly participate in staking while also maintaining the ability to use their LST elsewhere in decentralized finance (DeFi) or transfer ownership of their staked tokens. As a result, LSTs like Liquid Staked ETH (LsETH) provide increased liquidity and capital efficiency for stakers.

While withdrawals are now enabled on Ethereum the network's validator activation and exit queues still create meaningful barriers for those deciding to start or stop staking ETH—stretching over 40 days to start staking and nearly four days to exit—which LSTs can also help solve for stakers. By retaining the option to access liquidity on-demand via their liquid staking token, stakers can focus on leading considerations like custody and security when making the decision to participate directly in securing the decentralized web.

Conclusions and future research

Overall, the results of this survey suggest that:

- Access to liquidity is a key factor in deciding to participate in staking

- The importance of self-custody is top-of-mind for the most experienced stakers in the industry

- Preferences when deciding to stake can vary according to the level of experience

As the staking landscape continues to evolve, understanding these dynamics will be crucial for protocols seeking to attract and retain staking participants in a changing crypto landscape.

While this analysis provides valuable insights, it is based on a specific dataset that may not represent the wider staking participant population. Future research into stakers' preferences could benefit from a larger, more diverse respondent pool to enhance the generalizability of the findings. Further, conducting similar analyses over time could help track trends and changes in participant preferences and experience levels.

Overall, we hope that these findings contribute to a better understanding of the staking landscape and provide a foundation for future research and strategy development when considering the shifting needs of stakers as the ecosystem develops.

Staking ETH with Liquid Collective

Why not have the best of all worlds? Liquid Collective is the secure liquid staking standard: a decentralized liquid staking protocol built and operated by a broad and distributed group of industry leaders, and designed to meet the needs of institutions offering staking to their customers with enterprise-grade security and compliance.

Liquid Collective is non-custodial at the protocol level, providing stakers with the option to custody or onboard with their preferred Platform. The protocol's LST, Liquid Staked Ether (LsETH) is integrated directly with top trading venues and custodians, including Coinbase Prime and Bitcoin Suisse, so any staker can stake knowing they have the option to access liquidity when they need it.