Mar 15 2024

Congratulations are in order for the entire Ethereum ecosystem following this week’s successful Dencun Upgrade, which included EIPs with the potential to make liquid staking protocols more efficient and effective!

We’d also like to thank everyone who joined Liquid Collective at our joint ETHDenver events with Coinbase Cloud, Eigen Labs, Certora, and Gauntlet. If you couldn’t make it, don’t fret; read on for upcoming events and panels, and a robust, perhaps even bullish, News from the Collective & Ecosystem Updates roundup.

Also, in case you missed it—we launched an official Liquid Collective Telegram channel (https://t.me/liquidcollective) following reports of an impersonating scam channel. Stay safe out there, and stay tuned for the latest from Liquid Collective.

Liquid Collective's Latest

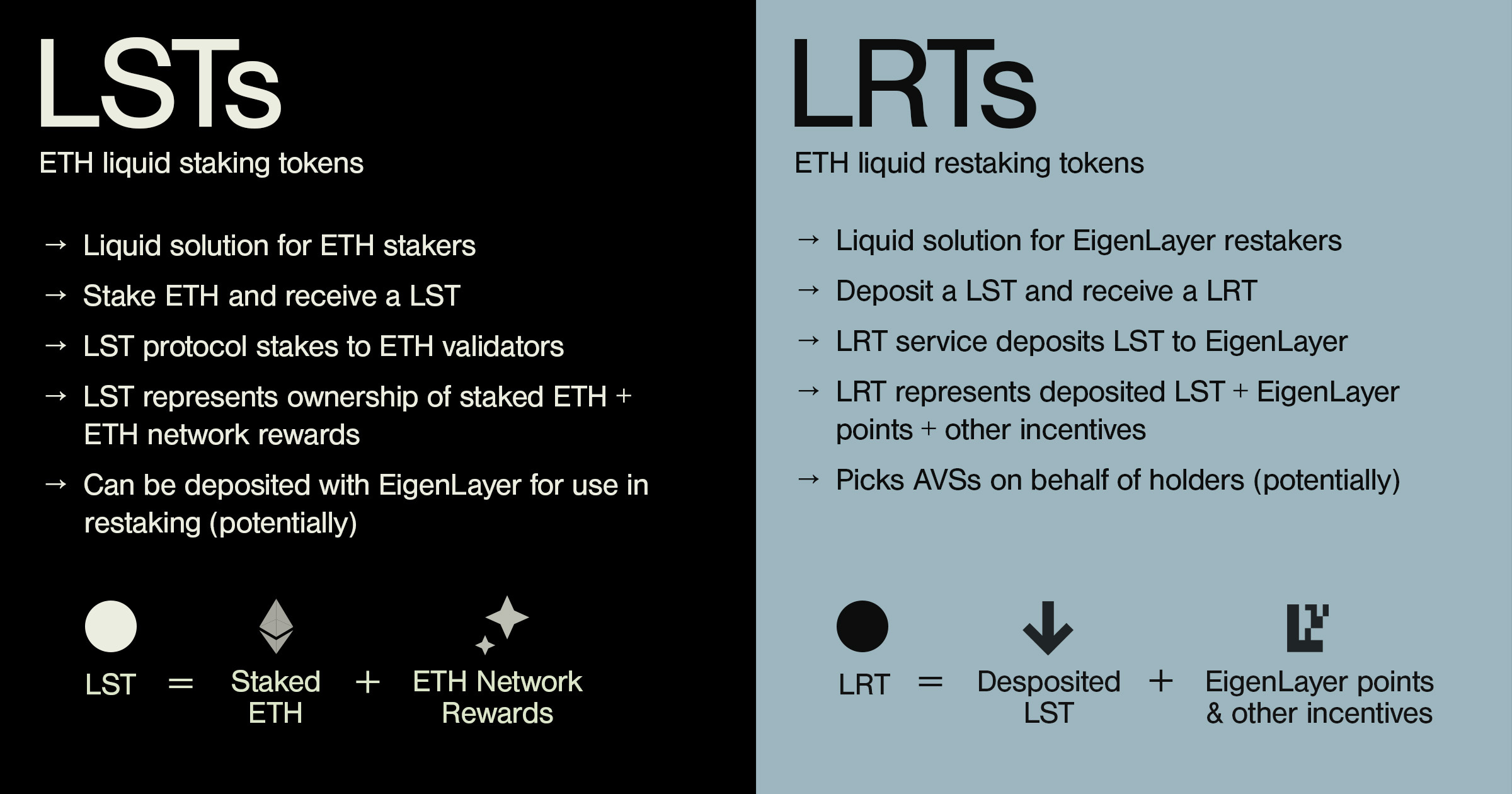

Breakdown: LSTs vs. LRTs

EigenLayer restaking dominated as a theme at this year’s ETHDenver, and, by extension, liquid restaking services built on top of EigenLayer’s platform. With ETH newcomers quickly becoming confused between liquid staking (LSTs) and liquid restaking (LRTs), Liquid Collective shared the breakdown pictured above to help clear the waters. Coinbase Cloud also shared a X thread breaking down the differences between liquid staking, liquid restaking, and restaking, and how they related to DeFi.

EigenLayer launched support for LsETH staking in January. You can learn more about restaking, the risks of participation, and how EigenLayer currently works in the announcement of EigenLayer’s LsETH integration.

Celebrating Ethereum’s Dencun Upgrade

Congratulations to the entire Ethereum community on the network’s successful Dencun Upgrade this past Wednesday, March 13, 2024. Much-lauded for its implementation of EIP-4844: Shard Blob Transactions, which sets the stage for Danksharding, a long-awaited change with the potential to greatly improve Ethereum’s scalability, the Dencun upgrade also represents the largest upgrade since The Merge transitioned Ethereum to PoS consensus in 2022.

Mara Schmiedt, CEO and Co-Founder of Alluvial, a team supporting Liquid Collective’s development, shared thoughts on how some of the EIPs included in Dencum may affect the staking landscape in this thread on X, along with sharing Dencun insights and predictions in Cointelegraph. You can learn more about the Dencun upgrade and some of the EIPs it included, along with community resources to deep-dive, in Liquid Collective’s Dencun overview here.

Is liquid staking safe?

Everything in crypto—including liquid staking—involves some level of risk. But due to the nature of their protocol design and smart contract configuration, the risks associated with liquid staking differ from some forms of DeFi participation, like bridges or lending protocols.

Explore how the risks of liquid staking compare and contrast with other forms of crypto participation in our latest post.

Events

Upcoming Conferences: To connect with the teams supporting Liquid Collective at an upcoming conference, contact us.

- Blockworks Digital Asset Summit: March 18 - 20, London

- Don’t miss The Next Generation of Institutional Staking panel at 2:00 PM on March 18, featuring Alluvial, Kiln, Chorus One, Steakhouse, and Rockaway X.

- DigiAssets: May 14 - 15, London

- Consensus 2024: May 29 - June 1, Austin

- Don't miss the Liquid Staking and Restaking Explosion panel at 10:00 AM on May 31.

- ETHCC: July 8 - 11, Brussels

News from the Collective & Ecosystem Updates

- Twinstake published a comprehensive research briefing on Ethereum’s Dencun Upgrade, which summarizes the impact of the EIPs they expect to have the highest influence on staking. Read it here.

- Variant published the recording of their LP Day Fireside Chat with Mara Schmiedt, CEO and Co-Founder of Alluvial, covering research, the staking ecosystem, Liquid Collective’s origins, and Variant’s thesis. Watch the recording or read the transcript here.

- Eigen Labs, developer of the EigenLayer restaking protocol and EigenDA data availability layer, raised $100m from a16z crypto. Read the announcement here.

- Figment Europe debuted two ETPs on SIX Swiss Exchange with Issuance.Swiss AG, Figment Ethereum Plus Staking Rewards (ETHF) and Figment Solana Plus Staking Rewards (SOLF). Read the announcement here.

- Obol published “The Distributed Validator Protocol Roadmap” outlining their vision for a distributed validator (DV) protocol and their plans for a DV R&D roadmap. Read it here.

- Kraken launched Kraken Institutional, which they note will grow to include a product suite and a qualified custody solution. Read the announcement here.

- Matt Leisinger, CPO and Co-Founder of Alluvial, a team supporting Liquid Collective’s development, published an analysis of the design choices surrounding liquid staking tokens and Validator NFTs, and what his research while building Liquid Collective found. Read it here.

- Anchorage Digital announced TuongVy Le, former senior lawyer with the SEC, has joined their team as General Counsel. Read the announcement here.

- German stock exchange Deutsche Boerse is launching a crypto spot trading platform for institutional clients. Learn more here.

- Rated Labs launched a rebrand and upgrade of the Rated Network Explorer, including a space for highlighting their coverage of multiple PoS networks. Learn more here.

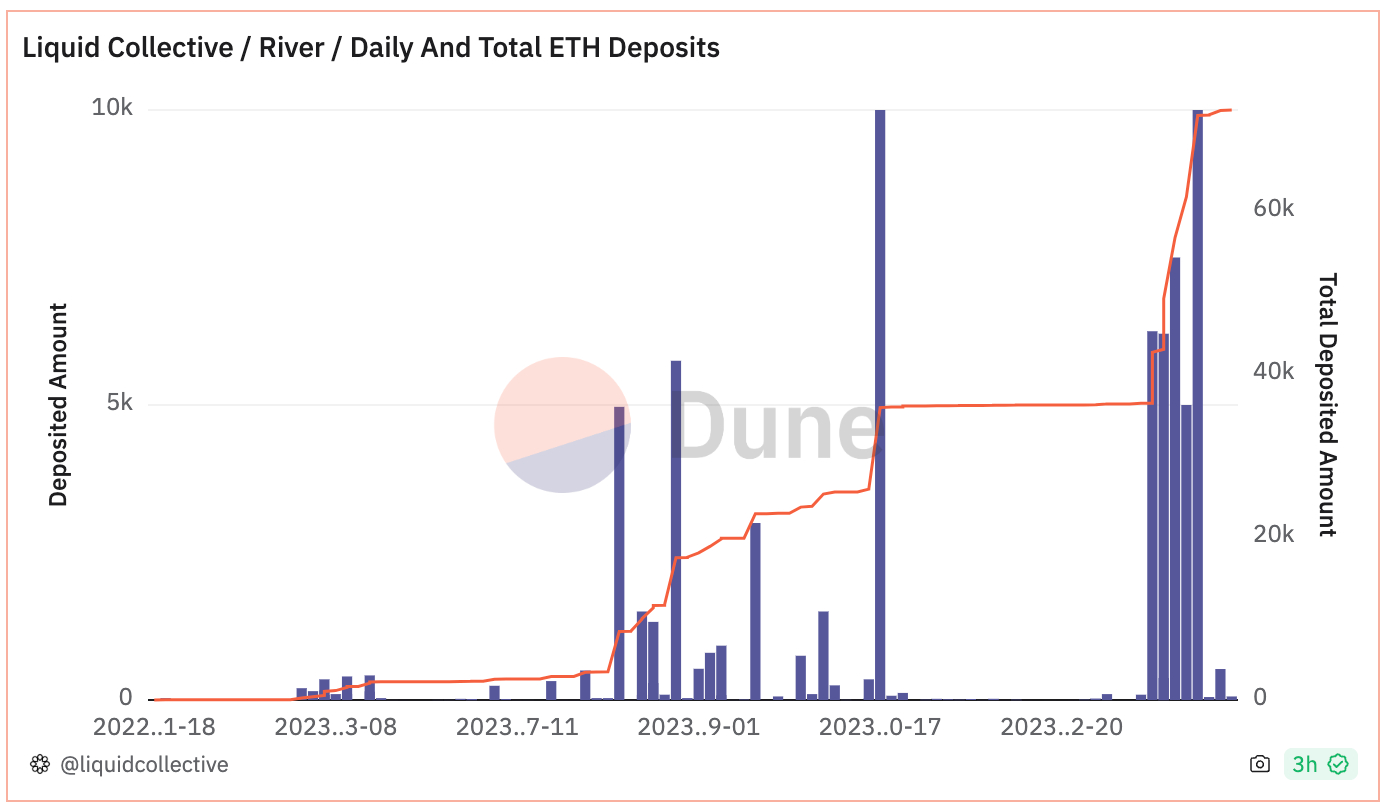

- DLNews’ DeFi overview covered Puffer Finance’s recent liquid restaking token depeg, along with noting Liquid Collective’s growth as up over 50%. Read it here.

- According to journalist Colin Wu, local Hong Kong media has reported that 10 financial institutions plan to apply to launch Bitcoin Spot ETFs, and Ethereum spot ETFs are under discussion. Learn more here.

- The London Stock Exchange will start accepting applications for bitcoin and ether crypto exchange-traded notes (ETNs) in H2 2024, according to The Block’s reporting. Read it here.

- Total Deposited ETH: 72,464.470 ETH + 0.92%

- Total Value Locked: $245,596,251 + 32.4%

- LsETH Conversion Rate: 1 LsETH = 1.04266 ETH + 0.25%

All data is accurate as of March 15, 2024. View real-time onchain data here on Dune. Percentage changes are from the February 16, 2024 edition of By The Numbers.