Jan 19 2023

- As participation in liquid staking continues to grow, a need for standardization is arising to combat fragmentation while also increasing security and capital efficiency in the ecosystem

- Developing a multichain liquid staking standard creates a commonality between different platforms and protocols, which should increase liquidity and composability in the market

- A decentralized approach to operating a liquid staking standard can support the web3 ecosystem's ethos of censorship resistance, interoperability, security, innovation, and experimentation

- Liquid Collective, which is a decentralized liquid staking protocol developed in collaboration with a broad and dispersed diverse group of industry leaders, was built to meet this need for a liquid staking standard

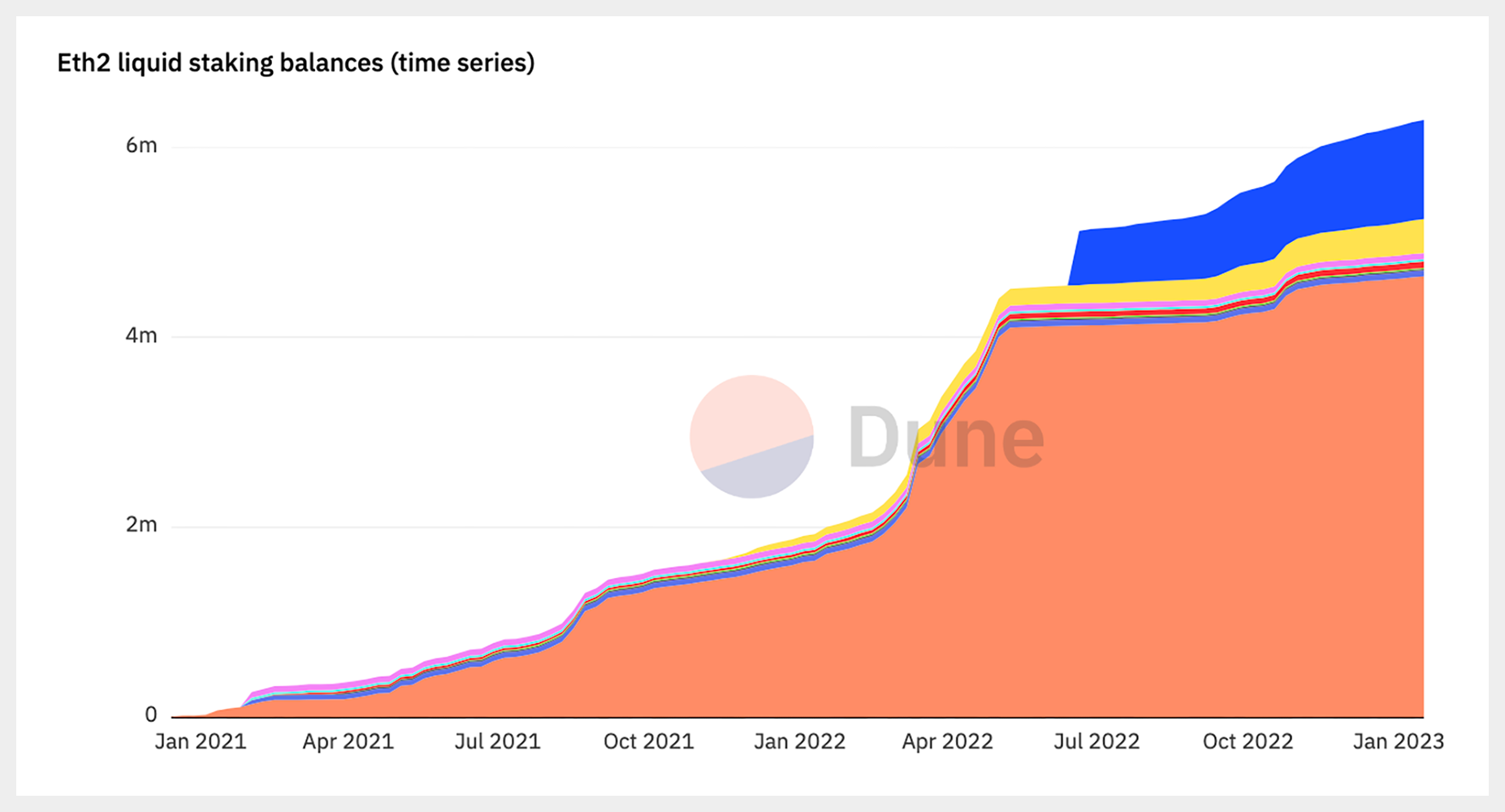

Liquid staking continues to emerge as a solution for both retail and institutional users in the decentralized finance (DeFi) ecosystem. On Ethereum alone, liquid staking has grown to represent over 42.66% of staked crypto assets with $10.51B staked at the time of writing.

Current decentralized liquid staking protocols have not prioritized building a product that is suitable for security- and compliance- conscious enterprises and institutions, as some lack transparency around validator counterparties.

At the same time, centralized liquid staking offerings are siloed and often non-interoperable, which may lead to increased fragmentation in the market. This is where the need for a secure, collectively-built, and decentralized liquid staking standard comes in.

The growing need for standardization

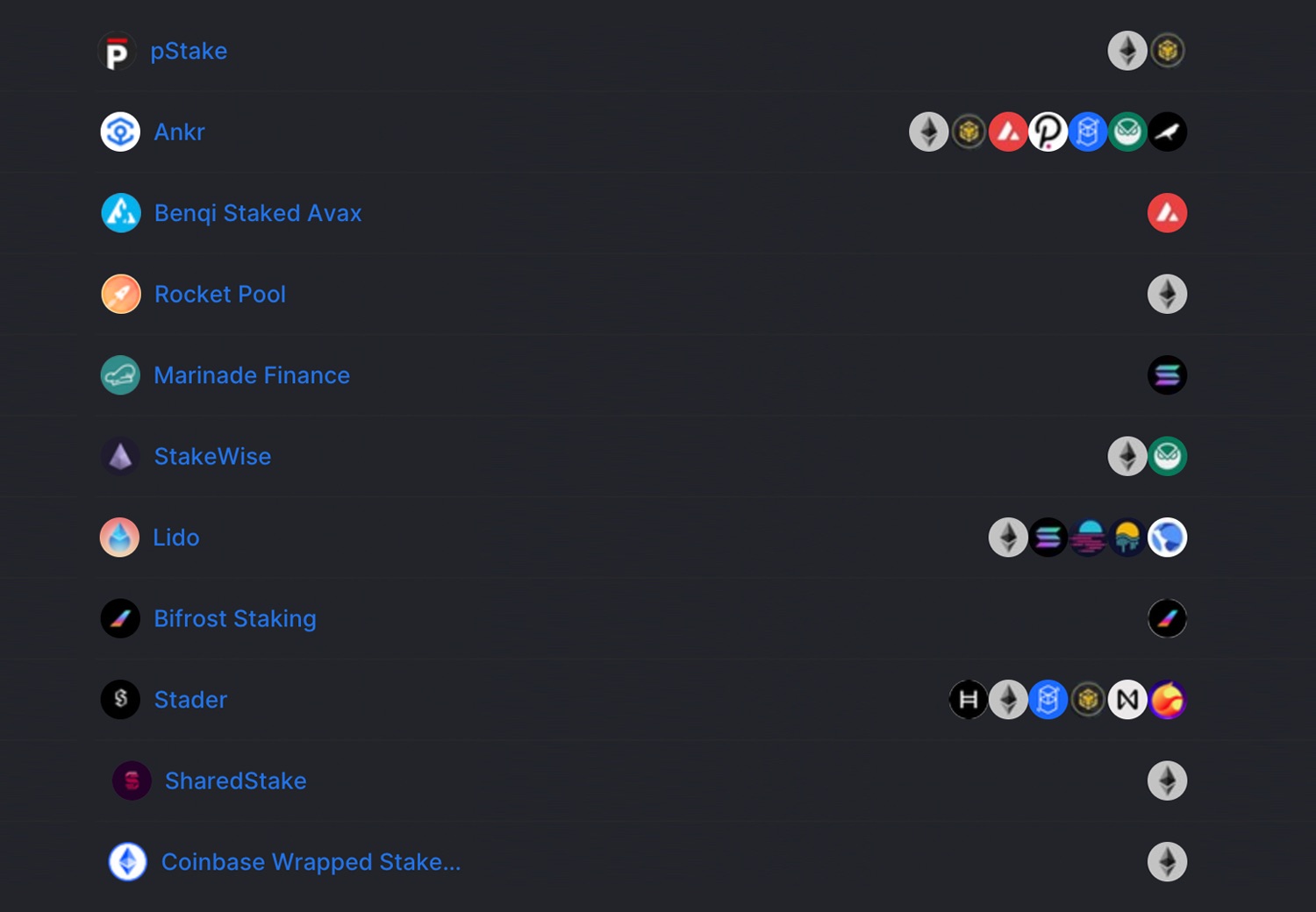

To meet the increased demand for liquid staking a multitude of decentralized protocols and centralized offerings are being developed. This leads to fragmentation in the market, with each bespoke liquid staking receipt token vying for DeFi integrations, liquidity, and traction in the liquid staking market.

Market fragmentation can create a number of challenges for liquid stakers. For example, a fragmented liquid staking market may limit available liquidity by making it difficult for participants to move their receipt tokens between different platforms. Additionally, a fragmented market may prevent diverse builders from collaborating with other builders to develop new financial primitives using liquid staking receipt tokens.

In our view, liquid staking's primary value proposition is enabling participation in staking while maintaining the ability to transfer, store, trade, and utilize the receipt tokens in DeFi and other decentralized applications (dapps). But the existing fragmented market arguably limits the potential of liquid staking.

We believe that platform-specific solutions have historically not gained as much traction relative to industry standards. For example, consider the stablecoin market, where the consortium-managed USDC stablecoin has 71x the market cap of the single exchange-managed GUSD stablecoin, despite both stablecoins being launched in the same month of 2018.

Current decentralized liquid staking solutions have varying levels of security, compliance, and validator performance standards, which can cause mistrust and uncertainty among users. As a result, those interested in compliance-focused solutions may look to more centralized services, which may not provide the same level of transparency and security, and have less DeFi composability than their decentralized counterparts.

Developing a liquid staking standard can help address certain market challenges by creating a commonality that different platforms and protocols can use to connect and transact with each other. A liquid staking standard can also increase liquidity and composability in the market, which can make it easier for users to move their staked crypto assets between different platforms and for different platforms to work together to create new financial primitives.

“With the rapid growth of different solutions in the liquid staking space, there is a clear need for a standard to address the fragmentation, lack of interoperability, and uncertainty that can arise with so many different protocols and platforms. A standard will help to increase liquidity and composability in the market while creating a more inclusive, fair, and efficient ecosystem.”

—Matt Leisenger, CEO at Alluvial, a company supporting Liquid Collective's development

Decentralized approach

While liquid staking continues to grow in popularity, it's crucial to maintain diversity across the liquid staking technology stack—from validators and execution client software to operations. We believe a decentralized approach to the standardization of liquid staking is important for several reasons.

1. Censorship resistance

A decentralized standard is more resistant to censorship and manipulation. In a centralized system, a single entity controls the standard and can make changes to it without the consent of the community. This can lead to a lack of trust and confidence in the standard. In contrast, a decentralized standard is controlled by a community of participants, making it less susceptible to manipulation and censorship.

2. Increased interoperability

When a standard is controlled by a single entity, it can create a closed ecosystem that is not interoperable with other systems, which can limit the potential for innovation and integration with other platforms. Alternatively, a decentralized standard is open and transparent, which can make it easier for different platforms to connect and communicate with each other.

3. More security

A decentralized approach helps to ensure the security and integrity of the liquid staking system as it is secured by a distributed network of nodes and node operators, which theoretically makes it more resistant to attacks or failures. Additionally, a decentralized standard can provide transparency and accountability, which can increase trust and confidence in the system.

4. Fostering innovation and experimentation

Lastly, a decentralized standard promotes innovation and experimentation. When a standard is controlled by a single entity, it can limit the potential for innovation and experimentation. In contrast, a decentralized standard allows for a group of participants to contribute to the development and evolution of the standard, which can lead to new and exciting use cases, and the development of more efficient and secure financial primitives.

While some may argue that standardization itself is a blocker to creative innovation, history has shown that industries aligning on a common set of standards opens the door for new paradigms of creative development built upon those standards. For example, consider the widespread adoption of the structured scale in late 16th century Western Europe, which birthed two centuries of prolific composition in the region—or the invention of the number zero, which led to massive leaps in the development of computation and mathematics.

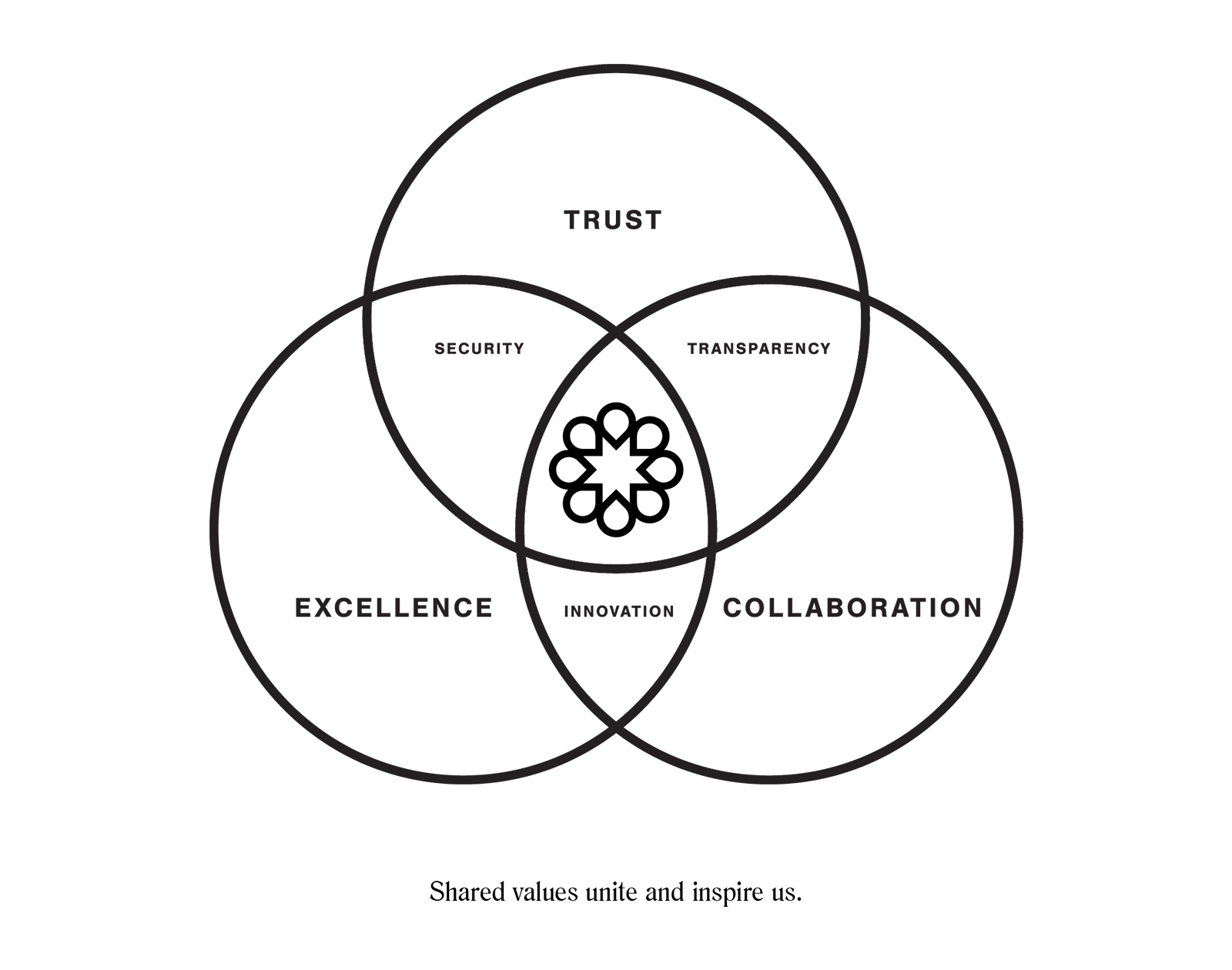

We believe a decentralized approach to standardization is important because it creates a more inclusive, fair, and efficient ecosystem that is resistant to censorship, manipulation, and attacks, and can promote interoperability, security and innovation. However, to ensure widespread adoption of a decentralized liquid staking standard, it's crucial that any decentralized approach implement certain compliance measures.

Liquid Collective: The enterprise-grade liquid staking standard

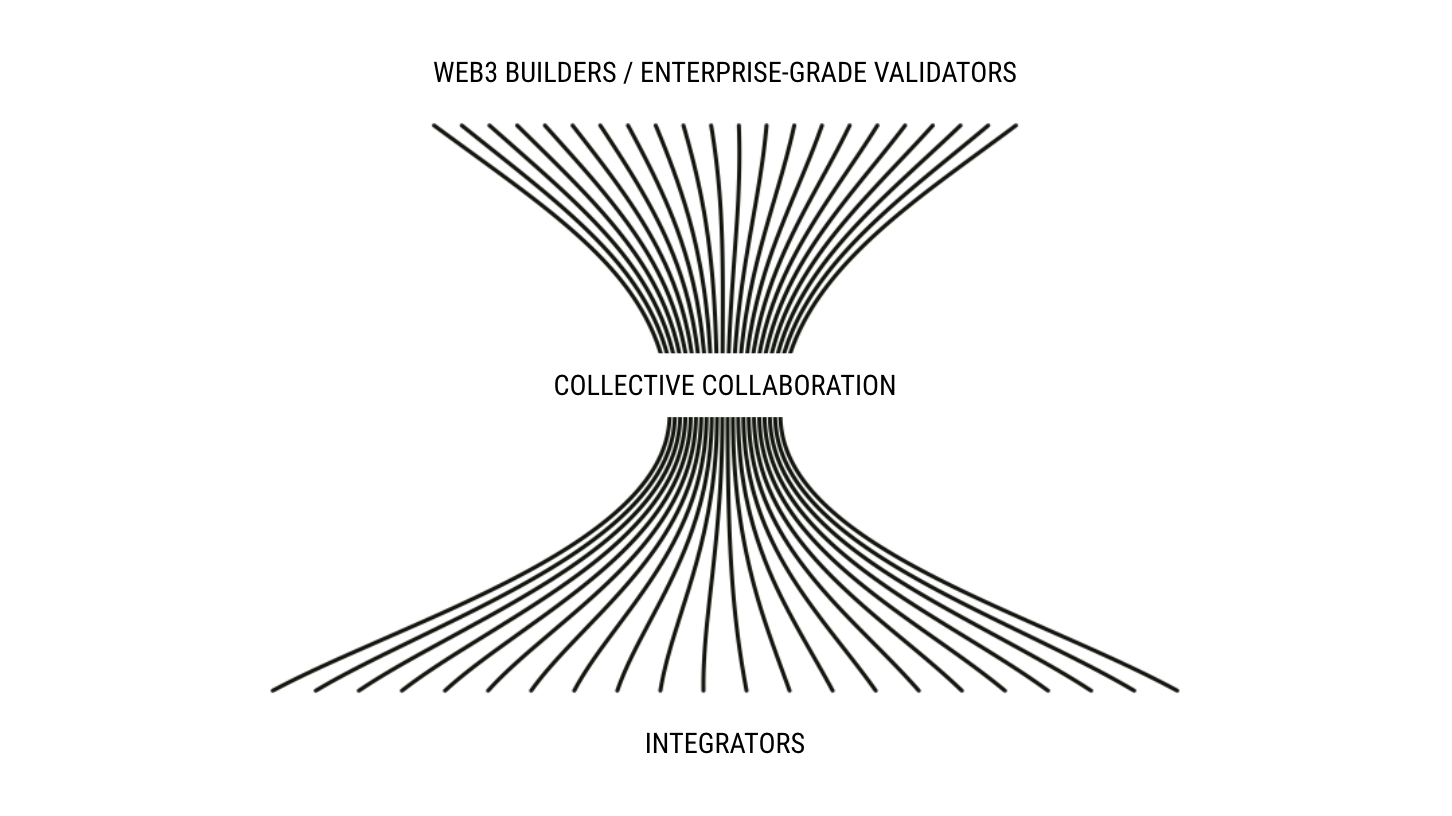

Liquid Collective, a multi-chain liquid staking protocol built and operated by a broad and dispersed group of industry leaders, was created to meet the need for a decentralized liquid staking standard in the web3 ecosystem. Decentralized and non-custodial, while implementing enterprise-grade compliance and security measures, the protocol is designed to be widely adopted to increase liquidity and composability in the web3 economy.

From the start, Liquid Collective intends to carry forward the vision of the blockchains that we build on, aiming to align on operational standards that will encourage client diversity, multi-region infrastructure configurations, and other robust security practices from leading operators. The protocol implements features that cater to the needs of institutions, such as KYC/AML checks, enterprise-grade security, and robust monitoring and reporting. This joining of secure and transparent operation with a decentralized approach results in a reliable and secure protocol that can be used by anyone while meeting the compliance needs of institutions.

Bringing this standard to stakers across multiple chains requires a community of service providers, validators, and other ecosystem participants. From Platforms that provide KYC/AML checks and seamless on-ramps like Coinbase and Figment, to leading Node Operators including Figment and Coinbase, Liquid Collective is succeeding in bringing the top players from the DeFi ecosystem into one collective to build this standard together.

One key aspect of Liquid Collective is the introduction of LsTokens, a single receipt token standard with multi-chain capabilities. By providing a decentralized system with standard tokenization of the staked assets, Liquid Collective expands the liquidity of staked assets while enabling the creation of new financial primitives to drive the adoption of liquid staking as the industry standard.

Learn more

To learn more about Liquid Collective, its goals, and how the protocol works, read the Liquid Collective Litepaper. You can find more resources on liquidcollective.io, including an introduction to Liquid Staking and an overview of LsETH, Liquid Collective's Ethereum Liquid Staking receipt token. Follow Liquid Collective on Twitter to stay up-to-date with the protocol's latest news, announcements, and educational resources.