Jun 06 2023

As the web3 space continues to evolve, so does the need for innovative solutions that accommodate new market dynamics. Proof of stake (PoS) protocols are gaining traction and becoming a staple in the investment portfolios of many retail participants—ETH staking in particular has seen net inflows of over 3 million ether since the activation of withdrawals in March of 2023.

However, as more users opt into staking, liquidity and trading volumes decrease, which can cannibalize retail exchanges' trading fees. This is because most traditional staking requires participants to lock up their tokens for a period of time or may have long waits to withdraw. Exchanges can help to circumvent this challenge by integrating support for Liquid Collective, a liquid staking protocol built for enterprises.

Liquid staking is a growing software solution that allows participants to stake while retaining the ability to transfer or use their staked tokens by minting a liquid staking token (LST) for the option to access liquidity. Liquid Collective is a secure liquid staking standard: a multi-chain protocol built to meet the needs of businesses offering staking to their customers.

The protocol was developed in collaboration with a diverse group of industry leaders to meet the need for an enterprise-grade liquid staking standard that can be widely adopted, increasing liquidity and composability for the web3 economy. Why should retail exchanges integrate Liquid Collective? Let's dive into the details.

Staking reward opportunities

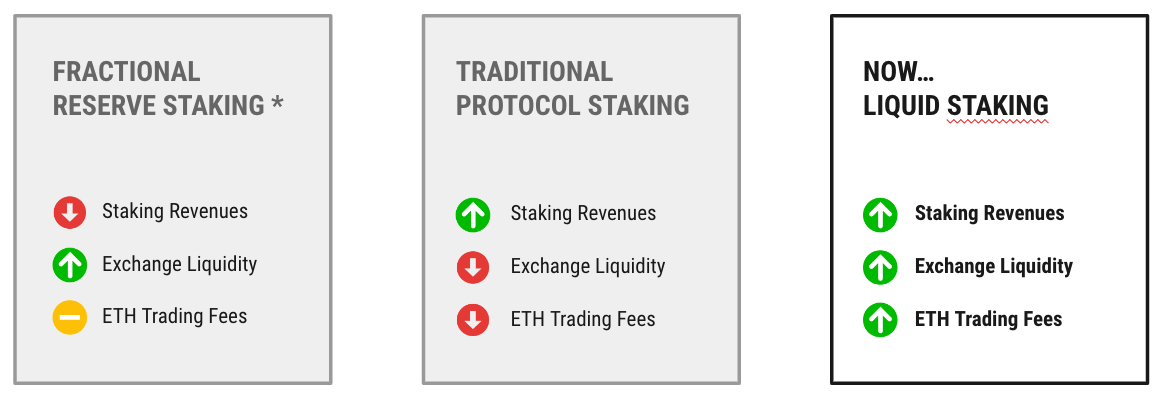

One of the key advantages of integrating Liquid Collective is its potential to provide exchanges with increased staking reward opportunities, without sacrificing important features for participants like exchange liquidity, or other revenue opportunities for exchanges, like ETH trading fees.

The traditional model of staking, while potentially beneficial for an exchange's revenue, reduces exchange liquidity and staking fees due to the illiquidity of the participants' staked assets on the platform. This is why prior to the introduction of liquid staking most exchanges used a fractional reserve model to provide their users with frictionless staking without sacrificing liquidity and optionality. But, while fractional reserve staking offerings can boost exchange liquidity, this comes at the expense of staking revenues for the exchange and user, while also introducing regulatory challenges.

However, offering Liquid Collective as a liquid staking solution can allow an exchange to generate full staking revenues while maintaining users' liquidity—and creating the potential to increase trading fees earned via the protocol's liquid staking token, LsETH. While it may feel like a dramatic shift, the potential to use LSTs like LsETH in areas where ETH alone was previously used, such as for default trading pairs, offers exchanges the opportunity to monetize staking participation while retaining the option to access liquidity.

The innovation of Liquid Collective lies in its ability to generate staking rewards while preserving users' liquidity. This ensures that users can enjoy the benefits of staking without compromising their ability to trade, ultimately enhancing the user experience on your platform.

Exchanges that integrate Liquid Collective can receive over 10x the percentage of network rewards generated by their clients' deposits to the protocol as they would with other liquid staking solutions on the market.

Additionally, Liquid Collective offers a unique opportunity to become an owner in the protocol. Built and governed by a collective of leading web3 teams and industry participants, the teams building and supporting Liquid Collective are fundamental to its long-term success. Liquid Collective's governance token supply is also awarded to Platforms based on the amount of client deposits their platform contributes to the protocol, allowing exchanges to actively participate in the protocol's decision-making processes and contribute to its growth and development while increasing their stake in the growing liquid staking market.

Enterprise-grade security and regulatory-focused design

Liquid Collective takes security and regulatory compliance seriously. The protocol has undergone multiple audits from leading security experts, and its active set of enterprise-grade Node Operators are required to meet strict security standards. Built-in slashing coverage, including Nexus Mutual cover, provides peace of mind to stakers and takes risk off your exchange's balance sheet.

As a decentralized protocol, transparency comes built-in with rewards and Node Operator performance fully visible onchain. At the same time, the protocol's Allowlist functionality can reduce the risk of smart contract hacks by limiting the participants that can directly interact with the protocol's code.

Liquid Collective was also designed from the start with a regulatory-focused mindset. It mandates KYC/AML for users & operators, facilitating compliance. Its LsETH user agreement is contractually structured as a bailment, offering a clear legal framework for staking activities. And, at its core, the protocol is built with a direct staking model, designed to expand direct staking through liquid staking tokens (LSTs), which represent legal and beneficial ownership of a staker's tokens and any network rewards the tokens accrue.

Easy integration

Liquid Collective was designed for seamless integration with retail exchanges. Its API-first approach, Rewards Reporting API, and use of the cToken standard for LsETH simplify the integration process.

Liquid Collective's API-first integration makes it easy and efficient to add native liquid staking support, a process made even easier as LsETH uses the familiar cToken standard. At the same time, the Rewards Reporting API allows exchanges to easily provide reward data to participants.

Testing plans and expert support ensure confidence prior to deployment, making the integration process as seamless as possible and ensuring confidence prior to deployment.

Avoiding the pitfalls of in-house development

Building your own in-house liquid staking solution can be costly and time-consuming. It requires significant resources for the high expense of Node Operators, security audits, slashing coverage, and internal product and development. In addition to Ethereum staking, these challenges make building in-house is not a scalable strategy for supporting liquid staking across major PoS protocols, a key need for exchanges, and a process that can take years.

With an existing, expert solution on the market that's easy to integrate, the opportunity cost of this time-consuming and resource-intensive development doesn't make sense. Partnering with an established liquid staking solution like Liquid Collective increases your speed to market for liquid staking while effectively outsourcing integrations, composability, and user benefits like slashing coverage.

By integrating Liquid Collective you can avoid these pitfalls and focus on high-impact priorities, maximizing the use of your existing resources. This allows exchanges to stay ahead of the curve by providing their clients with the best in staking technology, quickly and with similar economics to a solution built in-house, while simultaneously benefiting from the growth of the PoS market.

Liquid Collective is the liquid staking protocol built for enterprises

Liquid Collective provides the best of enterprise-grade security, compliance, liquidity, and slashing coverage. As a non-custodial liquid staking protocol built for performance and risk management, it can offer retail participants both liquidity and peace of mind—without cannibalizing the bottom line for retail exchanges.

Bring your team into the future of staking and maximize your company's growth potential with Liquid Collective. You can learn more about Liquid Collective and its advantages for your exchange at liquidcollective.io, or get in touch to learn more here.