Jan 12 2024

2024 is off to an exciting start, with over $90m staked with Liquid Collective representing 38% QoQ growth, LsETH restaking support launching on EigenLayer later this month—and, of course, the long-awaited approval of Bitcoin spot ETFs in the U.S. sparking excitement over the next phase for the crypto ecosystem.

Read on for the latest news and updates from Liquid Collective!

Liquid Collective's Latest

LsETH restaking support on EigenLayer launches: Jan 29 - Feb 2

This week, EigenLayer announced that it will be adding support for LsETH restaking starting on January 29th. Launched in June of 2023, EigenLayer introduces a new technological innovation to the Ethereum ecosystem: restaking, or the ability to stake ETH across multiple protocols at once. During its current Stage 1 of development Ethereum stakers can deposit supported LSTs within limited participation windows, and begin accumulating Restaked Points in exchange.

LsETH holders who participate will have the potential to receive additional incentives from the EigenLayer protocol, while simultaneously receiving ETH network rewards by holding LsETH. The window for restaking LsETH on EigenLayer will be open from January 29th - February 2nd, or until a maximum cap of 200k LsETH has been restaked.

Learn more in EigenLayer’s support announcement and thread. Stay tuned on Liquid Collective’s X and LinkedIn channels to learn more about restaking LsETH on EigenLayer over the next two weeks.

It’s important to note that EigenLayer is an independent third-party integration with its own risks of participation. You can learn more about EigenLayer’s security measures in their documentation here.

Mythbusting: Diving into why the value of LsETH isn’t pegged 1:1 to ETH

LsETH represents more than just staked ETH. Because it’s based on the cToken model, the rate at which LsETH can be redeemed for ETH dynamically incorporates accrued rewards, and adjusts for fees and penalties. This means that as ETH network rewards accumulate, the value of each LsETH increases, representing both one’s original staked ETH and earned rewards.

How does this relate to the concept of a 1:1 peg to ETH, and how does the cToken model compare to the aToken (aka rebase) model in which new tokens are minted to represent rewards received? Learn more in Liquid Collective’s educational post here, demystifying LsETH’s cToken model, Liquid Collective’s Protocol Conversion Rate, and why the value of LsETH isn’t pegged 1:1 to ETH.

Discover LsETH

Hold LsETH to receive ETH network rewards: it’s that simple. Dig into the details of Liquid Collective’s Liquid Staked ETH (LsETH), the liquid staking token with enterprise-grade security, built-in slashing coverage, leading Node Operators, and more, in Liquid Collective’s LsETH deep-dive.

ICYMI: Liquid Collective’s 2023 Year in Review

If one thing is for certain, the end of year has a lot going on. So, in case you missed it in December’s update: Liquid Collective’s 2023 Year in Review provides an overview of the protocol’s strategic collaborations and initiatives, along with an outlook of trends for the year to come.

After reviewing his annual OKRs (Objective Kibble Results), Liquid Collective’s Mr. X has decided to hang his broadcatter collar and transition away from recording monthly Liquid Collective Updates. Instead, he will be moving to an educational role, providing insights into Liquid Collective’s ecosystem and demystifying liquid staking purrticipation.

Follow Mr. X on X or Liquid Collective’s YouTube to watch his new productions, and get ready for 2024 by reading Liquid Collective’s 2023 Year in Review here, or watching Mr. X’s Year in Review Update here.

Security Updates

Known vulnerability disclosed

- On Friday, January 5th 2024, a known vulnerability was reported according to Liquid Collective’s Vulnerability Disclosure Policy, involving the potential for a malicious Node Operator to front-run user deposits by changing the withdrawal credentials to their own.

- The vulnerability has been classified with a severity of Low/Low Critical.

- Only current Node Operators in Liquid Collective’s active set, all known entities with significant ecosystem reputation at stake, could potentially exploit this vulnerability. This same vulnerability was exposed to the Lido community in 2021 and was classified by Lido as low at the time.

- Read the full security update here for more information.

Liquid Collective aims to meet high standards of excellence for operations and service by acting with accountability, urgency, and integrity. Find the latest audits and resources in our diligence hub.

Events

Upcoming Conferences: To connect with the teams supporting Liquid Collective at an upcoming conference, contact us.

- ETHDenver: Feb 23 - March 3, Denver Colorado

- Blockworks Digital Asset Summit: March 18 - 20, London United Kingdom

- Token2049: April 18-19, Dubai UAE

- SALT iConnections: May 16-18, New York New York

- Consensus 2024: May 29 - June 1, Austin Texas

News from the Collective & Ecosystem Updates

- The United States Security & Exchange Commission approved 11 Bitcoin spot ETFs simultaneously, a landmark for the crypto ecosystem at large. In tandem, ecosystem predictions around the potential approval for spot ETH ETF are heating up. Read Alluvial Co-Founder and CPO Matt Leisinger’s CoinDesk op-ed on what a spot ETH ETF could mean for liquid staking here.

- Exiger, along with InterSec, received a 5-year $7m contract from the U.S Department of the Interior to provide enterprise cyber supply chain risk management. Read the announcement here.

- Figment published a 2024 outlook covering ETFs, ETPs, ETH staking, and more. Read the report here.

- Bitcoin Suisse shared a Trading Desk Market Update covering the U.S. SEC’s BTC spot ETF approval and more. Read the update here.

- Anchorage Digital’s Diogo Mónica shared insights on risking institutional participation in crypto for The Block. Read it here.

- BitGo received in-principle approval from the Monetary Authority of Singapore, expanding the company’s APAC footprint. Read the coverage here.

- Liquid Collective’s Slashing Coverage Program remains the largest active cover on Nexus Mutual. View more data here.

- Coinbase Cloud is hosting a fireside chat with EigenLayer on January 16th to discuss how EigenLayer can change the future of staking on Ethereum. Register for the event here.

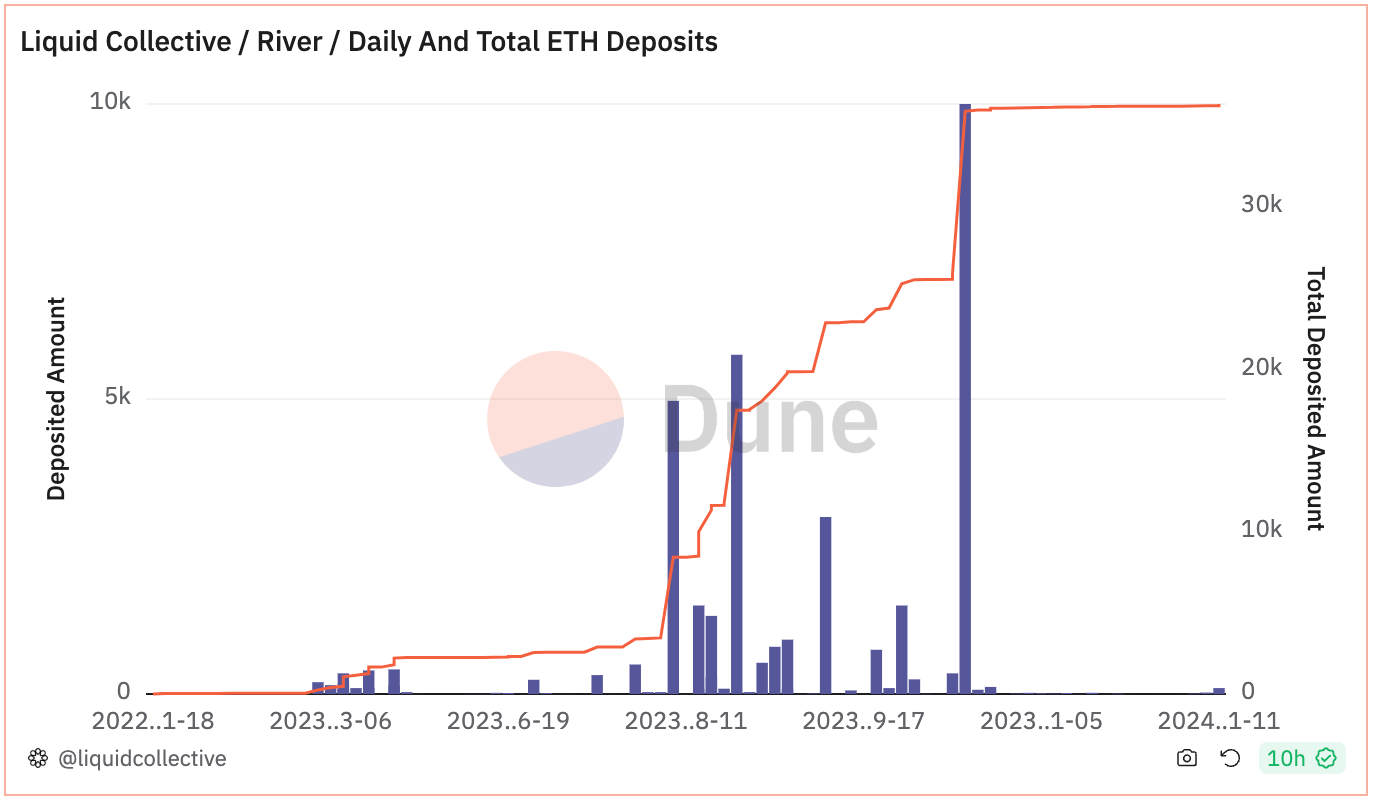

- Total Deposited ETH: 36,365.301 ETH + 0.38%

- Total Value Locked: $92,580,743 + 16.9%

- LsETH Conversion Rate: 1 LsETH = 1.03725 + 0.19%

- Total Reported Validator Count: 1,147 validators + 0.34%

All data is accurate as of January 12, 2024. View real-time onchain data here on Dune. Percentage changes are from the December 20, 2023 edition of By The Numbers.