Nov 30 2023

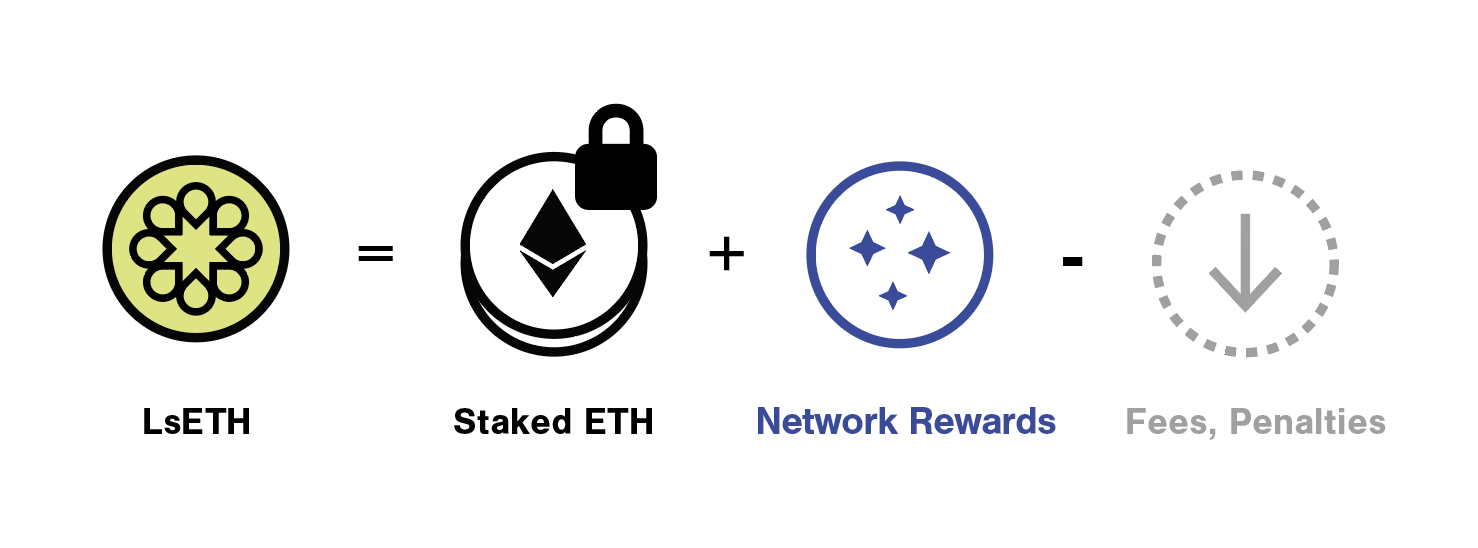

- LsETH represents more than just staked ETH. Because it is based on the cToken model, the rate at which LsETH can be redeemed for ETH dynamically incorporates accrued rewards, and adjusts for fees and penalties.

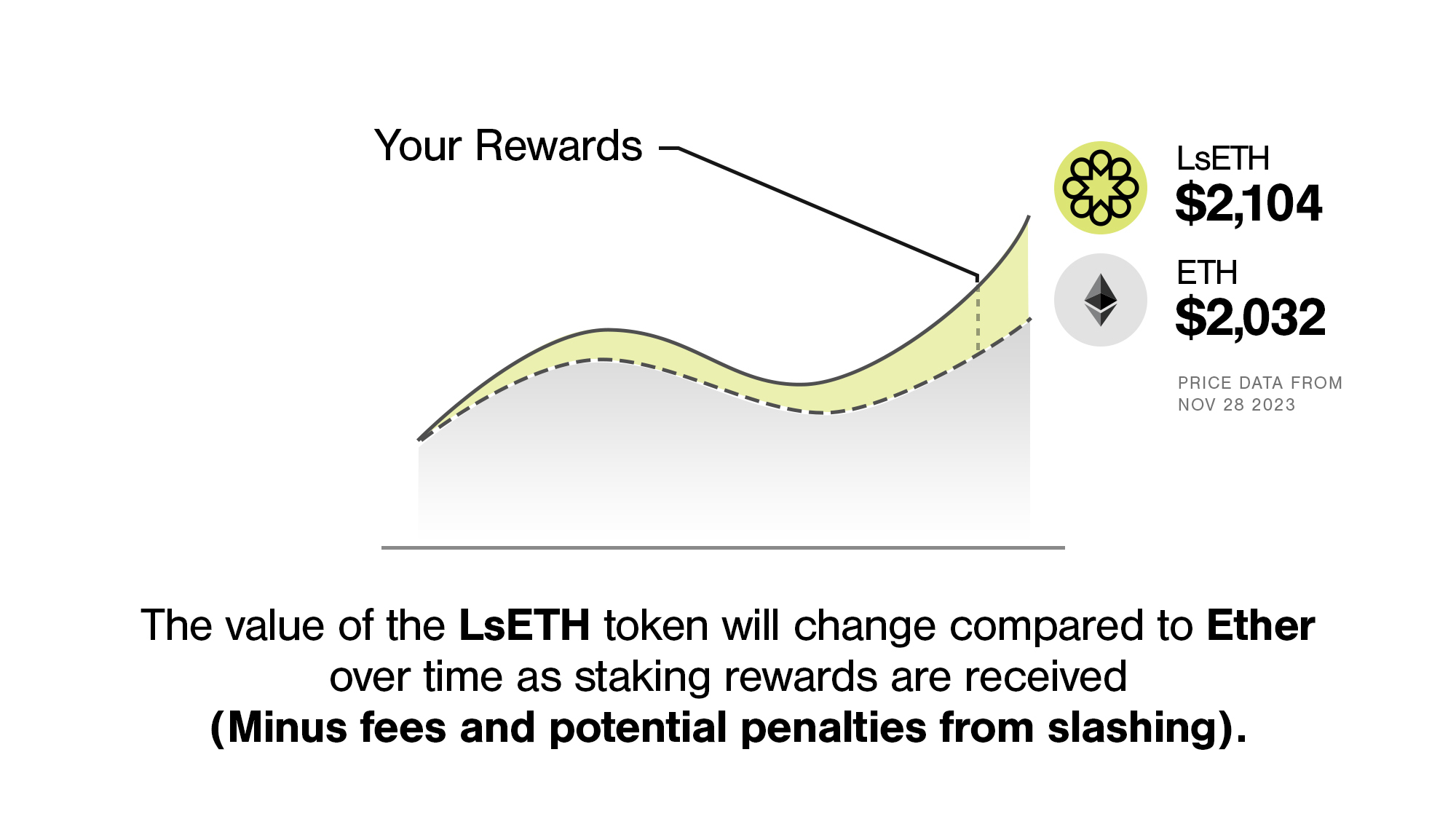

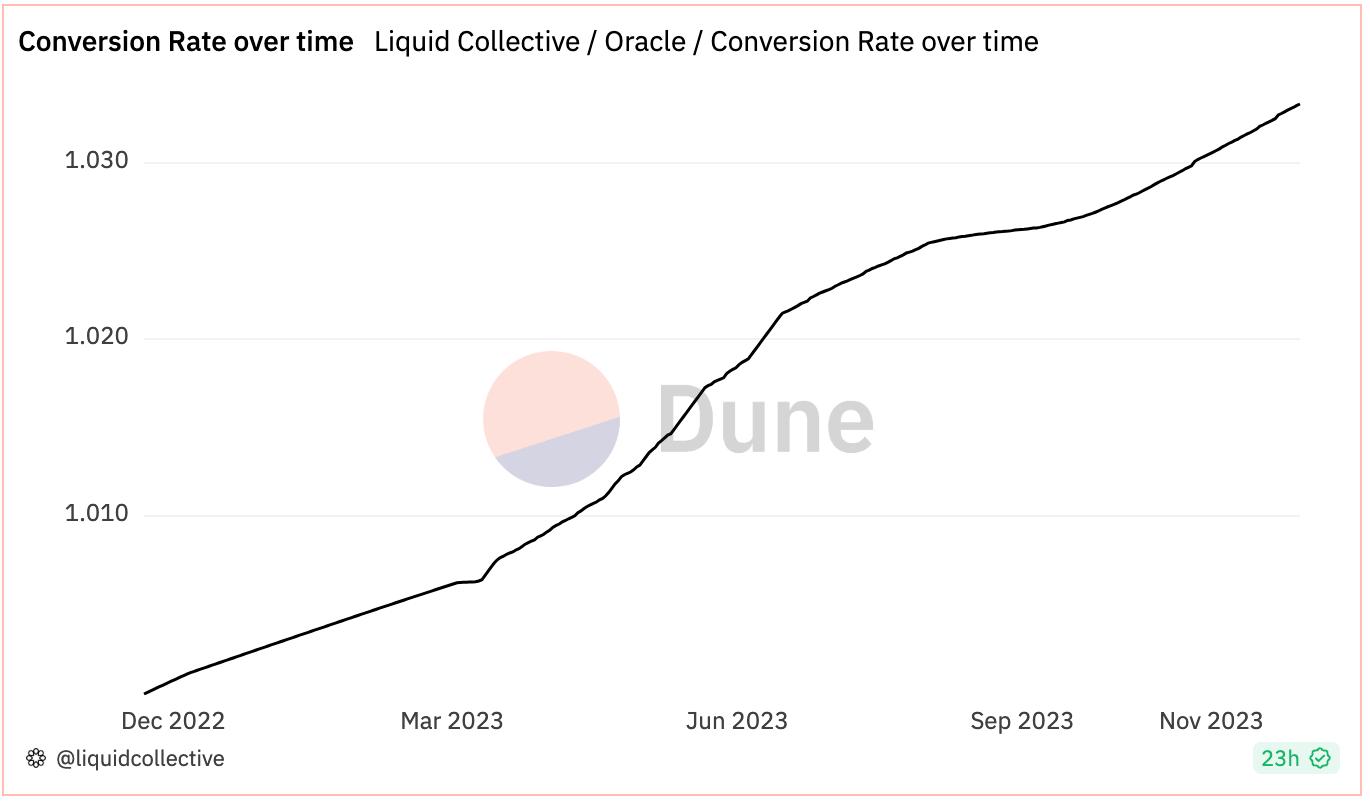

- Liquid Collective’s Protocol Conversion Rate, the internal rate that governs how LsETH is valued compared to ETH at minting and redemption, programmatically changes over time to accurately represent the value of staked ETH and accumulated ETH network rewards.

- Unlike tokens following the aToken model, such as stETH, LsETH does not mint new receipt tokens for ETH network rewards. Instead, LsETH’s conversion rate increases to represent ETH network rewards earned. Plus, the Liquid Collective protocol automatically stakes ETH network rewards received.

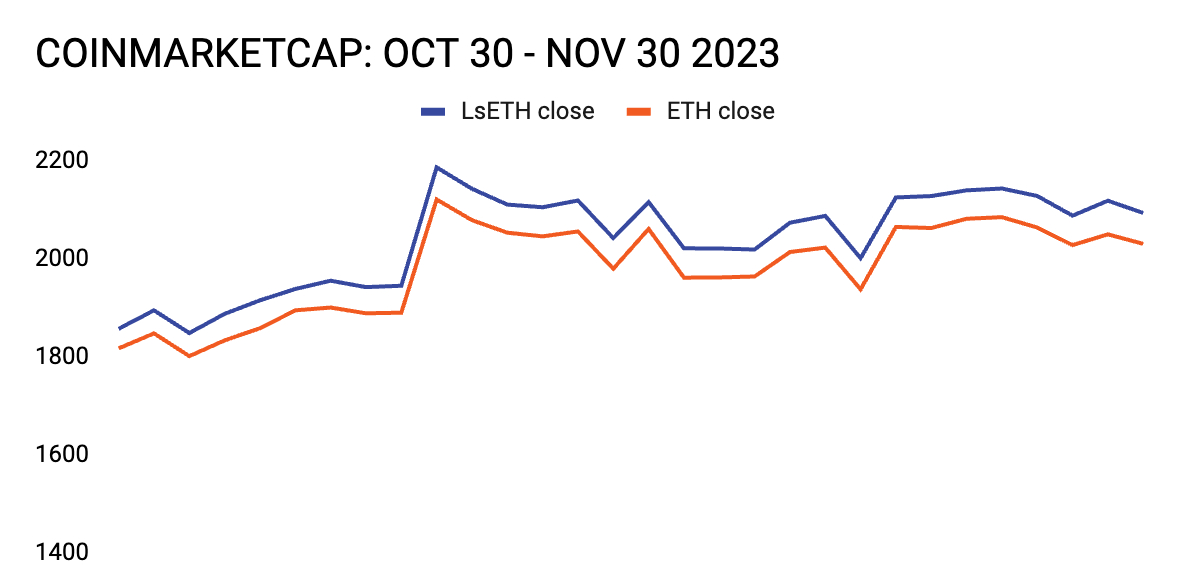

- Liquid Collective's Protocol Conversion Rate, set automatically at the protocol level, operates independently from any market trading rates of LsETH. Because the conversion rate means that each LsETH unit is redeemable for an amount of staked ETH plus accrued ETH network rewards, LsETH might seem to trade at a "premium" compared to ETH in open markets. However, this perceived premium is more likely a reflection of LsETH's value being greater than a single unit of ETH, due to the included rewards.

- Because the redemption value of LsETH represents staked ETH plus ETH network rewards earned, fees, and penalties, the value of LsETH does not have an explicit ‘peg’ to the market value of ETH. The concept of LsETH ‘depegging’ from the value of ETH is unlikely given the opportunity for arbitrage between the price in the secondary market and the LsETH/ETH Protocol Conversion Rate.

Understanding how different liquid staking tokens (LSTs) work can be a bit of a puzzle. This is because blockchain tokens are developed according to a variety of token standards, which define the parameters within which their smart contracts must operate in order to perform basic functions.

A common misconception is that LsETH should always match the value of ETH on a 1:1 basis. However, this isn't the case. Let's explore why LsETH, the LST minted when a participant stakes ETH through the Liquid Collective protocol, may differ in value from ETH, and why this difference is not only logical but beneficial to end users.

Understanding the cToken model

By standardizing token data types, functions, and behaviors, developers can create smart contracts that interact with each other seamlessly. However, the various token standards common in today’s networks often behave in very different ways depending on which use cases and features they're optimized for.

First, it's crucial to grasp the concept of the cToken model—the token standard on which LsETH is based.

When you stake on Ethereum with the Liquid Collective protocol, you receive LsETH as a receipt to represent ownership of your staked ETH. However, LsETH isn't just a static receipt token; it's dynamic and reflects the changing value of the underlying staked holdings (including the rewards you are earning).

cTokens are a model of Ethereum ERC-20 tokens originally developed by the Compound protocol. The cToken model uses a floating conversion rate between a receipt token and staked tokens to reflect the value of accrued network rewards, penalties, and fees associated with the staked tokens. Other tokens that follow the cToken model include cbETH, rETH, and more.

What is the Protocol Conversion Rate?

Liquid Collective’s Protocol Conversion Rate is the rate at which your LsETH is minted to represent the ETH you deposit. It’s also the rate at which your LsETH can be redeemed for ETH. This isn't a static rate, but a dynamic one that changes over time.

The conversion rate is an internal mechanism, defined at the protocol level, that ensures your LsETH represents the total value of your staked assets, including rewards. The conversion rate is onchain and transparent—you can check it in real-time here.

User example

If you deposit 100 ETH to the Liquid Collective protocol, when the Protocol Conversion Rate is 1, you will receive 100 LsETH in return (ETH amount / conversion rate = 100/1).

After some time, you decide it's time to withdraw your ETH from the protocol. Your staked ETH has accrued 20 ETH in network rewards. The conversion rate is now 1.2.

Your 100 LsETH is now equal to 120 ETH (100 * 1.2). You receive your 120 ETH when converting your 100 LsETH tokens.

How does it work?

- Initial conversion: When you first deposit ETH into the Liquid Collective protocol, you receive LsETH. Initially, this might seem close to a 1:1 ratio. However, this is just the starting point.

- Accruing ETH network rewards: As time passes, your staked ETH earns ETH network rewards. These rewards are not paid out as separate transactions, but are incorporated into the value of LsETH.

- Paying fees, or penalties: Your stake is also subject to Liquid Collective’s set Protocol Service Fee, distributed from network rewards earned, as well as any ETH network penalties which could be incurred (such as slashing penalties). These fees or penalties are not paid separately, but are also incorporated into the value of LsETH.

- Dynamic adjustments: The conversion rate programmatically adjusts to reflect the value of accrued rewards (and any fees or penalties). So, the amount of ETH your LsETH represents can increase. This means that over time, your LsETH could represent more ETH than you initially staked, because of the ETH network rewards you have earned.

The integration of staking rewards into LsETH’s redemption value is the primary reason the Protocol Conversion Rate changes.

How is the Protocol Conversion Rate calculated?

Each day, the protocol accounts for Ethereum network rewards, including consensus layer network rewards and execution layer fees, minus possible penalties. This calculation updates the total supply of ETH. When network rewards are earned, the protocol collects a service fee as a percentage of these rewards by minting LsETH, increasing the total supply of LsETH.

The conversion rate is calculated every 24 hours by oracles reporting the new balance of staked ETH, factoring in accrued network rewards or fees. This rate is the ratio of the total balance of staked ETH to the total supply of LsETH. If the accrued network rewards exceed penalties and fees, the conversion rate increases, reflecting the net Ethereum network rewards collected by the protocol.

Learn more in Liquid Collective’s documentation.

So, why isn’t LsETH pegged 1:1 to ETH?

- Accruing rewards: The value of LsETH changes over time because it includes the rewards earned from staking ETH. As these rewards accumulate, the value of each LsETH increases, representing a share of both the original staked ETH and the earned rewards.

- Not a mirror: Unlike tokens that are designed to mirror the value of another asset (like stablecoins pegged to fiat currencies), LsETH is meant to reflect the value of staked ETH plus rewards. LsETH is not a derivative. Hence, expecting a 1:1 peg with ETH is a misunderstanding of LsETH’s purpose and mechanics.

- Market dynamics: The native value redemption value of LsETH (as defined by the Protocol Conversion Rate) is separate and independent from the rate at which LsETH may trade on the open markets. The market value of LsETH is also influenced by market conditions and overall demand and supply dynamics.

Because the redemption value of LsETH represents staked ETH plus ETH network rewards earned, fees, and penalties, the value of LsETH does not have an explicit ‘peg’ to the market value of ETH. The concept of LsETH ‘depegging’ from the value of ETH is unlikely given the opportunity for arbitrage between the price in the secondary market and the LsETH/ETH Protocol Conversion Rate.

But aren’t other liquid staking tokens pegged to the value of ETH?

LsETH’s cToken model is different from the aToken model (also called a ‘rebase token model’) used by Lido’s stETH and others. The aToken model continuously updates the supply of its representative token to track the underlying token 1:1.

| aToken model (including stETH) | cToken model (including LsETH) |

|---|---|

| New receipt tokens are minted to represent ETH network rewards earned. | No new receipt tokens are minted to represent ETH network rewards earned. Instead, the Protocol Conversion Rate increases to represent ETH network rewards earned. |

| Redemption value of the receipt token is pegged 1:1 to staked ETH. | Redemption value of the receipt token is dynamic, representing staked ETH + ETH network rewards earned. |

| As you earn ETH network rewards, you receive more receipt tokens. | As you earn ETH network rewards, the value of your receipt token increases. You do not receive additional receipt tokens. |

Practical implications of the cToken model’s dynamic conversion rate

LsETH’s conversion mechanism has practical implications for stakers:

- Visibility of growth: You can see the growth of your stake directly in the value of LsETH, not just in the number of tokens you hold.

- Simplified rewards management: Instead of managing separate reward payouts, everything is consolidated under your LsETH holdings.

- DeFi and CeFi composability: cTokens are Ethereum ERC-20 compliant, and are more widely adopted (and thus more useful) than other forms of receipt tokens in DeFi today, such as aTokens. This is due in part between the challenges of accounting for dynamic balance updates when participating in DeFi protocols, which has led some to develop wrapped cToken versions of aTokens for use in DeFi. The composability of cTokens, and their wider adoption, were factors in the selection of the cToken model for the design of Liquid Collective’s LsTokens.

- Auto-staked rewards: Plus, with LsETH, you don't have to manually claim and stake. Network rewards are automatically staked while holding LsETH, so that opportunities to receive rewards are compounded with no action required.

Putting it all together

The notion that LsETH should always be equal in value to ETH is a myth that doesn't consider the reality of LsETH’s token model. LsETH's cToken design allows for a more dynamic representation of your staked ETH, accounting for accrued rewards and any fees or penalties incurred in the Protocol Conversion Rate.

You can learn more about LsETH, the cToken model, and how it all works, in the LsETH explainer, or by diving into Liquid Collective’s LsETH documentation.