Apr 12 2024

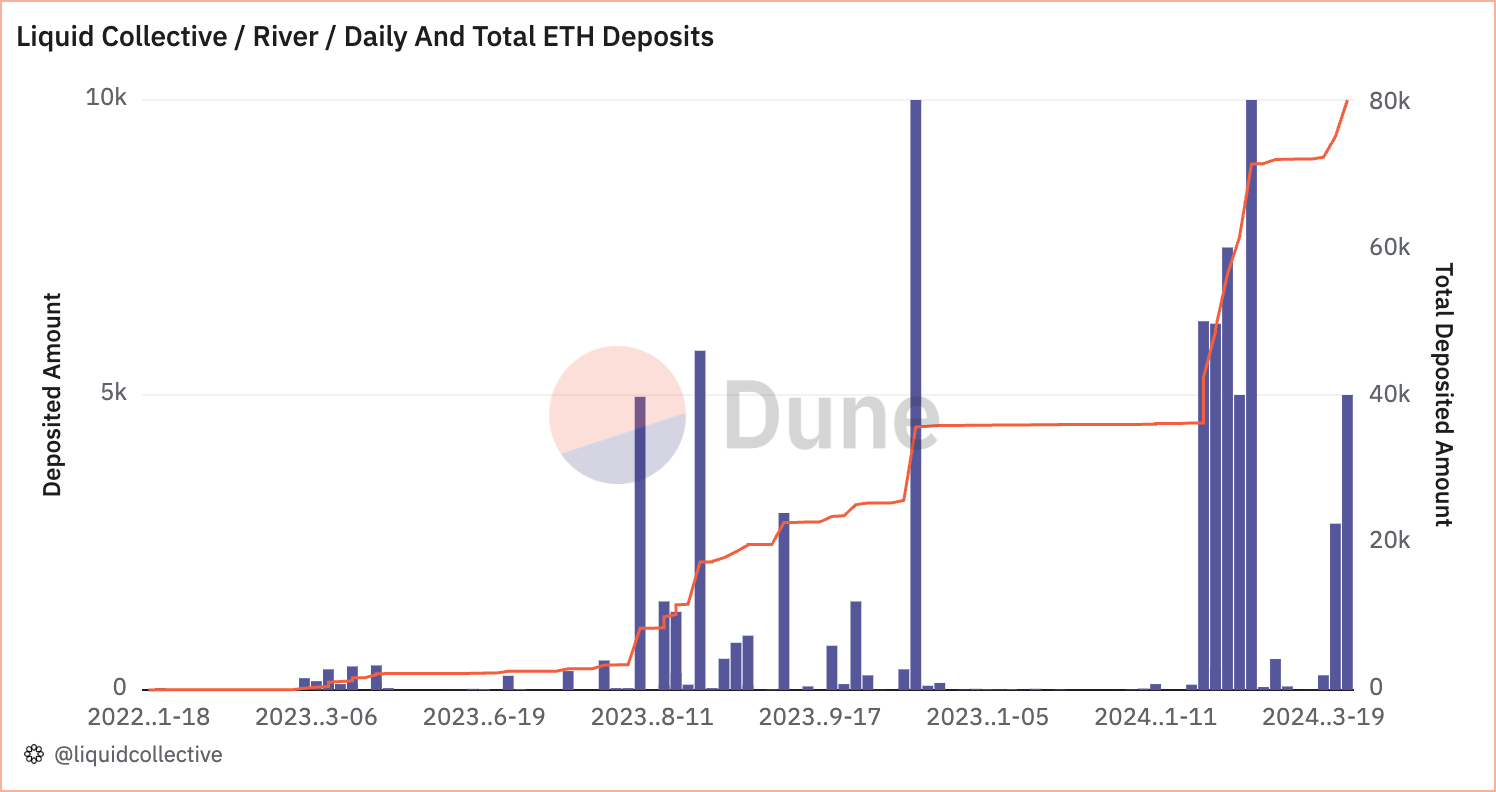

It’s been an action-packed month for Liquid Collective, including upgrades, collaborations, and a fresh apparel collection. The number of LsETH holders also increased by over 225% in Q4 + Q1 for a strong six months of growth, during which time the protocol’s TVL grew by 484.2%, to over $242M at the start of Q2.

Read on to catch up on Liquid Collective’s fee reduction, improved coverage, technical development, where to watch last week’s “Legal Analysis of Staking and Securities” panel, and more.

Liquid Collective's Latest

Obol Labs x Liquid Collective

We’re excited to share the kickoff of Obol Labs’ collaborative work with Liquid Collective. Obol Labs will leverage its expertise to assist Liquid Collective’s Node Operator Working Group in the exploration of how Distributed Validator Technology (DVT) can enhance the protocol's Node Operator set requirements and onboarding processes, supporting Liquid Collective’s Oracle operations, and more.

Learn more in our announcement, or in Obol’s blog post here.

Same security-focused LST, now with below-average fees

Liquid Collective reduced the Protocol Service Fee from 15% to 10%, a strategic update that aims to make Liquid Staked ETH (LsETH) more accessible and competitive across the diverse Platforms where it's supported (including Coinbase, Figment, Bitcoin Suisse, Anchorage, BitGo, Fireblocks, Copper, and more). The change brings the Protocol Service Fee below the liquid staking landscape’s average fee rate, while still offering the same security-focused, enterprise-grade liquid staking protocol.

Learn more in our announcement here.

Liquid Collective’s updated Nexus Mutual policy

The Nexus Mutual policy within Liquid Collective’s Slashing Coverage Program now has no correlation exclusions! While the Slashing Coverage Program’s structure remains the same, this pillar now covers any time a slashing incident takes place.

The Slashing Coverage Program is provided to every participant staking through the Liquid Collective protocol, including cover for network-wide events, such as network outages, and Node Operator failures. The program includes three pillars of coverage: Nexus Mutual Cover, the Slashing Coverage Treasury, and a Node Operator Commitment.

Learn more about the updated program in our overview here.

Industry-leading insights into staking's regulatory considerations

Last week, Liquid Collective hosted a stellar lineup of legal experts with leadership in US securities law, crypto regulation, staking, and liquid staking. The panel covered the technical considerations of staking and liquid staking, solo staking, pooling, legal frameworks under securities laws, comparisons to commodity futures laws, what’s next for the industry, and, of course, the Howey test.

Miss the live event? Watch the recording, or read the full transcript, here.

“When you look at staking, whether it's native staking onchain or it's a staking as a service provider, we just don't see the type of principle-agent relationship or the type of information asymmetry that would justify applying the securities laws.”

—Source: Jake Chervinsky - CLO, Variant

Liquid staking summer drip drops

Are you prepared for the liquid staking landscape to heat up? The spring 2024 collection is live in Liquid Collective’s apparel shop, including breezy T’s and liquid staked dreams for whales and dolphins alike. Check it out here.

Events

Upcoming Conferences: To connect with the teams supporting Liquid Collective at an upcoming conference, contact us.

- DigiAssets: May 14 - 15, London

- Consensus 2024: May 29 - June 1, Austin: Don't miss the Liquid Staking and Restaking Explosion panel at 10:00 AM on May 31.

- ETHCC: July 8 - 11, Brussels

News from the Collective & Ecosystem Updates

- Evan Thomas, General Counsel at Alluvial, a team supporting Liquid Collective’s development, published an op-ed in Blockworks, “Staking rewards do not make ETH — or ETH staking — into a security,” presenting that, “The fact that ETH can be staked does not mean it is a security, and staking ETH to earn staking rewards does not necessarily give rise to a securities offering.” Read it on Blockworks here, or Alluvial’s site here.

- Integral, a crypto accounting software and finops software provider, published “cTokens Explained: Guide to Liquid Staking Models and Potential Tax Impact.” The analysis covers the considerations between the cToken and aToken models, and why some projects, including Liquid Collective, believe the cToken model is ultimately beneficial. Read it here.

- EigenLayer announced its mainnet launch, alongside its launch of EigenDA. Restakers can now delegate to their chosen Operators, Operators can register with EigenLayer to opt-in to running Actively Validated Services (AVSs), and AVSs will begin to be able to register with the protocol. Learn more here.

- Alluvial CEO & Co-Founder Mara Schmiedt was named on Forbes’ “30 Under 30 Europe” list, in the financial sector. Read the Forbes profile, or watch the full interview with Mara, here.

- Figment published an announcement of the company’s strategic support for EigenLayer, including how ETH and LST holders (including LsETH holders) can restake with Figment. Read it here.

- Kraken Institutional launched a Qualified Custody solution for crypto in the US. Learn more here.

- OurNetwork Newsletter #219, featuring the LST ecosystem, included coverage of Liquid Collective’s impressive QoQ growth in LsETH holders and TVL, along with how the effect of LsETH’s inclusion in restaking can be seen onchain. Read it here.

- Franklin Templeton invested in Integral to build tokenization accounting infrastructure. Learn more here.

- Coinbase Developer Platform (formerly known as Coinbase Cloud) completed its initial rollout of the Nethermind execution client for ETH nodes, and shared that ∼50% of Coinbase validators are now running on Nethermind. Learn more here.

- Fidelity amended its spot Ethereum ETF proposal to include staking. Learn more here.

- BIT Crypto published an overview of liquid staking tokens, including how they work, and their appeal to the broader market. Read the report here.

- Total Deposited ETH: 80,535.534 ETH + 10.02%

- Total Value Locked: $245,431,805 - 0.06%

- LsETH Conversion Rate: 1 LsETH = 1.04512 ETH + 0.23%

All data is accurate as of April 12, 2024. View real-time onchain data here on Dune. Percentage changes are from the March 15, 2024 edition of By The Numbers.