Aug 15 2024

There are a lot of misconceptions and misunderstandings surrounding liquid staking and liquid staking tokens (LSTs). Liquid staking may be the largest sector of the crypto ecosystem, but the technical nuances and previously niche audience means confusion still exists.

As Liquid Collective represents a relatively new entrant to the liquid staking ecosystem, many people are still learning about Liquid Collective’s LST, Liquid Staked ETH (LsETH), too.

Myth 1: Only institutions can use LsETH

While the Liquid Collective protocol is built with enterprise-grade security and performance to meet the needs of institutions, anyone can use its liquid staking token (LST), LsETH.

LsETH is a freely-transferable ERC-20 token that can be held in a wallet or with a custodian, traded on both CEX and DEXs, and is widely composable for integrations with DeFi apps for activities like lending and restaking.

So, if anyone can use it, how does LsETH meet the needs of institutions?

- Known counterparties: The Liquid Collective protocol requires KYC/KYB/AML and other counterparty checks for all operators, including the protocol’s Node Operators. This enables the protocol to be used by institutions who have strict regulatory requirements and need to meet due diligence standards for the operators they stake through.

- KYC on mint/redeem: Similar to the model used by Circle’s USDC stablecoin, all users are required to complete counterparty checks through their preferred Liquid Collective Platform when they stake ETH to mint LsETH, or redeem LsETH for ETH. This aims to ensure that all ETH staked through the protocol has passed the anti-money-laundering (AML) checks required by institutions, while the LST, LsETH, remains freely transferable for anyone to use.

- Ecosystem support for enterprise APIs: The Liquid Collective protocol's API-first solution, supported by ecosystem participant Alluvial, provides a frictionless onboarding path for enterprises to offer staking to their users.

- And more: From LsETH’s industry-first Performance SLAs, to the unique LsETH User Agreement that provides a built-in slashing coverage program to all LsETH holders, many of Liquid Collective’s features are built to provide an enterprise-grade staking solution for all stakers to access. Learn more about LsETH’s features here.

Myth 2: Liquid staking is less secure than other DeFi opportunities

While participating in staking always involves some risk, there is not inherently more risk incurred when liquid staking than participating in other DeFi opportunities. Rather, risk originates from different places.

When lending via a DeFi protocol or bridging tokens between chains, a user’s ETH remains susceptible to attack for an extended period of time. With liquid staking, the staker’s ETH sits in a smart contract for a limited time before it is automatically deposited to Ethereum’s deposit contract, a significantly more secure contract.

Still unsure? Learn more in our post: Is liquid staking safe?

Myth 3: LsETH is a cover for staking with One Big Exchange

A common myth is that Liquid Collective is not really a distributed protocol, but instead just a ‘rebrand’ to obscure staking through One Big Centralized Exchange. This is not the case—Liquid Collective is built and supported by a broad and dispersed collective of industry leaders, including a diverse set of leading Node Operators and more than a dozen LsETH Platforms and custodians. The Liquid Collective protocol is overseen by The Liquid Foundation, an independent steward of the Liquid Collective protocol designed to support the distributed growth and long-term sustainability of the protocol and its participants.

Why stake across a diversity of enterprise-grade participants? Prior to the existence of Liquid Collective, long-ETH participants had two primary options for liquid staking:

- Stake through a decentralized option appropriate for crypto-native users, but less suitable for institutions due to lack of enterprise-grade features and compliance focus.

- Use a centralized entity that offered security, SLAs, compliance, and other guarantees, but came with centralization and correlation risks.

Neither option was ideal for enterprises or individuals, such as a crypto fund, who wanted to uphold the values of decentralization but had to also uphold fiscal and regulatory responsibilities.

By bringing together a breadth of trusted industry operators into one distributed protocol, Liquid Collective allows these types of entities to participate in liquid staking without putting “all their eggs in one basket.” LsETH supports decentralization with the assurance of known counterparties and high-quality providers.

Myth 4: Liquid staking rewards are lower than traditional staking

Staking rewards on Ethereum are programmatically determined by the performance of the validators on which the ETH is staked, in accordance with the Ethereum protocol’s consensus mechanism—not based on the staking solution used to participate. Therefore, tokens staked in the traditional manner can earn estimated staking reward rates both higher and lower than those staked through a liquid staking protocol.

Liquid Collective includes a broad and distributed active set of enterprise-grade Node Operators, including Coinbase, Figment, Staked, and Blockdaemon, with great track records of operating performant validator infrastructure. Liquid Collective is also the first liquid staking protocol to introduce service level agreements for baseline Node Operator performance. Under these SLAs, Liquid Collective’s Node Operators are required to perform in the top 50th (-1σ) percentile of all ETH staking providers that operate 100+ nodes, based on deterministic performance on the consensus layer. Once fully implemented, failure to comply with the SLAs will result in Node Operators reimbursing the Liquid Collective protocol for missed reward opportunities. In addition, with Liquid Collective, ETH network rewards received are staked automatically on a daily basis.

Learn more about how auto-staking of ETH network rewards helps make staking participation more efficient in our post, Unlock the power of ETH liquid staking with Liquid Collective.’

Myth 5: The value of LsETH is pegged 1:1 to ETH

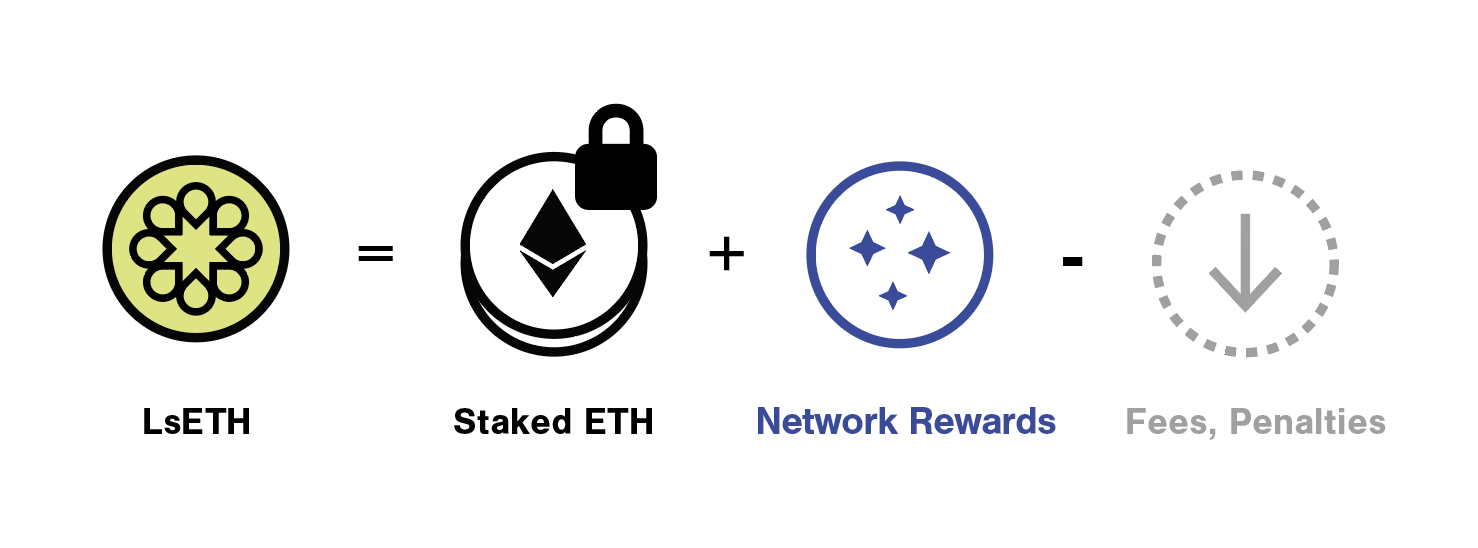

The conversion rate of LsETH to ETH is not a pegged amount; LsETH represents more than just ownership of the original staked ETH. LsETH can be redeemed for ETH at a dynamic value that reflects the accrued ETH network rewards plus the original ETH amount, adjusted for fees and penalties.

Unlike with the aToken model used by stETH and others, which includes a “peg” to ensure that the aToken remains a 1:1 equivalent with ETH, nothing new is minted to an LsETH holder’s wallet when they receive ETH network rewards. Instead, LsETH’s conversion rate increases over time to represent the ETH network rewards received. This introduces efficiencies such as improved composability and simplified rewards management. cTokens could also have potential tax advantages, as the increase in token value may be considered capital gains rather than ordinary income.

Learn more about LsETH’s conversion rate, the cToken model, how it compares to the aToken model, and the benefits of Ethereum’s cToken design, in our post, ‘Why isn’t LsETH pegged to the value of ETH?’

Myth 6: Liquid staking is only for advanced users

If you can stake, you can liquid stake. Liquid staking is just a software innovation that enables users to stake directly on a proof of stake network such as Ethereum, with a liquid staking token (LST) programmatically minted by the protocol to evidence ownership of the staked token and to provide access to liquidity.

In both cases, stakers choose an amount of ETH to stake, and sign a transaction to facilitate the deposit of that ETH to Etheruem’s Deposit Contract, where it activates a validator node. With liquid staking, stakers automatically receive a new set of tokens back to their wallet (their LST). The LST can then be used as any token on Ethereum, they can be traded, participate in DeFi, or redeemed to withdraw the underlying staked ETH.

Learn more about how liquid staking works in our educational post.